Better Buy: Cameco Corporation vs. Denison Mines Corp

Cameco Corporation (NYSE: CCJ) is the world's largest publicly traded uranium miner, while tiny Dension Mines Corp's (NYSEMKT: DNN) key assets are uranium development projects. One is big today; the other could be big tomorrow. The uranium industry is in the doldrums right now despite a positive outlook, which may make Dension appear a better option. But Cameco is still the right choice in my book.

Bright tomorrow, horrible today

The world's fleet of nuclear power plants went from 439 to 446 in 2016. Cameco expects that number to increase again in 2017, to 456. And it's only set to go up from there, with 58 reactors currently under construction around the world. China is leading the way, with 21 reactors. That's the backstory for uranium, which industry players expect to lead to solid demand...at some point in the future.

Image source: Cameco Corporation.

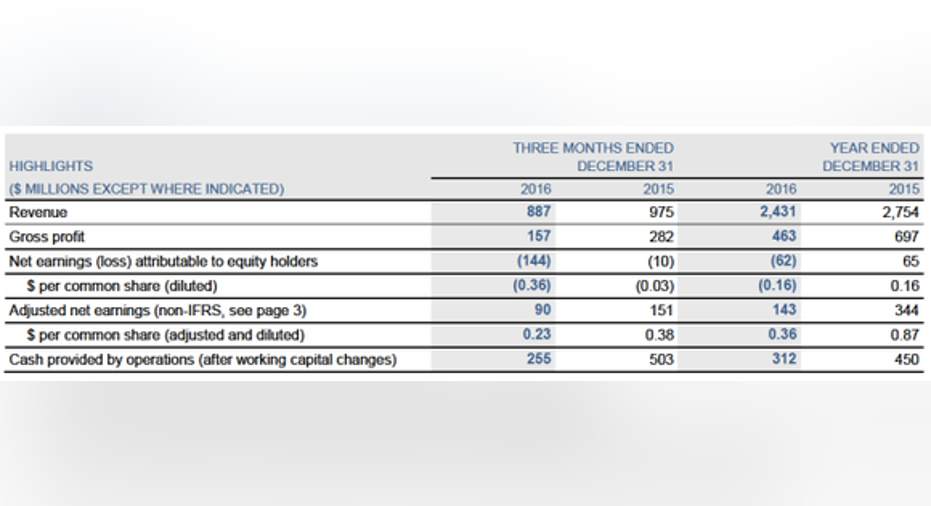

The problem is that demand for uranium right now is weak, and so is pricing. In fact, when Cameco reported its full-year 2016 results, it noted that uranium prices are near 12-year lows. All of the industry is doing a delicate balancing act, since companies can see the demand potential but have to invest in today's lousy market.

All about the future

That dichotomy might make Dension Mines sound like a great investment option. This $340 million market cap company has a small operating investment but an impressive portfolio of exploration and development projects. It's basically doing the groundwork today so it can supply tomorrow's demand. It's a growth story.

But, as with any miner that's building a business from the ground up, it's bleeding red ink. In fact, it hasn't made money since 2007. Denison has a 22.5% interest in a uranium processing facility that brings in some revenue, but it's not nearly enough to offset the costs of developing new mines. It has supported its development efforts by steadily issuing stock. The share count has increased from roughly 190 million in 2008 to more than 530 million in September of 2016.

Cameco's nuclear reactor growth projections. Image source: Cameco Corp

Summing it up, Dension is a money-losing uranium company with projects that could, if uranium markets improve, be worth a lot of money in the future. The penny stock (it's trading below a $1 a share) is a gamble on the future. Only, every time it issues stock to fund development, it dilutes the value of existing shareholders. So, the spending it's doing today is taking a heavy toll, with the shares worth just a fraction of the more than the $13 they fetched in 2007.

Up and running

This is almost the exact opposite of what's going on at Cameco. Cameco sold 31.5 million pounds of uranium in 2016, down 3% year over year. Its focus on long-term contracts allowed it to charge 60% more than spot price, protecting its core business from the uranium downturn. And while the company lost money in 2016, if you pull out one-time charges related to adjusting to today's difficult market, it was profitable. In other words, it's muddling through the downturn in decent shape.

The types of adjustments Cameco made to deal with the industry-wide malaise include closing mines and trimming staff, among other things. There's no way around it -- it isn't pretty. But Cameco is making these moves from a position of strength within the industry. And it has uranium assets that it could bring online if demand picks up as expected.

Cameco Corporation's earnings before and after one-time charges. Image source: Cameco Corporation.

In my mind, the big difference between Denison and Cameco is that Cameco has a sizable business to support it today and in the future, regardless of what the uranium markets do. Denison is spending money it doesn't have on a future that may or may not materialize as expected -- or in a timely fashion. I'm a bird-in-the-hand kind of guy, so Cameco looks far more attractive to me.

Adjusting for today

The big story at Cameco is adjusting its business to today's uranium market. It hasn't been smooth or easy, with the company falling into the red, including one-time charges, in 2016. That said, it has a solid portfolio of contracts, an operating business that's making money (if you pull out the charges), and the ability to expand production if the future for nuclear power is as bright as current development suggests it will be. Dension, meanwhile, is all about the future, but it will have to keep issuing stock to get there. Unless you have an iron-clad stomach, Cameco is the better choice even though times look tough right now.

10 stocks we like better than CamecoWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now...and Cameco wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017.

Reuben Brewer has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.