Banks pass Fed’s stress tests results with flying colors

The restrictions on U.S. banks will be lifted officially on June 30

Stocks at session highs as Biden announces infrastructure deal

Fox News contributor Liz Peek and Brandywine Global portfolio manager Jack McIntyre analyze the market's reaction to an infrastructure deal.

America's largest banks aced the Federal Reserve’s stress tests and are now free to dole out dividends and step up share buybacks which were restricted during the height of COVID-19.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.40 | +12.24 | +3.95% |

| WFC | WELLS FARGO & CO. | 93.97 | +2.41 | +2.63% |

| BAC | BANK OF AMERICA CORP. | 56.53 | +1.59 | +2.89% |

Those restrictions will be lifted officially on June 30 after 27 of the nation’s largest banks including JPMorgan, Wells Fargo, and Bank of America, now hold more than double the average capital cushion required by the Fed to ensure the stability of the U.S. financial system and the ability to lend to both businesses and consumers.

Bank of America CEO Brian Moynihan is among the chiefs that will start rewarding shareholders who currently sit with a dividend yield of 1.76%

"We expect to increase our dividend and increase our share buybacks because frankly, it’s simple, we’re making good money doing a great job for our customers and a great job for society and, therefore, our shareholders ought to benefit too so that’s what we’ll do," said Bank of America CEO Brian Moynihan on "Mornings with Maria" last month.

Wells Fargo shareholders may also see a boost to their dividend yield of 0.90%.

FANNIE AND FREDDIE SHARES TANK

"It's not lost on us that our dividend is quite low, certainly relative to where we're earning today and as we look forward," said CEO Charles Scharf during the company’s April earnings call. "We would like to increase the dividend to a more reasonable level."

Piper Sandler analyst R. Scott Siefers also notes the bank is in a strong position for a robust share buyback.

"There is no denying the potential power of repurchase for this company. The Fed’s asset cap has constrained balance sheet growth, allowing a massive horde of capital to build" he wrote in a note to clients.

All in all Siefers points out the wildcard is not if banks will return capital to shareholders but when.

"We expect our banks to boost their dividends by a median 7.6% from the current levels, and we see them repurchasing shares equal to 6.4% of 1Q21 shares outstanding in 2H21/1H22" he predicts.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XLF | FINANCIAL SELECT SECTOR SPDR ETF | 54.26 | +0.97 | +1.82% |

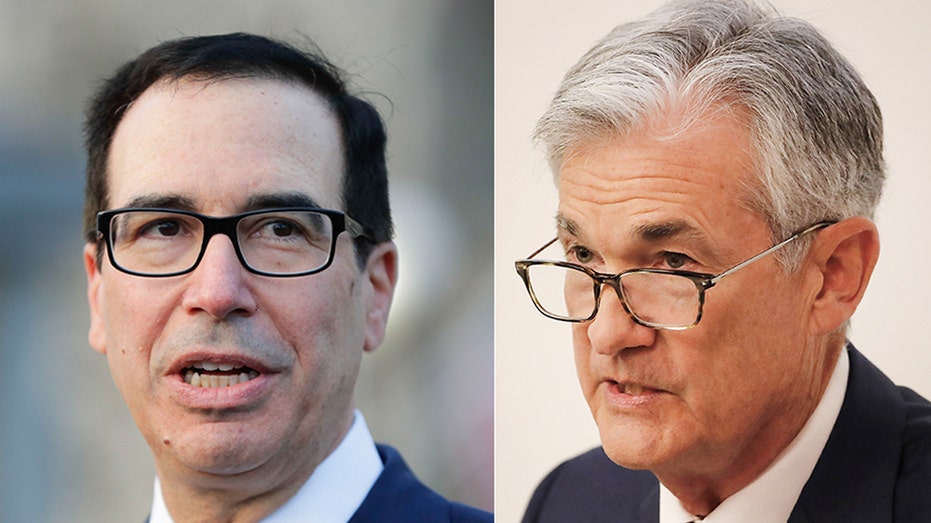

As COVID-19 hit, the U.S. Treasury Department, under the direction of then-Secretary Steven Mnuchin, along with Fed Chairman Jerome Powell took a number of measures to keep liquidity in the system and get funds to struggling small businesses and Americans who lost their jobs – while also keeping the banks prudent and healthy.