BlackRock's third-quarter profit rises as investors flock to its funds

BlackRock ended the third quarter with $9.10 trillion in assets under management

This will be a great earnings season: Donald Luskin

TrendMacro Chief Investment Officer Donald Luskin reacts to oil prices rallying as attacks on Israel could fuel tensions in the Middle East

BlackRock BLK.N handily beat third-quarter profit estimates on Friday but posted a sharp drop in net inflows, sending shares of the world's largest asset manager down 1% in premarket trade.

The company's adjusted profit of $10.91 per share breezed past analysts' estimates of $8.26, according to LSEG data, helped by strong investment advisory fees.

However, its net inflows for the quarter fell to $2.57 billion from $16.9 billion last year, reflecting $49 billion of net outflows from lower-fee institutional index equity strategies, including $19 billion from a single international client, the company said.

BLACKROCK’S RICK RIEDER SAYS THE FED WILL CUT INTEREST RATES IN 2024

BlackRock's Rick Rieder: Fed will start cutting rates in 2024

BlackRock Global Fixed Income CIO Rick Rieder discusses whether the Fed is close to ending the current rate hike cycle on 'The Claman Countdown.'

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,056.88 | +2.43 | +0.23% |

BlackRock ended the third quarter with $9.10 trillion in assets under management (AUM), up from $7.96 trillion a year earlier and lower than $9.4 trillion in the second quarter this year.

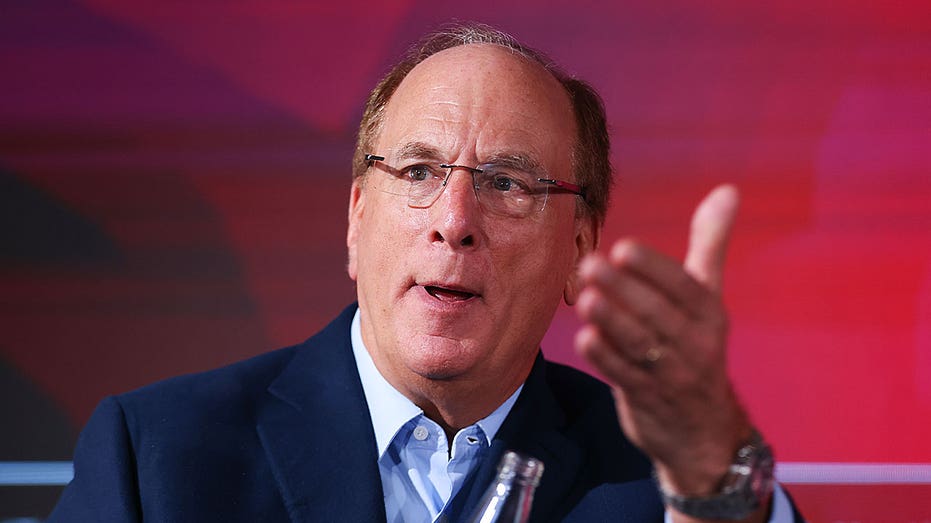

"For the first time in nearly two decades, clients are earning a real return in cash and can wait for more policy and market certainty before re-risking. This dynamic weighed on industry and BlackRock third quarter flows," CEO Larry Fink said in a statement.

VANGUARD JOINS BLACKROCK IN REJECTING MORE ESG PROPOSALS FROM SHAREHOLDERS

Hopes that the Federal Reserve could soon be done with its monetary tightening has helped calm investor worries about a potential recession.

BlackRock CEO Larry Fink speaks at event on the sidelines of the opening day of the World Economic Forum (WEF) in Davos, Switzerland, on Tuesday, Jan. 17, 2023. (Hollie Adams/Bloomberg via Getty Images / Getty Images)

But the central bank has also indicated it would keep its benchmark interest rate higher for longer, keeping a lid on the positive sentiment.

JPMORGAN'S JAMIE DIMON SAYS INTEREST RATES ‘MAY GO UP MORE,’ SAYS HE HOPES FOR SOFT LANDING

Revenue at BlackRock rose nearly 5% to $4.52 billion from a year earlier, driven by organic growth and the impact of market movements over the past 12 months on average AUM and higher technology services revenue, it said.

The New York-based company's chief source of revenue is the management fees it earns as a percentage of the total AUM.

GET FOX BUSINESS ON THE GO BY CLICKING HERE