Amazon employees will be able to use stock as collateral for home loans

Arrangement with Better.com will allow borrowing against shares for down payments at higher interest rates at a time when Amazon’s stock is down

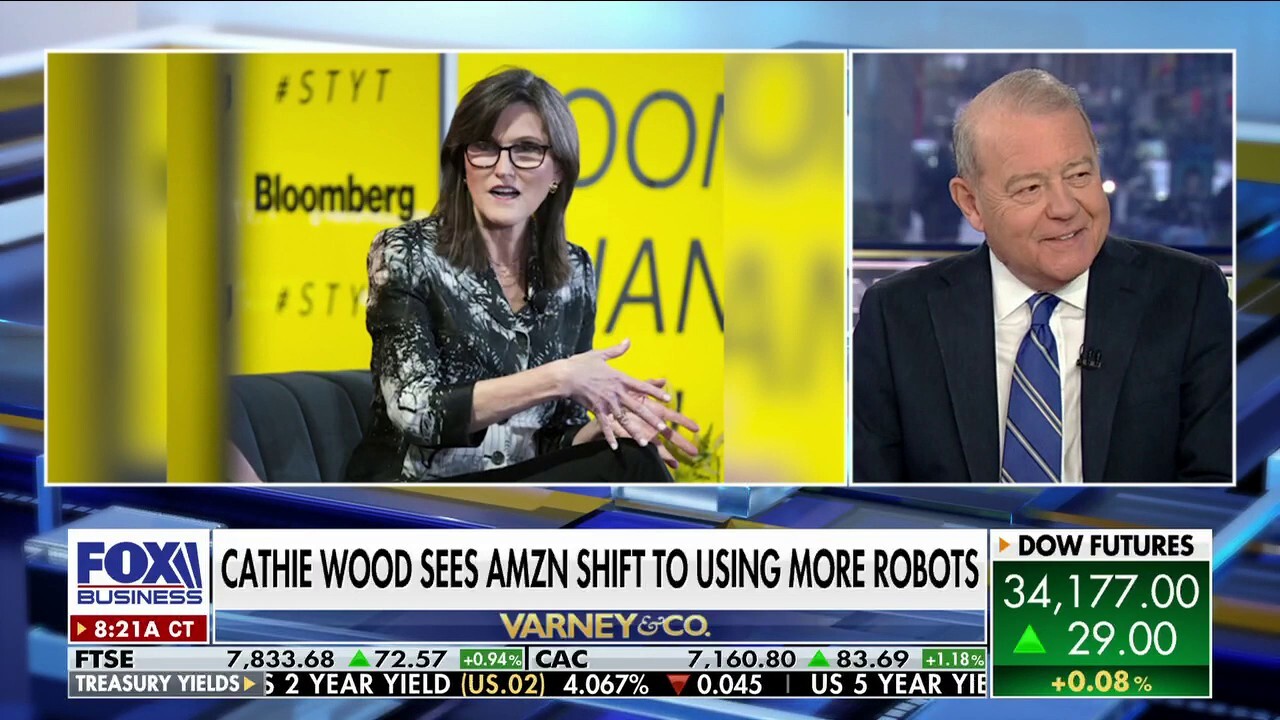

Cathie Wood makes a prediction about Amazon's future workforce

Ark Invest's Cathie Wood predicts Amazon will have more robot employees than humans by 2030.

Amazon.com Inc. employees will soon be able to use their company shares as collateral when buying homes, under an arrangement with online mortgage lender Better.com.

A new Better.com product, Equity Unlocker, will allow employees to pledge stock for loans for down payments, the companies said, rather than having to sell the stock to raise cash.

To protect itself from a continued slide in Amazon’s stock price, Better.com will charge a higher rate on the mortgages of employees pledging stock — between 0.25 and 2.5 percentage points above the market rate, depending on how the down payment is structured, the company said.

