Chevron CEO says there may never be another oil refinery built in the US

Mike Wirth points to the federal government's policies on energy

US ‘lacking’ oil production: Fmr Energy Sec. Brouillette

Former Energy Secretary Dan Brouillette argues that since the U.S. is ‘lacking’ in oil production, it’s causing high gas prices.

Chevron CEO Mike Wirth says he does not expect another oil refinery to be built in the U.S. ever again, pointing to decades of federal government policies as the reason why.

"There hasn’t been a refinery built in this country since the 1970s," Wirth said at Bernstein's Strategic Decisions Conference this week, when asked about the prospect of new capacity being added in the Gulf of Mexico. "I personally don’t believe there will be a new petroleum refinery ever built in this country again."

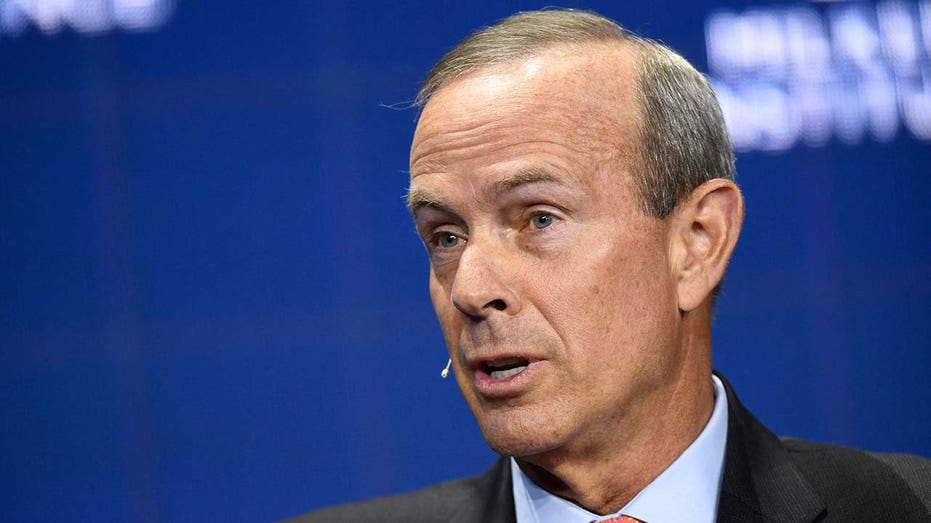

Michael Wirth, Chairman and CEO of the Chevron Corporation, during the Milken Institute Global Conference on October 18, 2021 in Beverly Hills, California. (Photo by PATRICK T. FALLON/AFP via Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CVX | CHEVRON CORP. | 180.86 | +1.63 | +0.91% |

"Capacity is added by de-bottlenecking existing units by investing in existing refineries," he explained. "But what we’ve seen over the last two years are shutdowns. We’ve seen refineries closed. We’ve seen units come down. We’ve seen refineries being repurposed to become bio refineries. And we live in a world where the policy, the stated policy of the U.S. government is to reduce demand for the products that refiners produce."

GAS PRICE SURGE MAKING ALTERNATIVES ‘MUCH MORE ATTRACTIVE’: FORMER UBER SVP

Wirth went on to list examples such as the Corporate Average Fuel Economy (CAFE) standards for fuel efficiency in vehicles that Congress first enacted in the 70s, the Renewable Fuel Standard created in 2005 requiring a certain amount of biofuels like Ethanol to replace petroleum-based fuels, and electric vehicle tax subsidies.

"At every level of the system, the policy of our government is to reduce demand, and so it’s very hard in a business where investments have a payout period of a decade or more," Wirth said. "And the stated policy of the government for a long time has been to reduce demand for your products."

A view of the Phillips 66 Company's Los Angeles Refinery (foreground), which processes domestic and imported crude oil into gasoline, aviation and diesel fuels, March 11, 2022. ( REUTERS/Bing Guan / Reuters Photos)

To put things in perspective, Wirth asked rhetorically, "How do you go to your board, how do you go to your shareholders and say 'we're going to spend billions of dollars on new capacity in a market that is, you know, the policy is taking you in the other direction."

Chevron

Wirth's comments come as the U.S. grapples with soaring gasoline prices that were already climbing in 2021 amid increased demand and reduced supply and were exacerbated by Western sanctions imposed on Russia, a major oil exporter, for its invasion of Ukraine.

GAS PRICES ON THE ROAD TO $5 NATIONWIDE VERY SOON

The average price for a gallon of gasoline in the U.S. hit a fresh record high of $4.761 on Friday, according to the latest data from AAA. While U.S. crude closed at $118.87 per barrel on Friday.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND - USD ACC | 76.98 | +0.28 | +0.37% |

| UGA | UNITED STATES GASOLINE FUND - USD ACC | 69.43 | +0.94 | +1.37% |

The Biden administration has sought to ease the rising prices by releasing a record 180 million barrels from the already-depleated Strategic Petroleum Reserve over six months starting in March, and by urging both foreign and domestic producers to increase output.

Wirth said that is just what the industry is doing.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"We raised our Permian [Basin] production growth outlook to 15% this year," he said. "So the narrative you hear that the industry is not growing production is not true. We are growing production and our industry is growing production."