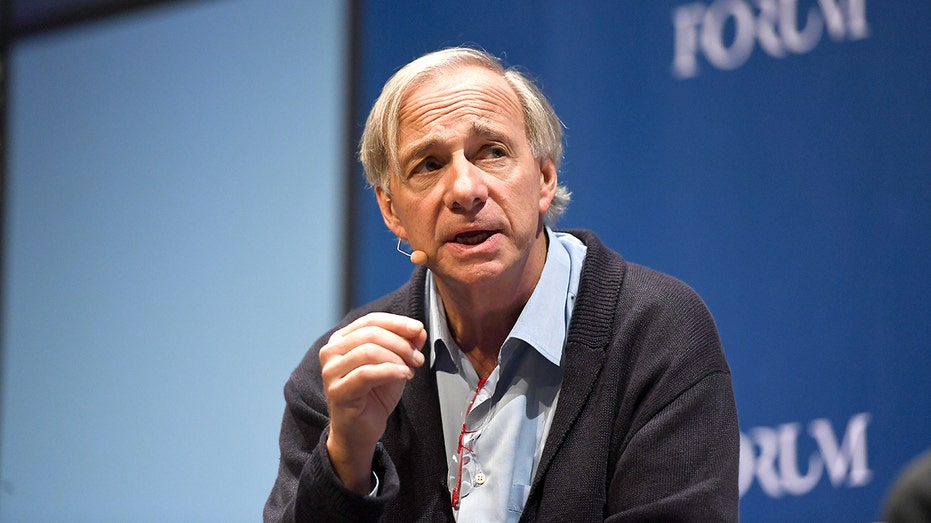

Bitcoin over bonds: Ray Dalio reveals he owns crypto

Billionaire: as bitcoin becomes more popular, investors might choose to put savings in crypto rather than government-backed bonds

Billionaire investor Ray Dalio revealed Monday that he has some skin in the game on bitcoin — and said he’d rather invest in cryptocurrencies than buy bonds.

"I have some bitcoin," said the founder of Bridgewater Associates, the largest hedge fund in the world. He did not say how much he owned.

He added in a pre-recorded interview with CoinDesk that as bitcoin becomes more popular, investors might choose to put their savings in the crypto rather than government-backed bonds.

INFAMOUS BITCOIN PIZZA GUY WHO SQUANDERED $365M HAUL HAS NO REGRETS

"Personally, I’d rather have bitcoin than a bond," said Dalio, who has been vocal about his displeasure with the low payout from bonds, especially during times of high inflation. The interview was recorded on May 6.

Dalio made his comments before the past week of whiplash that’s struck the cryptocurrency market.

Billionaire investor Ray Dalio revealed Monday that he has some skin in the game on bitcoin — and said he’d rather invest in cryptocurrencies than buy bonds.

When Dalio’s remarks were recorded earlier this month, bitcoin was trading at about $57,000 per coin, near the crypto’s peak. Last week, the digital currency fell below $40,000 per coin and nearly touched $30,000 before starting this week off with a comeback.

Bitcoin’s price was up more than 18 percent Monday afternoon to about $37,400 per coin.

Dalio’s disclosure that he owns some of the crypto also came with a warning. He said governments could be increasingly threatened by the rise of bitcoin and the effects it might have on state monetary systems. Governments might seek to crack down on the sector, Dalio added, because as the crypto becomes more popular than bonds, governments could lose control over their ability to raise money.

"Bitcoin’s greatest risk is its success," he said.

Last week, bitcoin fell below $40,000 per coin.

BITCOIN MINERS AGREE TO FORM COUNCIL AMID MEETING WITH ELON MUSK

Investors have already seen some regulatory developments around cryptocurrency since Dalio’s remarks were recorded.

Last week, both the Federal Reserve and the Treasury Department signaled a crackdown could be coming for cryptos, with the Fed announcing it would explore releasing its own cryptocurrency. The Treasury Department said it will require any crypto transfer worth $10,000 or more to be reported to the Internal Revenue Service, adding that crypto transactions represent a tax flight risk.

And authorities in China last week called for a crackdown on "mining" and trading, saying that greater regulation is needed to protect the country’s financial system and economy.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Dalio warned about looming regulation back in January in a blog post titled "What I Think of Bitcoin."

"I suspect that Bitcoin’s biggest risk is being successful, because if it’s successful, the government will try to kill it and they have a lot of power to succeed," Dalio wrote.