However, unlike in stock-based loans that carry the risk of margin calls, requiring borrowers put up more collateral or sell assets to reduce debts, Amazon employees’ loan arrangements would be protected if the stock price slides, Better.com Chief Executive Vishal Garg said in an interview.

AMAZON STOCK DROP HAS WORKERS FACING PAY SQUEEZE

Workers sort arriving products at an Amazon Fulfilment Center in Tracy, Calif., Aug. 3, 2015. (Reuters/Robert Galbraith / Reuters Photos)

The plan, which doesn’t involve any financial agreement between the companies, is designed to give flexibility to a workforce paid largely in company stock. Amazon historically has given less cash compensation to employees than its big-tech peers, and tried to make up the difference with restricted stock units — shares given to employees that vest over several years.

The longer employees stay with Amazon, the more their compensation can depend on these stock awards, with shares making up more than half of total income for some executives. Last year, amid a tight labor market and a slumping stock price, Amazon raised the cap for the cash component of salaries to $350,000 from $160,000.

The stock-based compensation was predicated on the assumption that Amazon’s stock would rise at least 15% each year, a mark it had been beating until recently. But over the past year Amazon’s share price is down more than 35%, dropping compensation below internal targets, the Journal has reported.

As a result, Amazon is guiding its employees to "think like owners" and hold the stock longer to experience an increase in the price, according to statements from spokespeople and training documents viewed by The Wall Street Journal.

AMAZON WORKERS EXPECTED TO BE IN PERSON 'MAJORITY OF THE TIME,' CEO SAYS

Amazon.com

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMZN | AMAZON.COM INC. | 204.86 | +0.07 | +0.03% |

The Better.com arrangement is similar to a service that banks offer high-net-worth clients, issuing loans backed by their portfolios of stocks and bonds. Such securities-backed loans can be risky for the banks when asset prices fall sharply.

The partnership between Amazon and Better.com would allow Amazon employees to hold stock longer if they want to wait for the price to recover, while still participating in buying a home.

"Any company that wants to maintain an RSU-centric strategy is going to have to be creative about figuring out ways that the RSUs can be valuable to employees when those employees don’t want to sell them when stock prices are going down," Better.com’s Mr. Garg said, referring to restricted stock units.

AMAZON AXES FREE GROCERY DELIVERY ON SOME PRIME ORDERS

In this Dec. 17, 2019, photo Steven Smith places packages onto a conveyor prior to Amazon robots transporting packages to chutes that are organized by zip code, at an Amazon warehouse facility in Goodyear, Ariz. (AP Photo/Ross D. Franklin / AP Images)

An Amazon spokesman said the new service aligns with Amazon’s benefits program that seeks to care for the financial wellness, mental wellness and physical wellness of its employees.

The program, launching Tuesday in states including Washington, New York and Florida, will also be available to laid-off Amazon employees who still retain restricted stock units. Over the past few months, Amazon has laid off around 18,000 employees, joining other tech companies in cutting the workforce to reduce costs as demand weakens.

TECH GIANTS’ CLOUD PAINS AREN’T SHARED EQUALLY

Attendees walk through an expo hall at AWS re:Invent 2021, a conference hosted by Amazon Web Services (AWS), on Wednesday, Dec. 1, 2021, at The Venetian in Las Vegas. (Noah Berger/Amazon Web Services via AP Images) (Noah Berger/Amazon Web Services via AP Images / AP Newsroom)

Better.com is a customer of Amazon’s cloud-computing business, Amazon Web Services. The company pitched the partnership to Amazon’s innovation team as a result of that relationship, said Mr. Garg. He hopes to work with other companies with Better.com’s Equity Unlocker product.

Better.com was launched in 2014. The company benefited from the boom in housing prices and wave of mortgage refinancing that accompanied the pandemic and low interest rates. It has since been rocked by the rise in interest rates and resulting sharp pullback in refinancings, as well as a controversy when Mr. Garg laid off 900 workers via a Zoom call in late 2021. He apologized for his handling of the layoffs. The company has since cut thousands more jobs.