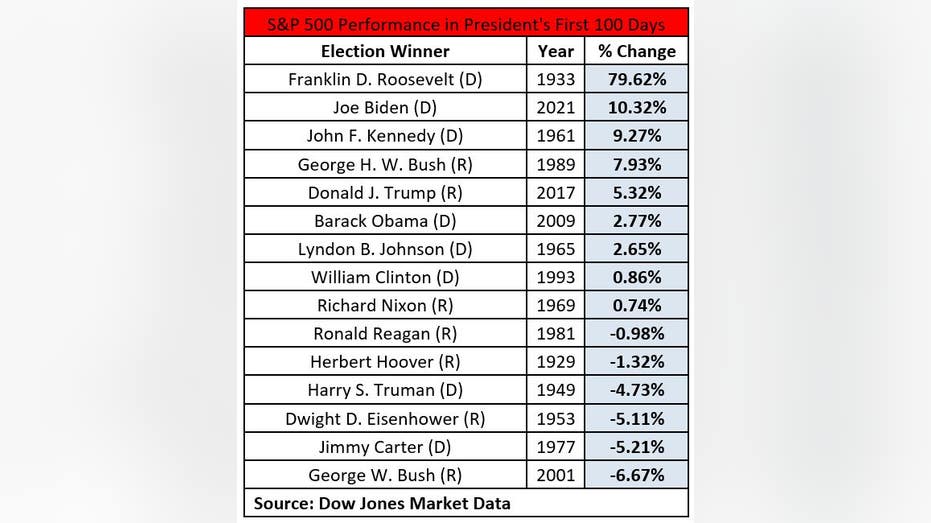

Biden's first 100 days best for stock market since FDR, but risks loom

Biden just provided an extension to a bull market already in motion, expert said

How Biden's capital gains tax will impact investors

BMO Capital Markets chief investment strategist Brian Belski provides insight into the possible market and economic impact of raising the capital gains tax, the Federal Reserve and earnings.

President Biden’s first 100 days in office were the best for stock market investors since President Franklin Delano Roosevelt launched the New Deal that pulled the U.S. economy out of the Great Depression, but strategists warn headwinds are forming.

The S&P 500 has rallied 10.12% since Biden’s inauguration on Jan. 20, building on the recovery that began under President Trump, who lifted the U.S. economy out of the deepest downturn of the post-World War II era.

"Joe Biden just provided an extension to a bull market that was already in motion," said David Rosenberg, chief economist and strategist at Toronto-based Rosenberg Research.

The benchmark index finished Thursday 87% above its March 2020 bottom, fueled by the Federal Reserve’s loose monetary policy, Congress’ spending binge, vaccinations and the reopening of the U.S. economy.

However, momentum has stalled over the past two weeks as investors have begun to assess Biden’s proposed $2.3 trillion infrastructure package, called the American Jobs Plan, and the tax hikes that will be needed to help pay for the spending package, which Republicans say is Alexandria Ocasio-Cortez’s Green New Deal rebranded.

Biden, who has been championed by self-proclaimed democratic socialist Sen. Bernie Sanders to be the "most progressive" president since FDR, is also considering a $1.8 trillion package called the American Families Plan to provide money for child care, tuition-free college and other programs.

STOCK INVESTORS DISSECT BIDEN’S CAPITAL GAINS TAX HIKE PROPOSAL

So far there has been "celebration and jubilation over government spending," said Rosenberg. "We haven't seen yet how it's going to be paid for."

To help pay for the American Jobs Plan, the Biden administration has discussed raising the top corporate tax rate to 28% from 21%. The American Families Plan, meanwhile, would be partially paid for by raising income taxes on those households making $400,000, or $200,000 per individual, in addition to hiking the capital gains tax for wealthy Americans to 39.6%, or 43.4% when including a tax on net investment income.

Goldman Sachs analysts predict the top tax rate on capital gains for wealthy Americans will go up, but only to 28% and that any impact on the stock market will be limited.

S&P 500 returns have been "weak ahead of past capital gains tax hikes, but selling was short-lived and reversed afterward," wrote David Kostin, chief U.S. equity strategist at Goldman Sachs. He added that the U.S. economic growth is "peaking," which will limit short-term upside for stocks.

Kostin has a 4,100 mid-year target and a 4,300 year-end target for the S&P 500, which settled at 4,183.13 on Wednesday.

THE RECORD STOCK MARKET IS SHOWING SIGNS OF CRACKING

Meanwhile, Scott Wren, senior global strategist at Wells Fargo Investment Institute, also forecasted the S&P 500 will climb to 4,300 by year-end.

Wren said that stimulus has "overwhelmed" the threats of higher taxes and more regulation and that the stock market is exhibiting "early-cycle behavior."

He noted the market’s advance has been very broad with a "high percentage" of S&P 500 stocks trading above their 200-day moving averages. At a top, the market tends to narrow as investors crowd into the biggest, best names because they are viewed as "safe."

CLICK HERE TO READ MORE ON FOX BUSINESS

Rosenberg said the fundamentals are strong, but "already priced in," and warned investors should brace "for a very serious correction" sometime in the next 12 months as investors grapple with the looming fiscal cliff that will occur when the stimulus checks run out and Trump’s tax cuts begin to disappear.

He said that if Biden's tax cuts are as advertised, the result will be the S&P 500 being 16% lower than if they had not occurred.

"The stock market may end up going up for different reasons when all it is said and done," Rosenberg said. "But I don't think people will look back on the next four years that whatever the stock market does, if it does continue to go up, that it has anything to do with Joe Biden's policies."