9 Easy-to-Use Budget Templates

Image source: Getty Images.

Whether you're single, part of a couple, or even head of a large family, creating a budget is a great way to track expenses and income to keep you on track toward your financial goals. Although a simple home budget worksheet can be scribbled out with plain pencil, paper, and a calculator, today's technology means you have access to many easy-to-use budget templates online.

9 free budget spreadsheets

Many of these budget templates use Excel spreadsheets, but you'll also find a few for Google Docs and OpenOffice. Find the budget template that best suits your financial situation, download it to your computer, and you'll be ready to start better managing your money.Here are nine of the best free budget templates available to download.

Simple budget template

If you're new to budgeting and your expenses are few and easy-to-track, simple is best. This basic monthly budget worksheetcomes from My Excel Templatesand provides a simple spreadsheet for your monthly and annual budget. This template allows you to customize the pre-populated spending categories to match your lifestyle.

Download thissimple budget template.

Personal budget template

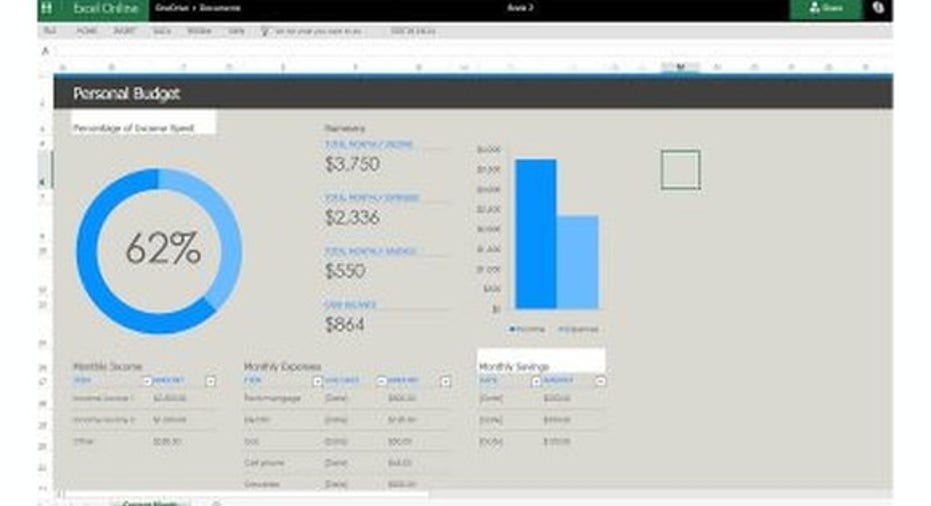

Image source: Microsoft Office.

Microsoft Office offers afree personal budget templatethat's a great option for singles or couples looking to get started with personal finance budgeting. This template shows a summary of the month's income, expenses, savings, and cash balance, as well as a circle graph showing the percentage of income spent each month.

Download thispersonal budget template.

Family budget template

Budgeting for a family can be more complicated than budgeting for just one person. This freefamily budget templatefrom Vertex42 is available for Excel, OpenOffice, and Google Docs. Thisfamily budget plannerincludes categories for various home expenses and for children's expenses, too, so you get a good look at just how much your children cost each month.

Download thisfamily budget template.

Weekly budget template

If you're looking for a free budget planner to track expenses on a weekly basis, this planner from Spreadsheet123 could be just what you need. This weeklyhome budget template budgetis available in Excel, OpenOffice, or Google Docs.

Download thisweekly budget template.

Monthly budget template

This free Excelmonthly budget templatefrom Bank of America suits people who prefer to calculate income and expenses on a monthly basis. It even includes space for your unplanned expenditures, so you can see what type of financial emergencies are making a dent in your wallet.

Download thismonthly budget template.

Annual budget template

Sometimes it helps to get an overview of your entire year's budget. This editableyearly personal budget template plannerfromBudget Template presents a calendar year's worth of budgeting information in a horizontal spreadsheet. It also includes categories for dividend and other investment income.

Download thisannual budget template.

Household budget template

This Excelhousehold budget worksheetfrom Vertex42 has space for your household income and expenses, including household-specific expenses such as lawn care, maintenance, and home insurance.

Download thishome budget template.

Free budget template with financial snapshot

If you need a budget template that not only tracks your income and expenses but also gives you an at-a-glance look at your current financial situation, this is it.This free budget template, from Budgets Are Sexy, comes with a financial snapshot and is available as both anExcelbudget templateand in Google Docsformat.

Download thisfinancial snapshot template.

Budget template for students

For many students, going away to college is the first time in their lives they'll be solely responsible for managing their own finances. Start out on the right foot with this free downloadableExcel college budget template -- available directly from Microsoft and ready to customize to your own needs.

Download this student budget template.

How to make a budget

If you still feel like you can't find a budget template that's just right, you can always make your own budget. To start, you'll need to track at least two basic categories -- income and expenses. Start by adding up all sources of after-tax income on a monthly basis, as this makes it easier to calculate how much money you have available to meet your expenses, since many of them, such as rent and utilities, are probably billed monthly.

Next, list all of your fixed expenses.These are expenses you already know the amount of, such as:

- Rent or mortgage.

- Insurance payments.

- Car loans.

- Student loans.

- Cable and internet bill.

- Savings contribution.

Then, add in your variable expenses that have amounts that might change monthly, such as:

- Groceries.

- Dining out.

- Gas for your car.

- Entertainment.

- Clothing.

Add up all of your income and all of your expenses. If your expenses are greater than your income, it's time tofind ways to cut costs. And if you have money left over after all your expenses are paid, you're doing great. You could increase your savings contributions, pay down debt faster, or even consider making a regular monthly charity donation.

No matter what format works for you, the important thing about budgeting is to start now. Getting a handle on where your money goes as soon as possible will give you the information you need to make any necessary changes. Then, you'll be better able to achieve your short- and long-term financial goals.

This article originally appeared at GoBankingRates.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

GoBankingRates has no position in any stocks mentioned. The Motley Fool owns shares of Microsoft. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.