AMC chief executive delivers warning after stock conversion rejected

‘I repeat, to protect AMC’s shareholder value over the long term, we MUST be able to raise equity capital,’ says AMC CEO

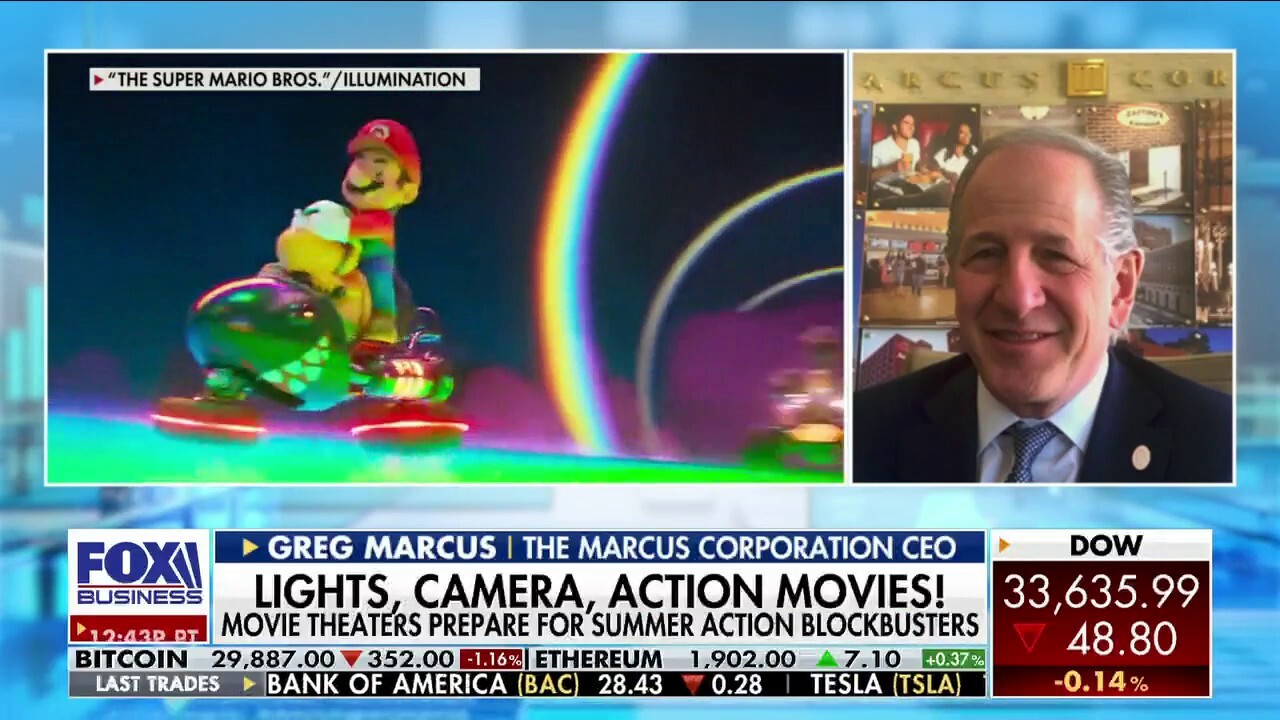

Movie theaters are an important part of film entertainment ecosystem: Greg Marcus

The Marcus Corporation CEO Greg Marcus previews the summer movie season after theater stocks experienced a recent boost on 'The Claman Countdown.'

AMC Entertainment CEO Adam Aron is warning that the company could "conceivably" run out of cash over the next two years if not allowed to raise money through a stock conversion.

Aron is responding to Delaware Vice Chancellor Morgan Zurn’s Friday decision to block a proposed settlement that would have allowed the American movie theater chain to issue more shares. The company is still trying to recover financially from the pandemic.

AMC THEATRES SCRAPS SEAT LOCATION-BASED PRICING PLAN

"AMC must be in a position to raise equity capital," Aron tweeted in an open letter to company investors. "I repeat, to protect AMC’s shareholder value over the long term, we MUST be able to raise equity capital."

Zurn said in her ruling that she cannot approve the settlement "as submitted," because it would release potential claims by preferred shareholders who were not represented in the lawsuit or settlement.

AMC shares soared on Monday, while the preferred stock, Ape shares, sank.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMC | AMC ENTERTAINMENT HOLDINGS INC | 1.49 | +0.09 | +6.05% |

| APE | NO DATA AVAILABLE | - | - | - |

Adam Aron, chairman of the board and CEO, AMC Entertainment, listens during the Milken Institute Global Conference on Oct. 18, 2021 in Beverly Hills, California. (Photo by PATRICK T. FALLON/AFP via Getty Images / Getty Images)

Aron said 72% of AMC common shareholders and 91% of APE preferred unit holders that voted in the March 14, special election wanted to proceed with the conversion.

AMC Entertainment

."Given the absolute imperative to be able to raise equity capital going forward, we take seriously the court’s Friday ruling," he continued. "In response, we along with the plaintiffs filed with the Delaware court, a modification of the legal release surrounding the settlement of the Delaware litigation in an effort to address the court’s concern."

UNIVERSAL STUDIOS DENIES IT TRIMMED TREES TO EXPOSE STRIKING WORKERS TO HEAT

The conversion would dilute the common stockholders' ownership while allowing AMC to chip away at some of its $5.1 billion debt.

Meanwhile, the judge rejected the settlement after determining the holders of common stock could not release AMC from potential claims that belong to holders of preferred shares, an issue which objectors did not raise.

IS THE 60/40 INVESTMENT PORTFOLIO MAKING A COMEBACK?

"If the court agrees, it would be our hope to implement as soon as possible the plan approved by AMC shareholders election in March," Aron tweeted.

AMC movie theater exterior, Marlton, New Jersey, Oct. 20, 2021.

In February, AMC was sued for allegedly rigging a shareholder vote that would allow the company to convert preferred stock to common stock and issue hundreds of millions of new shares.

AMC has not responded to inquiries from FOX Business.

If inflation keeps going down, investors will want to be in stocks: Kenny Polcari

Slatestone Wealth chief market strategist Kenny Polcari shares investment strategies for the earnings season on 'Varney & Co.'

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Reuters contributed to this report.