Bitcoin, gold prices jump on inflation hedge

Consumer prices rose 6.2% Y/O/Y in October, the most in 31 years

Art Laffer on surging inflation: Fed does not have an answer

Former Reagan Economist Art Laffer discusses the administration's handling of inflation, Biden's Build Back Better agenda, unemployment in the U.S. and the ongoing economic recovery.

Investors are rushing to pad their portfolios with both new and traditional inflation hedges, a sign higher prices won't abate anytime soon.

Following October's 6.2% surge, annually, in consumer prices, reported on Wednesday, crypto and gold prices spiked.

STOCKS SLIDE AS INFLATION SURGES

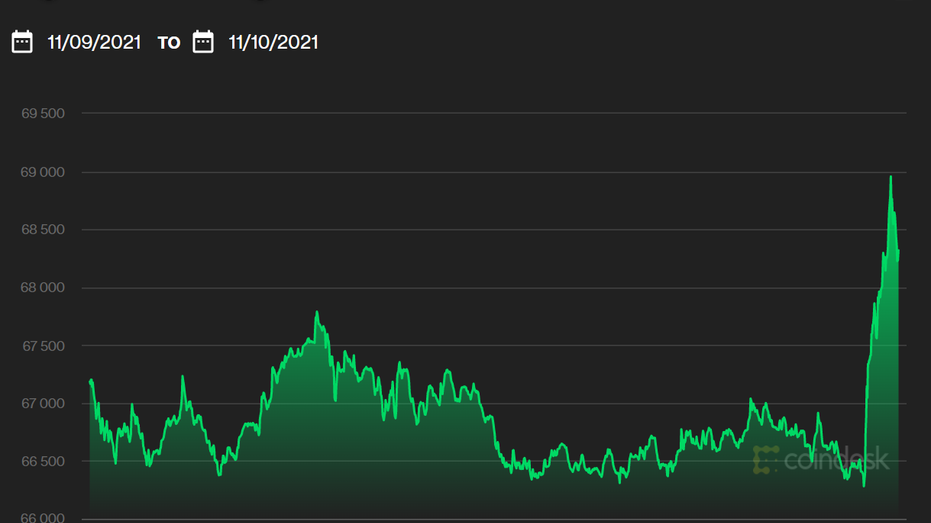

Bitcoin surged above the $68,000 level, just below its all-time high of $68,525.84, as tracked by CoinDesk.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BITO | PROSHARES BITCOIN STRATEGY ETF - USD DIS | 9.27 | +0.11 | +1.20% |

| GCC | WISDOMTREE TRUST ENHANCED COMMODITY STRATEGY | 22.27 | +0.08 | +0.36% |

| BITQ | BITWISE CRYPTO INDUSTRY INNOVATORS ETF - USD DIS | 19.29 | +0.14 | +0.73% |

In turn, various crypto exchange-traded funds also rose.

INFLATION WILL LIKELY GET WORSE BEFORE IT STARTS IMPROVING, GOLDMAN WARNS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GLD | SPDR GOLD SHARES TRUST - USD ACC | 459.61 | +1.44 | +0.31% |

By the same token, gold, a traditional inflation hedge, rose nearly 2% to $1,862.50. The SPDR Gold ETF traded higher in tandem.

The yellow metal is on pace for its fifth straight session of gains and year to date has fallen over 3%.