Barnes & Noble shares tumble to new lows amid retail apocalypse

Barnes & Noble’s shares plunged to new lows on Friday after the struggling retailer reported a major drop in sales for the holiday season.

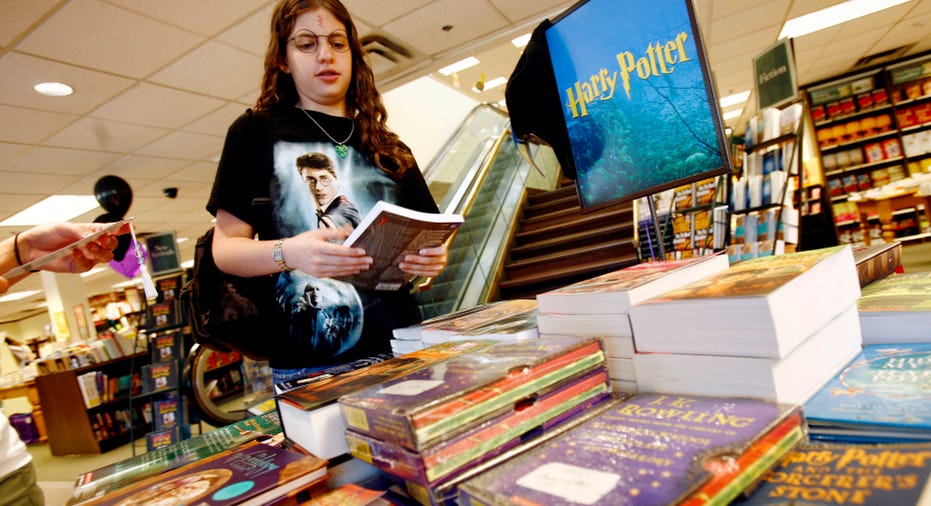

The New York-based company, which is best known for selling books, said same-store sales fell more than 6% to $953 million in its most recent fiscal quarter. Barnes & Noble’s digital business was an area of particular weakness, as sales dropped 4.5% even as more customers turn to e-commerce operations like Amazon to do their shopping.

Barnes & Noble’s stock fell as much as 17% after the subpar report and was trading down roughly 15% at $5.55 per share as of Friday afternoon. Shares fell to their lowest level since the mid-1990s, according to Barron’s.

Many traditional retailers are contending with declining foot traffic in stores amid the e-commerce boom. Digital-first companies like Amazon are producing record sales figures even as brick-and-mortar giants like Macy’s and J.C. Penney close store locations and lay off employees.

Retail bankruptcies hit a six-year high in 2017 and are expected to occur at a high rate again this year.

Barnes & Noble executives have touted a reorganization plan that includes a sharper focus on the digital and mobile shopping experience, as well as smaller, streamlined stores that will focus on successful product segments while shifting away from underperforming offerings.

Activist investors have proposed taking Barnes & Noble private or selling the company amid stiff competition in the retail space, according to multiple reports. However, no deal has materialized yet.