Charles Schwab lands DOJ approval to buy TD Ameritrade

$26 billion combination would cement Schwab's role as a dominant player in the discount-brokerage market

Charles Schwab Corp. said the U.S. Justice Department's antitrust division has closed its investigation of the company's proposed acquisition of TD Ameritrade Holding Corp., clearing the path for the $26 billion combination that would cement Schwab's role as a dominant player in the discount-brokerage market.

The deal is expected to close in the second half of the year, with integration likely to take between 18 and 36 months, Schwab said. The proposed combination attracted regulators' scrutiny because of the firms' dominant positions in the industry and their direct contact with individual investors.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SCHW | THE CHARLES SCHWAB CORP. | 105.06 | +3.08 | +3.03% |

"We are pleased to be clearing an important milestone in our planned acquisition of TD Ameritrade and look forward to today's scheduled votes by the stockholders of our two companies, which represent another important step toward completion of the transaction," Schwab President and Chief Executive Walt Bettinger said.

WALL STREET FIRM WILL PAY JUNIOR BANKERS NOT TO WORK

The San Francisco-based Schwab is the largest discount broker, while TD Ameritrade, based in Omaha, Neb., is No. 2. The firms have traditionally catered to lower-end clients with cheap online offerings, a business model that big Wall Street Brokers like Morgan Stanley and Bank of America Corp. are increasingly emulating.

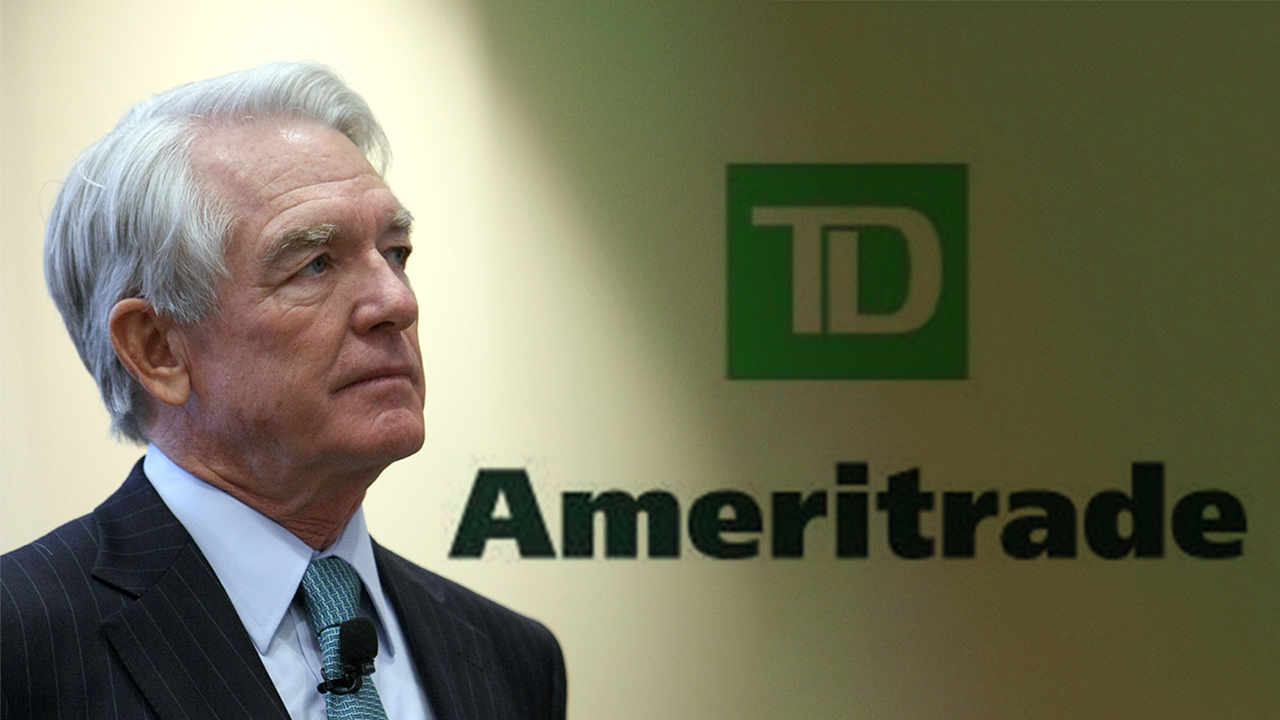

Charles Schwab Corp. founder and chairman Chuck Schwab looks on during the grand opening of the new Charles Schwab flagship branch Oct. 27, 2009 in San Francisco. (Photo by Justin Sullivan/Getty Images)

The proposed acquisition came as the firms were under pressure from falling trading commissions and a dwindling pool of fees for managing clients' money. Schwab has made online stock trades free, and TD Ameritrade followed suit. The combination would help save costs and improve profitability in the zero-commission environment.

GET FOX BUSINESS ON THE GO BY CLICKING HERE