Capital One to end overdraft fees

No-fee overdraft will launch in early 2022 for all customers

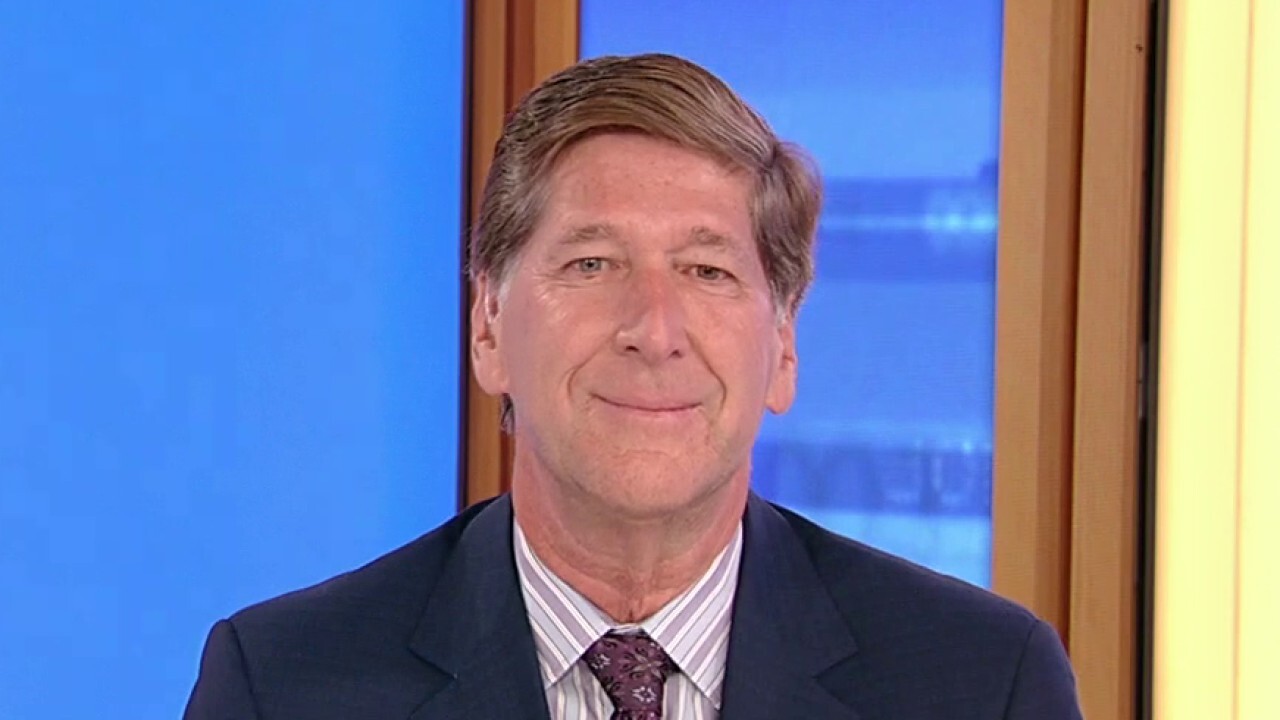

US banking system 'real strength' of national economy: Citizens Bank CEO

Citizens Financial Group Chairman and CEO Bruce Van Saun says he's hopeful that Biden's Federal Reserve appointments won't bring too much change.

The holidays came early for Capital One customers, with the bank announcing it will eliminate all overdraft fees and bring "humanity" back to banking.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| COF | CAPITAL ONE FINANCIAL CORP. | 222.79 | +5.86 | +2.70% |

"The bank account is a cornerstone of a person's financial life," said Richard Fairbank, Capital One's Founder and CEO. "It is how people receive their paycheck, pay their bills and manage their finances. Overdraft protection is a valuable and convenient feature and can be an important safety net for families. We are excited to offer this service for free."

WHAT TO KNOW

- Customers can choose whether or not to access overdraft protection.

- All customers currently enrolled in overdraft protection will be automatically converted to No-Fee Overdraft on the launch date in early 2022.

- Eligible customers who are not currently enrolled can enroll at any time. For customers not enrolled, transactions that would overdraw an account will be declined and no fees will be assessed.

Source: Capital One

On Wednesday, the Consumer Financial Protection Bureau released fresh data on overdraft fees noting revenue from the practice reached an estimated $15.5 billion in 2019.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.35 | +12.34 | +3.98% |

| WFC | WELLS FARGO & CO. | 93.93 | +2.37 | +2.59% |

| BAC | BANK OF AMERICA CORP. | 56.55 | +1.64 | +2.99% |

JPMorgan Chase, Wells Fargo, and Bank of America accounted for 44% of the total.

Source: Capital One