Bitcoin’s bounce ‘still early innings’

Bitcoin has jumped over 159% after falling to $17,000 last December

Bitcoin will run over the next 18 to 24 months: Anthony Pompliano

Pomp Investments' Anthony Pompliano explains why big banks like J.P. Morgan are afraid of crypto on 'Making Money.'

Bitcoin’s crypto winter appears to be thawing, bouncing to the $43,000-$46,000 range, up 159% from last December as tracked by Dow Jones Market Data Group. The upward move could be the start of a new cycle.

"There seems to be a lot of retail investor sentiment that's been sidelined. There hasn't been the hype and excitement that you've seen kind of mid to late cycle of the last crypto rally. So that actually gives us confidence that we're still a little bit early innings, that there's a lot of capital that has a cushion," John Todaro, senior research analyst, Needham & Company, told FOX Business.

Several tailwinds are fueling the recent run. The Federal Reserve, which ends its final meeting of the year Wednesday, may start cutting rates in March 2024, according to forecasts tracked by the CME’s FedWatch Tool, which would be supportive of cryptos.

Plus, BlackRock and Fidelity have pending applications for Bitcoin exchange-traded funds filed and under review with the Securities and Exchange Commission. There has been speculation at least one of these could win approval, which would mark the first Bitcoin ETF. BlackRock CEO Larry Fink, whose firm oversees $9 trillion in assets, commented on rumors of a possible approval during an appearance of "The Claman Countdown" in October.

FOX BUSINESS' LIVE CRYPTO PRICES: HERE

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,056.88 | +2.43 | +0.23% |

"I can't talk about the specifics of anything, I think it's just an example of the pent-up interest in crypto. We are hearing from clients around the world about the need for crypto," Fink said. Investors, including Todaro are eyeing early January for a possible decision.

Larry Fink: Hatred and fear are growing, and we need to focus on hope

BlackRock chairman and CEO Larry Fink reacts to the Israel-Hamas war and the state of the economy on 'The Claman Countdown.'

Many investors who held Bitcoin when it was trading at the all-time high of $67,802.30 in November 2021, before sinking to the $16,000-$17,000 range, are gun shy, Todaro noted, but he sees a turning point.

"I think if Bitcoin crosses $50,000, which is a psychological point for a lot of retail investors, I think it starts to see a wave of some of that capital come back," he added.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| COIN | COINBASE GLOBAL INC. | 165.12 | +19.00 | +13.00% |

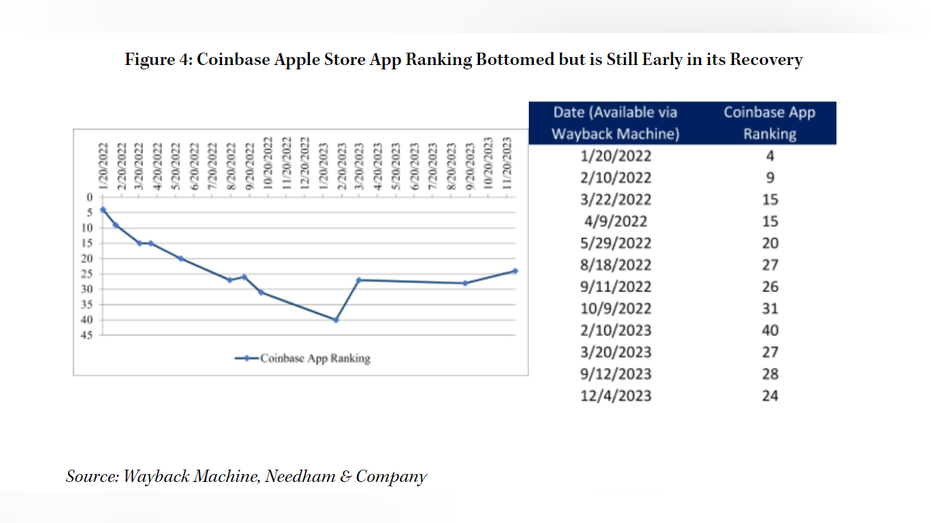

Additionally, Todaro has a buy rating on crypto trading exchange Coinbase, which gets 90% of its revenue from retail customers. He notes interest in its app on the Apple store bottomed to No. 40 in February 2023 following the implosion of Sam Bankman-Fried’s FTX. Bankman-Fried was found guilty on all charges last month and is facing over 100 years in prison.

FTX KING SAM BANKMAN-FRIED FOUND GUILTY ON ALL CHARGES

Sam Bankman-Fried, co-founder of FTX Cryptocurrency Derivatives Exchange, arrives at court in New York, on Jan. 3, 2023. (Stephanie Keith/Bloomberg via / Getty Images)

Since it has recovered to No. 24 this month, further improvement would correlate with retail investors putting new money to work.

Coinbase Apple Store App ranking bottomed but is still early in its recovery. (Wayback Machine, Needham & Company)

Todaro has a $160 per-share price target on Coinbase.

Coinbase

Not everyone is a believer. Last week JPMorgan CEO Jamie Dimon told lawmakers during a hearing that cryptocurrencies are for criminals and if he had control of the U.S. government he would "close it down."