AT&T Has a Risky Plan to Grow DIRECTV NOW

When AT&T (NYSE: T) launched DIRECTV NOW, its digital streaming live television service, at the end of November, it offered more than 100 channels for $35 a month. That was a special introductory price designed to jump-start not only the service, but also the category. Even though DISH Network's(NASDAQ: DISH) Sling TV had been in the space since early 2015 and Sony (NYSE: SNE) entered it earlier last year with PlayStation Vue, neither company's services have been big hits.

AT&T hoped to change that by offering a cable-like package at a heavily discounted price. That did make its service stand out compared to Sling TV, which offers over 20 channels for $20, and PlayStation Vue, which offers 90 channels for $54.99 (marked down from its regular price of $64.99).

From the beginning, however, AT&T said its $35-a-month offer was an introductory price that would be a limited-time offer. Now, perhaps as an attempt to push consumers to make a choice, the company has decided to set an end date for the promotion: Jan. 9 is that date.

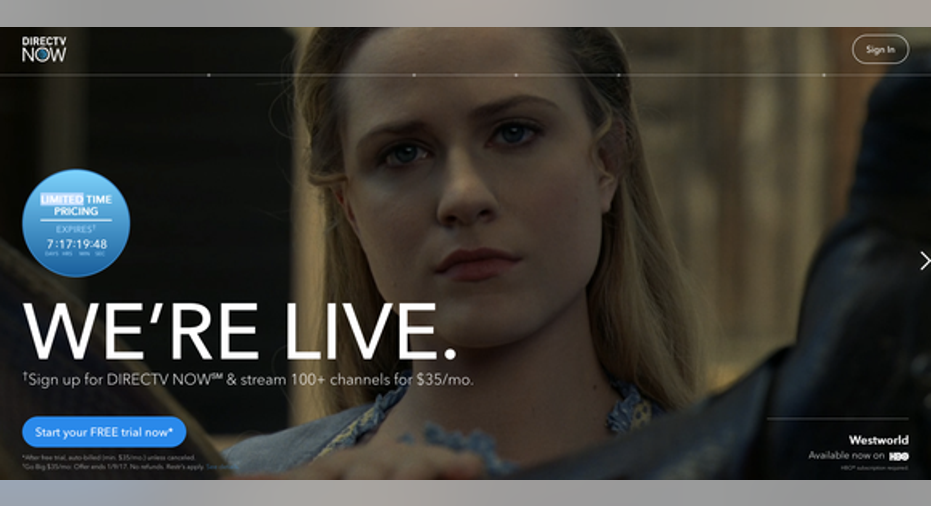

AT&T has added a countdown clock to its DIRECTV NOW website signaling the end of the promotion. Image source: AT&T.

What is AT&T doing?

AT&T has put a countdown clock on its website, showing time for the $35-a-month deal ticking down to a Jan. 9 closing. In theory, existing customers get to keep the promotional price forever (though AT&T reserves the right to change fees and move channels out of the package). That means that ending the deal -- which is a very good price for what it offers compared to traditional cable or satellite -- forces people to make a decision.

Why is AT&T doing this?

While the company has not published numbers for what it pays channel owners, it's very likely DIRECTV NOW loses money at the $35 price. That's actually OK for AT&T, as it can use the service to bring in customers who do not have its wireless or internet product and then offer them deals to add those.

Putting an end date on the promotion should force fence-sitters to make a decision. In theory, these are people -- maybe millions of them -- who either do not have cable or are considering dropping it. DIRECTV NOW at $35 offers a very cable-like package for a much cheaper price than most people pay. It's a good deal, but not if consumers don't actually want live-streaming cable-like services.

Why would people not want this?

When it first launched, Sling TV seemed like it would be a big hit. That has not proven to be the case possibly because the cord-cutting audience has learned to live without cable and the cord-never folks (people who never had cable in the first place) perhaps don't miss what they never had.

Neither DISH nor Sony releases subscriber counts for their streaming TV services, but the total subscriber count likely sits between 1 million and 1.5 million customers. That's a raw guess, based on the total customer counts DISH does release, but it's a relatively tiny number in a cable universe that still has 94 million homes.

By putting an end date on this promotion, AT&T can gauge whether enough interest exists in live-streaming television for the company to continue. These are products that seem like a good idea, that have so far been rejected by the marketplace.

That may be because even the top packages from the live-streaming services have holes compared to cable. In most cases they are missing at least some broadcast networks and their interfaces -- while not bad for a digital product -- are clunky compared to just flipping around with a remote control.

It's also very possible that cord-cutters and cord-nevers are finding their entertainment elsewhere. That could mean that live-streaming cable, even at a very good price, has only a very limited audience. That would be bad news for DIRECTV NOW, Sling, and PlayStation Vue, but it's better for all three companies to know if they are going after some portion of the total cable audience or a very small subset of it.

10 stocks we like better than AT and T When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and AT and T wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

Daniel Kline has no position in any stocks mentioned. He tried cutting the cord and hated it. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.