Altria-Philip Morris merger torpedoed by Juul crackdown

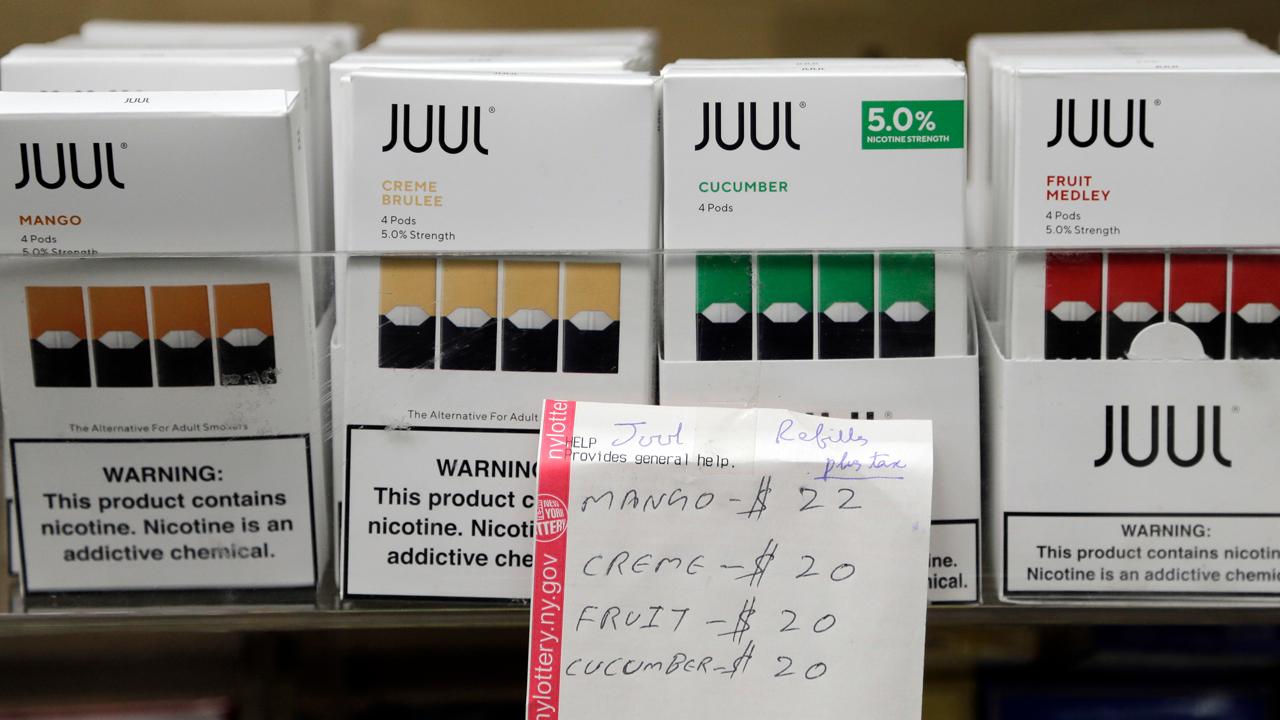

Deal talks between Altria and Philip Morris are off amid the ongoing crackdown of e-cigarette maker Juul, of which Altria owns a 35 percent stake.

“While we believed the creation of a new merged company had the potential to create incremental revenue and cost synergies, we could not reach agreement,” said Howard Willard, Altria’s chairman and CEO, in a statement.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MO | ALTRIA GROUP INC. | 65.40 | +0.01 | +0.02% |

| PM | PHILIP MORRIS INTERNATIONAL INC. | 182.73 | +0.74 | +0.41% |

The developments follow the resignation of Juul CEO Kevin Burns on Wednesday after what has been a widespread push against the e-cigarette maker from health officials and lawmakers.

Last November, Altria purchased a stake in Juul for nearly $13 billion. That value has fallen amid talk that vaping products are linked to lung illnesses, while speculation is rising that some products could face bans in the United States. Altria shares are down 17 percent this year.

Altria executive K.C. Crosthwaite was named Juul CEO on Wednesday, effective immediately.

“K.C. is a proven industry leader who understands the importance of responsible business practices. This decision by JUUL recognizes that this is a critical time for the company. I believe K.C.’s experience, discipline and dedication to making harm reduction an industry-wide reality will help JUUL achieve its mission, while also urgently confronting and reversing underage use of vapor products" said Willard.

So what now for the two leading tobacco makers?

Wells Fargo analyst Bonnie Herzog says the stocks are still good buys for investors and concerns are overblown.