BlackRock CEO Larry Fink predicts number of total Federal Reserve interest rate increases

Fink said he thinks interest rates need to go higher to tame inflation

BlackRock's Larry Fink makes surprising Fed rate hike prediction

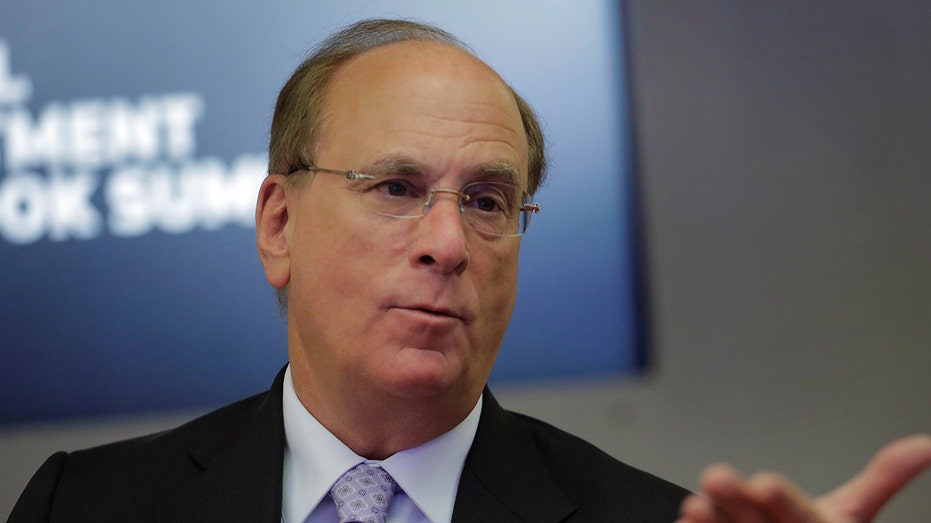

BlackRock Chairman and CEO Larry Fink discusses the banking crisis and the Fed's inflation battle on 'The Claman Countdown.'

Larry Fink gave a prediction for how many more times the Federal Reserve will raise interest rates.

"I think we’re going to have two to three more rate increases," the BlackRock CEO said during a phone interview with "The Claman Countdown" Friday. "The reason why is I believe interest rates need to go higher, especially in the short end, because we have stickier inflation."

BlackRock CEO Larry Fink during The New York Times DealBook Summit in the Appel Room at the Jazz At Lincoln Center Nov. 30, 2022, in New York City. (Michael M. Santiago/Getty Images / Getty Images)

He said inflation was "coming down" but questioned whether it could be brought below the 4% level, saying it would be "hard" to do.

BLACKROCK CEO LARRY FINK WEIGHS IN ON RECESSION PROBABILITY, US DEBT DEFAULT

Inflation measured by the Consumer Price Index rose 0.1% month-over-month and 5% year-over-year in March, as previously reported by FOX Business. That marked a slight easing.

While speaking with FOX Business’ Liz Claman and Charlie Gasparino, Fink also provided insights on the recent banking crisis.

"The large U.S. banking system is as strong as ever, and I think they have a great global run in front of them. They’re just very well positioned," the BlackRock CEO said. "In terms of small regional banks, there are many issues that could really make it more difficult for them."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,081.68 | -10.31 | -0.94% |

One of those issues is "there is somewhat of a loss of confidence," something Fink said factored into the U.S. seeing "hundreds of billions of dollars of deposits leaving into larger banks, into money market funds, bonds and ETFs" in a few weeks.

VANGUARD NARROWS ETF GAP WITH BLACKROCK

"What we are seeing is the balance between the capital markets and the banking system," Fink said. "The United States has the strongest, most robust markets in terms of capital markets and banking system in the world, and there are times when the banking system is not as strong and money moves into the capital markets."

Fink was asked about potential problems among some mid-sized, community or regional banks.

"We certainly may have a few other banks that are going to show real problems to their income statements as they are having to pay much higher rates for deposits and their assets were accumulated heavily during 2020, 2021, when rates were much lower, so they have big losses in their bond portfolios," Fink explained.

He referenced Silicon Valley Bank and Signature Bank, which the Federal Deposit Insurance Corporation took over in March. Those bank collapses were followed by turbulence in the market, particularly among some banking stocks.

A Silicon Valley Bank logo in an illustration from March 13, 2023. (REUTERS/Dado Ruvic/Illustration / Fox News)

WARREN BUFFETT ON BANKING CRISIS: ‘NOBODY IS GOING TO LOSE MONEY ON A DEPOSIT IN A US BANK’

The quarterly earnings reports slated to be put out in the next few weeks by small and regional banks could potentially be a trigger for more banks, according to Fink.

"How much will their net interest margins decline, and how impacted they will be?" the BlackRock CEO wondered. "We’re going to learn about how much deposit losses have occurred, how much borrowing they had to do with the Federal Reserve or the Federal Home Loan Bank Board. They’ve received liquidity there."

Larry Fink, founder and CEO of BlackRock, speaks during the Reuters Global Investment Outlook Summit in New York Nov. 3, 2017. (REUTERS/Lucas Jackson / Reuters Photos)

He noted that liquidity "keeps them going," but they’re paying current market rates, something he said is "going to be the issue."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Another "big issue" Fink pointed to was "what triggered with Silicon Valley Bank and Signature Bank were the impairments in their held-to-maturity account."