Brent crude oil marks biggest one-day price slump in almost 2 years

The US price dropped to $108.70 per barrel

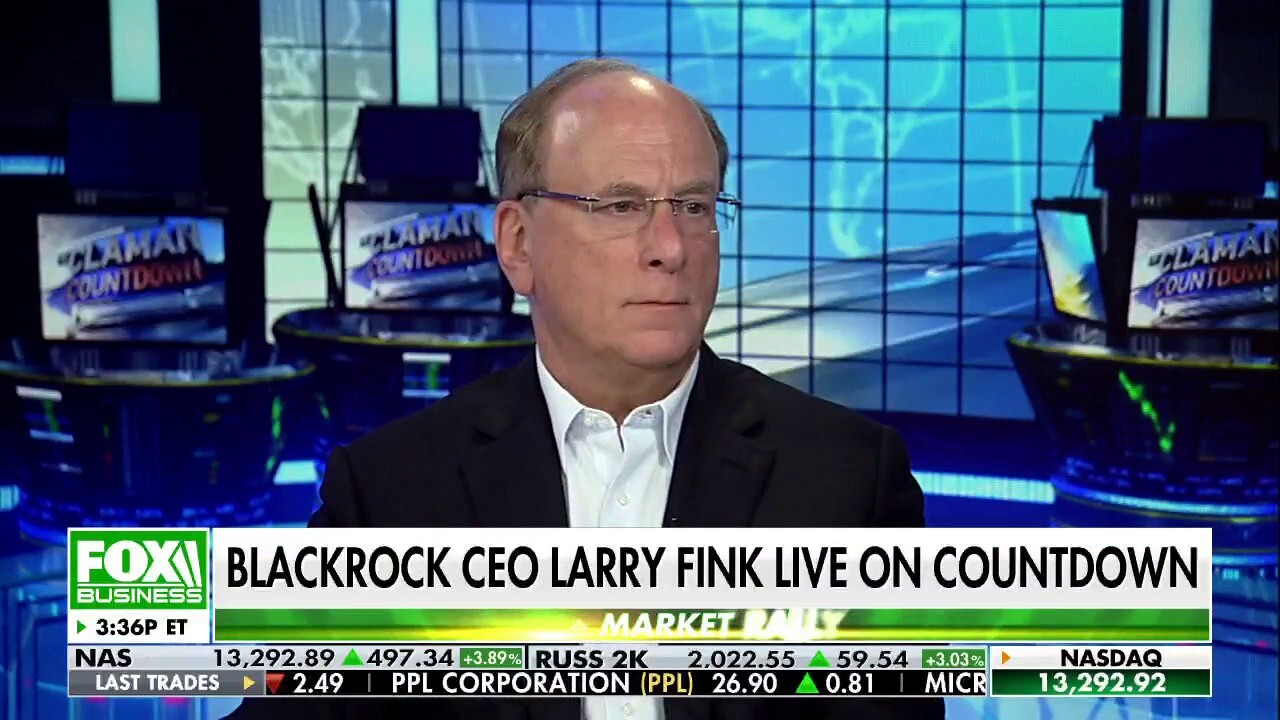

BlackRock CEO Larry Fink: Russia-Ukraine war more treacherous than the financial crisis

Wall Street legend gauges the financial climate after Russia's invasion of Ukraine on 'The Claman Countdown.'

Brent crude oil saw its biggest one-day percentage decline in almost two years as prices settled at $111.14 per barrel.

The 13.16% drop in price per barrel for ICE Brent is the biggest since April 21, 2020, and ends a three-session winning streak for oil prices. The U.S. price fell to $108.70.

But the price is still the fifth-highest for the year. The price peaked at $127.98 on Mar. 8, and is still up 10.05% month-to-date and 42.89% year-to-date.

View of the pumpjack in the oil well of the oil field. The arrangement is commonly used for onshore wells producing little oil. Pumpjacks are common in oil-rich areas. | AP Images

The wild swing to a record high followed by a severe drop plainly lays out the complete uncertainty investors feel trying to gauge the impact Russian sanctions and economic damage from the invasion of Ukraine will have.

ENERGY ETFS TO PLAY AS GAS, OIL PRICES JUMP

Oil, in particular, fell after the United Arab Emirates urged OPEC partners to increase production in the face of Russia energy sanctions and the resulting price squeeze in the market.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XOM | EXXON MOBIL CORP. | 149.05 | +2.97 | +2.03% |

| SHEL | SHELL PLC | 75.29 | +0.66 | +0.88% |

| BP | BP PLC | 39.01 | +0.84 | +2.20% |

The U.S. and Britain both announced they would cut Russian oil imports, which sent oil and gas prices higher: The price-per-gallon of regular unleaded gas hit an all-time high in the U.S.

AIRLINES SLASH FLIGHTS AMID RISING FUEL, OIL PRICES

But the UAE said that it believed OPEC could bring "about 800,000 barrels to the market very quickly, even immediately."

Such an increase in production would allow OPEC to cover "one-seventh" of the supply lost from Russia.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The International Energy Agency said oil reserves could be further tapped to help alleviate the losses from Russian sanctions, noting "we can bring more oil to the markets, as one part of the response."