Beta

Beta is a metric that compares a stock's movements relative to the overall market, or a certain stock index. A high-beta stock tends to be more volatile than average, while a low-beta stock tends to be less volatile. While it's true that high-beta stocks are typically riskier than the average stock, beta isn't necessarily indicative of risk, as many people believe.

What the number means

A stock's beta compares its historical movements to the overall market, or a stock index -- usually the S&P 500. And there are three possible categories a stock can be in, based on its beta.

- A stock with a beta less than one tends to be less volatile than the overall index. For example, a beta of 0.5 implies that a stock's movements will theoretically be about 50% of the index's movements.

- A stock with a beta of more than one is more volatile than the overall index. For example, a beta of 2.0 implies that the stock will move twice as much as the market.

- A stock with a beta of exactly one is theoretically exactly as volatile as the overall market.

Examples

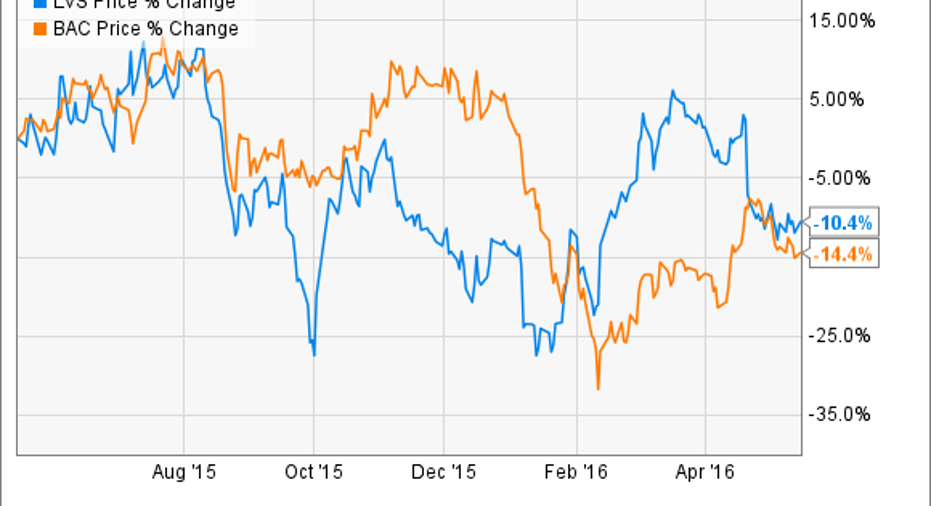

To illustrate what a stock's beta means, let's consider a few examples. Las Vegas Sands and Bank of America are relatively high-beta stocks, with betas of 1.9 and 1.8, respectively, as of this writing. They've had some pretty significant price swings over the past year:

On the other hand, Procter & Gamble and Target both have betas of 0.5 and 0.6, respectively. And you can see an obvious difference between these and our high-beta examples. Just look at the scale of percentage moves on the right side of each chart:

What beta doesn't mean

Keep in mind that a high beta doesn't necessarily imply that a stock is risky or volatile, and that a low beta doesn't necessarily imply that a stock is safe.

Also keep in mind that beta is based on historical average movements of a stock. It doesn't take into account such variables as earnings reports, news items, or overall sector trends. Therefore, on any given day, the performance of a stock is unlikely to match its beta's theoretical implications exactly.

For example, as this article is written, the S&P 500 is up by 1.17% for the day. National Oilwell Varco, a manufacturer of oil-drilling equipment, has a beta of 1.6, implying that it should be up by about 1.87%. However, thanks to a spike in oil prices, the stock is up by 4.04%, or more than twice the gain implied by its beta. And just because it's been rather volatile lately doesn't automatically make it a risky stock. In fact, we've written to the contrary several times.

The point is that beta is just one piece of the puzzle, and is useful for predicting overall volatility and price movements. So, if you don't have the stomach for large price swings in your portfolio, you're probably better off sticking to low-beta stocks. However, a stock's price depends on many different factors, so be sure to look at the big picture before investing.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us atknowledgecenter@fool.com. Thanks -- and Fool on!

The article Beta originally appeared on Fool.com.

The Motley Fool recommends Bank of America and Procter & Gamble. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.