Bond yields hold big clue on inflation

Market expectations of first Fed rate hike continue to get pushed back

Fed needs to prepare for tapering or we'll have 'inflation problem': Economist

Former Chase Chief Economist Anthony Chan on the Federal Reserve and President Biden's claim that spending money will moderate inflation.

Plunging bond yields have farther to fall as the market comes to the realization that the recent bout of inflation is transitory, according to Wall Street strategists.

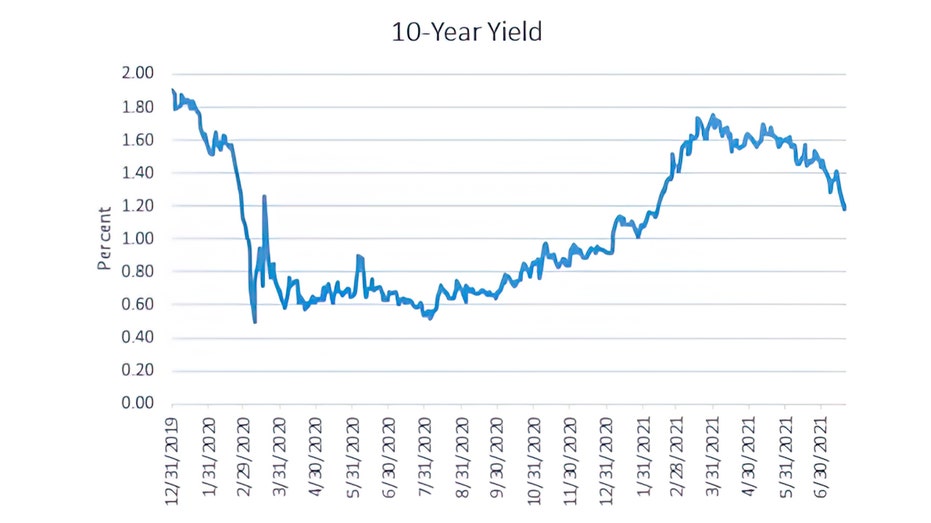

The 10-year Treasury note yield on Monday fell 12 basis points to 1.18%, the lowest since Feb. 11. With the decline, the benchmark yield has fallen 59 basis points since topping out on March 31.

"The yield on the 10-year note has sliced below the 200-day moving average in these past 24 hours like a hot knife through butter," wrote David Rosenberg, chief economist and strategist at Toronto-based Rosenberg Research. "There is nothing but dead air down to 1.0% on the charts."

Source: Tradeweb ICE Close, Dow Jones Market Data

What started as a steady decline in yields has accelerated in recent weeks as the bond market has come to terms with the idea that the Federal Reserve won’t need to be as aggressive as first thought.

Market expectations of the first Fed rate hike continue to get pushed back, and four rate hikes, or 100 basis points of tightening, have been removed from Treasury pricing since April, according to Rosenberg.

POWELL DEFENDS FED'S INFLATION STANCE AS GOP LAWMAKERS CAST DOUBT

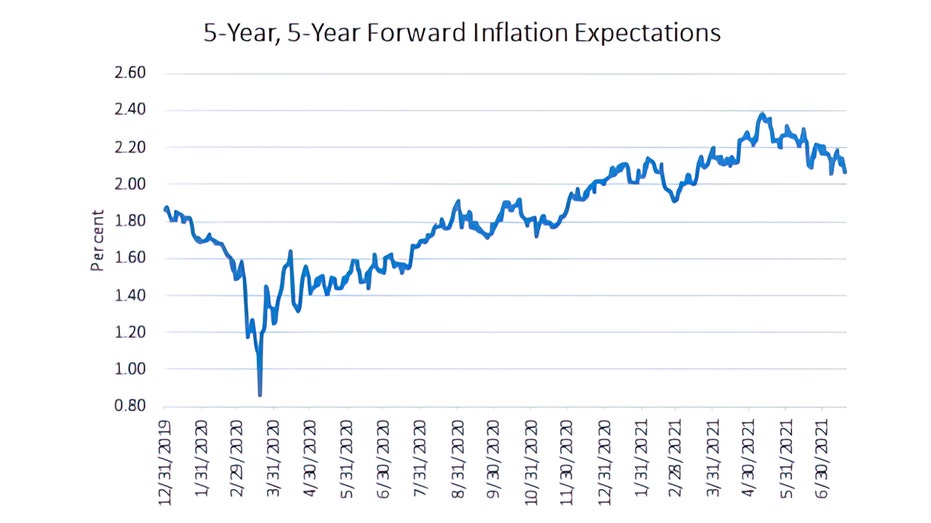

This as the 5-year, 5-year forward, the Federal Reserve’s preferred gauge for inflation expectations, has fallen to 2% from its recent high of almost 2.5%, a sign the recent surge in prices for some goods and services is temporary, like has been suggested by the central bank.

Source: St. Louis Fed

The consumer price index rose 5.4% annually in June, the most since August 2008. Price jumped 0.9% on a monthly basis, also the fastest in almost 13 years.

The price gains were skewed heavily by the 10.5% increase in prices for used cars and trucks. Already, those prices have begun to fall at the wholesale level, which should in the next few weeks show up in consumer prices.

CAR DEMAND TO REMAIN STRONG INTO NEXT YEAR: AUTONATION CEO

Fed Chairman Jerome Powell called the issue a "perfect storm of very strong demand and limited supply" and said the price gains were temporary but that he was unsure when they might reverse.

In this Tuesday, Dec. 1, 2020, file photo, Federal Reserve Chairman Jerome Powell, right, testifies before the Senate Banking Committee on Capitol Hill in Washington. (AP Photo/Susan Walsh, Pool, File) (AP Newsroom)

The used-car market has seen a surge in demand as supply chain dislocations caused by COVID-19 have crimped chip production, causing automakers to slow production.

In the near term, supply chain disruptions aren’t the only problem that markets must grapple with. Traders must also navigate an uptick in COVID-19 cases due to the delta variant and the ongoing fiscal drama on Capitol Hill

All that should lead to a risk-off environment that pushes bond yields lower, according to Alex Pelle, U.S. economist at Mizuho Securities USA.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Still, he warns that yields are eventually heading higher.

"Additional fiscal policy should lead to higher relative US growth and inflation in the medium-term alongside a more cautious Fed," Pelle said. "The net result should be a re-steepening of the Treasury curve."