Buffett's Berkshire Hathaway buys Kroger stock for first time

Warren Buffett has an appetitie for the nation's largest grocers.

Warren Buffett's Berkshire Hathaway has taken a stake in Kroger.

According to SEC Filings, an 18.9 percent stake was disclosed in the nation's largest grocer by revenue on Friday after the closing bell.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KR | THE KROGER CO. | 67.50 | +0.83 | +1.24% |

| BRK.B | BERKSHIRE HATHAWAY INC. | 508.01 | +4.19 | +0.83% |

Kroger shares jumped on the news in the extended session and are little changed for the year.

Buffett also owns stakes in other food-related companies.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KHC | THE KRAFT HEINZ CO. | 24.64 | +0.20 | +0.80% |

Kraft Heinz Co. has been struggling, and on Friday got hit with a downgrade from Fitch, slashing its credit score to BB+, the highest level of junk, in another blow to one of billionaire Buffett's biggest stock holdings.

This pushed shares of the Chicago-based food giant to their lowest level since October. Buffett’s Berkshire Hathaway is Kraft's largest shareholder, with a stake of 325.6 million shares, or 27% of the company.

Buffett disclosed Friday he also upped his stake in Kraft.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KO | THE COCA-COLA CO. | 79.03 | +0.52 | +0.66% |

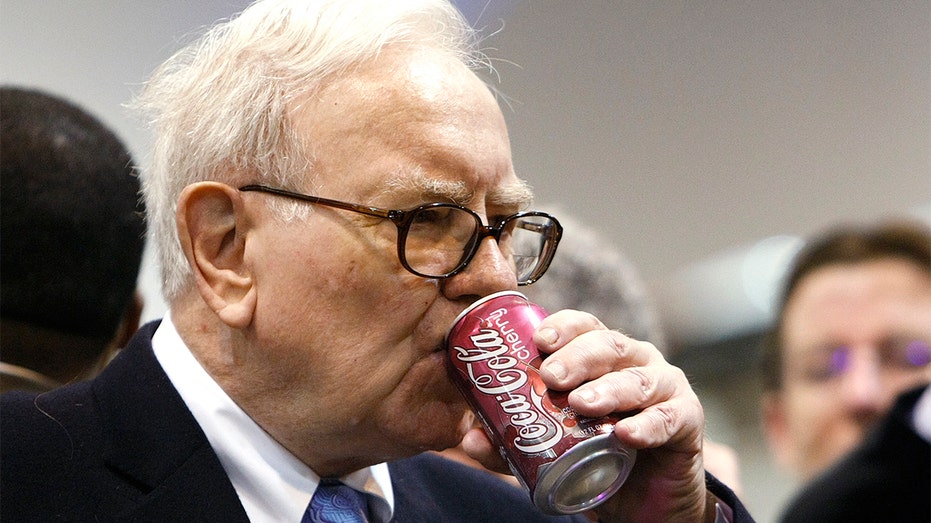

Berkshire is also the largest shareholder in Coca-Cola and is often seen drinking a Coke.

REUTERS/Rick Wilking

Buffett also owns smaller stakes in Sees Candies and Dairy Queen.

FOX Business' inquiries to Kroger were not immediately returned at the time of publishing.

Buffett's taste for a grocer follows Amazon's's purchase of Whole Foods back in 2017 for nearly $14 billion.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMZN | AMAZON.COM INC. | 210.32 | -12.37 | -5.55% |

CEO Jeff Bezos is the world's richest man, per Forbes, with a net worth of $129 billion. Buffett has slipped to fourth place with a net worth of $89 billion.

RESTORATION HARDWARE IS THRIVING, WHILE RIVALS LEFT REELING

Other portfolio moves Buffett disclosed late Friday include a new stake in Biogen, 41 percent increase in shares Restoration Hardware, 3.8 increase in General Motors and a 153.5 jump in Occidental Petroleum, the company which is currently under fire from activist investor Carl Icahn.

ICAHN BLASTS OCCIDENTAL TOP BRASS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BIIB | BIOGEN INC. | 201.18 | +15.82 | +8.53% |

| RH | RH COM | 211.16 | +15.72 | +8.04% |

| OXY | OCCIDENTAL PETROLEUM CORP. | 46.31 | +1.22 | +2.71% |

| GM | GENERAL MOTORS CO. | 84.24 | +0.94 | +1.13% |

Some of the other well-known investors also revealed how they have re-balanced their portfolios. Highlights include:

- Nelson Peltz’s Trian Fund Management cuts its stake in packaged goods giant Procter & Gamble by 12.2 percent.

- Carolina Panthers owner David Tepper’s firm, Appaloosa LP upped its stake in China’s Alibaba Group Holdings by a whopping 84.6 percent and increased its stake in Micron Technology by 35 percent.

- Paul Singer’s Elliott Management, which last week made an activist shareholder move on Softbank investing $2.5 billion, has dissolved its stake in Devon Energy while increasing its stake by 16.4 percent. The New York-based investment house and hedge fund also cut its shares in Citrix Systems by 14.6 percent.

- Philanthropist/investor George Soros raised his stake in electric automaker Tesla by 2 percent. He also dissolved his stake in online trading/shopping site eBay and did the same with international oilfield services company Schlumberger.

- Greenlight Capital, headed by David Einhorn reduced holdings in cable company, Altice USA 33.2 percent while the lion of activist investors, Carl Icahn dropped his holdings in Occidental Petroleum by 14.3 percent.