American Airlines boosts profit outlook on record travel

American Airlines, regional partners operated nearly 500K flights in second quarter

American Airlines passenger gets entire plane to himself after 18-hour delay

An American Airlines passenger was the only one on his flight after it was delayed by 18 hours.

American Airlines raised its annual forecast for adjusted profit on Thursday thanks to increasing demand for domestic and international travel.

The airline now said it expects an adjusted profit of $3 to $3.75 per share for 2023 compared with its prior outlook of $2.50 to $3.50 per share.

The carrier reported a record quarterly revenue of $14.1 billion on Thursday, a 4.7% increase from the prior year.

AMERICAN AIRLINES BANS NORTH CAROLINA TEEN WHO TRIED POPULAR TRAVEL HACK

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AAL | AMERICAN AIRLINES GROUP INC. | 15.24 | +1.08 | +7.63% |

American and its regional partners operated nearly 500,000 flights throughout the second quarter, with an average load factor of approximately 86%, according to the airline.

JetBlue and American Airlines planes are seen at LaGuardia Airport in the Queens borough of New York City on Thursday, June 8. (Michael Nagle/Bloomberg via Getty Images / Getty Images)

The air carrier also delivered a record percentage of scheduled departures over the Memorial Day weekend, with momentum continuing into a record June for scheduled departures and controllable completion factor.

NORTH CAROLINA RESIDENT 'INTERROGATED' AT AIRPORT AFTER USING POPULAR TRAVEL HACK, FATHER SAYS

"Our operation is performing at historically strong levels, and we have worked to refresh our fleet and build a comprehensive global network, all of which helped to produce record revenues in the second quarter," American Airlines CEO Robert Isom said in a statement. "We will build on this momentum the rest of the year and continue to prioritize reliability, profitability, accountability and strengthening our balance sheet."

People wait for their luggage at an American Airlines baggage claim at the George Bush Intercontinental Airport on Aug. 5, 2021, in Houston, Texas. (Photo by Brandon Bell/Getty Images / Getty Images)

JETBLUE, AMERICAN AIRLINES ENDING POPULAR BENEFITS AS ALLIANCE WINDS DOWN

Despite the profit boost, shares of American Airlines are down on Thursday. However, shares for the airline have taken off since Jan. 1, gaining around 37%.

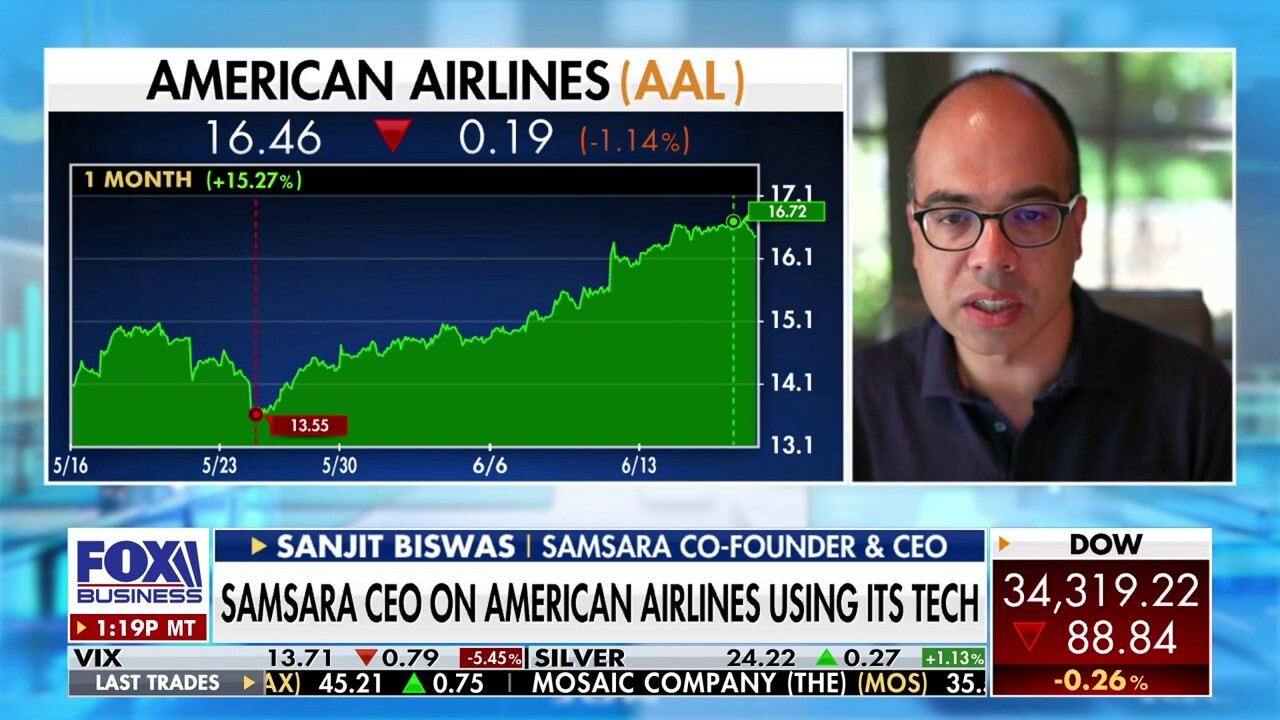

American Airlines reduced flight delays by 15% using Samsara's tech

Samsara co-founder and CEO Sanjit Biswas explains how the Internet of things company got American Airlines' Dallas hub to decrease flight delays on 'The Claman Countdown.'

While the stock value has risen sharply in the last 12 months, analysts at Barclays don’t expect the shares to hold their current trajectory.

BLACKROCK GIVES PROXY VOTE TO RETAIL INVESTORS OF ITS BIGGEST ETF

Analysts have maintained their underweight rating, saying it reflected the airline’s industry-high in financial leveraging that presents the greatest uncertainty and relative risk under the current environment.

American Airlines

.According to Barclays, risks specific to American could include the carrier's inability to pass along cost inflation in the form of price, which can further dilute margins.