Las Vegas casinos light back up to 'pent-up demand'

'There’s clear pent-up demand'

Casino operators rallied Thursday as the Las Vegas Strip opens for business following a months-long shutdown during the COVID-19 pandemic.

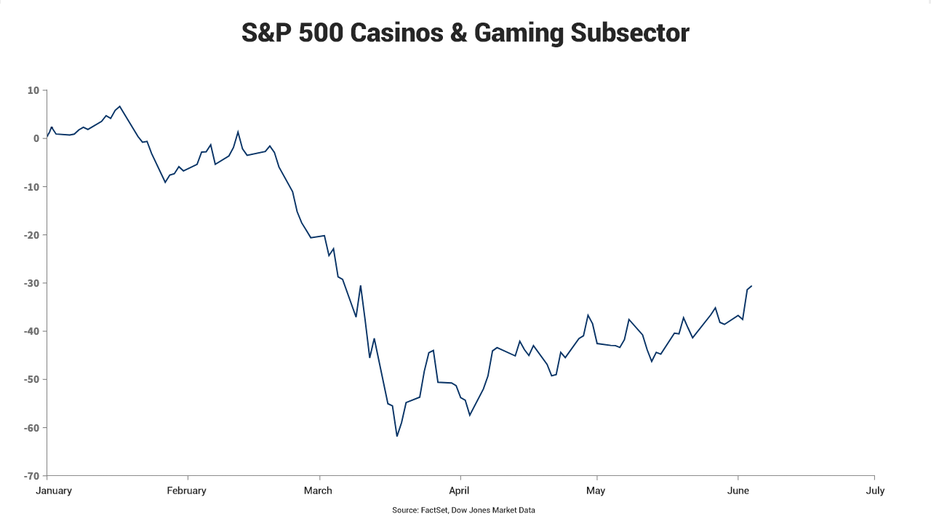

Industry closings to curb the virus' spread caused the S&P 500 Casinos & Gaming index to shrink by 30 percent this year to a market capitalization of $59.7 billion, according to Dow Jones Market Data. The subsector contains Las Vegas Sands, MGM International and Wynn Resorts.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LVS | LAS VEGAS SANDS CORP. | 57.78 | +0.84 | +1.48% |

| MGM | MGM RESORTS INTERNATIONAL | 37.49 | +1.21 | +3.32% |

| WYNN | WYNN RESORTS LTD. | 117.96 | +4.76 | +4.20% |

Gaming companies have lost about $4 billion in revenue since they were forced to close their doors in mid-March for the first time since former President John F. Kennedy’s assassination in 1963.

“There’s clear pent-up demand,” Barry Jonas, a New York-based analyst at SunTrust Robinson Humphrey told FOX Business last week. “I think you’ll see decent lines, albeit with reduced capacity.”

WHY STOCKS ARE RALLYING AMID AMERICAN RIOTS

Las Vegas casinos, which are opening at 50 percent capacity, have a number of enhanced safety measures in place to ensure social-distancing rules can be followed.

Customers will have their temperatures checked before entering the casino floor and will be required to wear face masks. Gaming options will be limited, with at least 50 percent of slot machines, the casino’s biggest revenue generator, turned off and the number of players at most tables being limited to three.

LAS VEGAS STRIP RETURNS FROM CORONAVIRUS WITH LESS OF ITS NOTORIOUS EXCESS

A limited number of players means gaming operators won’t see revenue snap back to pre-COVID-19 levels – at least not right away. Gaming accounted for 35 percent of Las Vegas Strip revenue in 2019, according to Nevada Gaming Control Board data.

CLICK HERE TO READ MORE ON FOX BUSINESS

“From an investor perspective, we've certainly seen a recovery in the stocks and in some cases back to near pre-coronavirus levels,” Jonas said. “There clearly is a reopening trade going on here.”