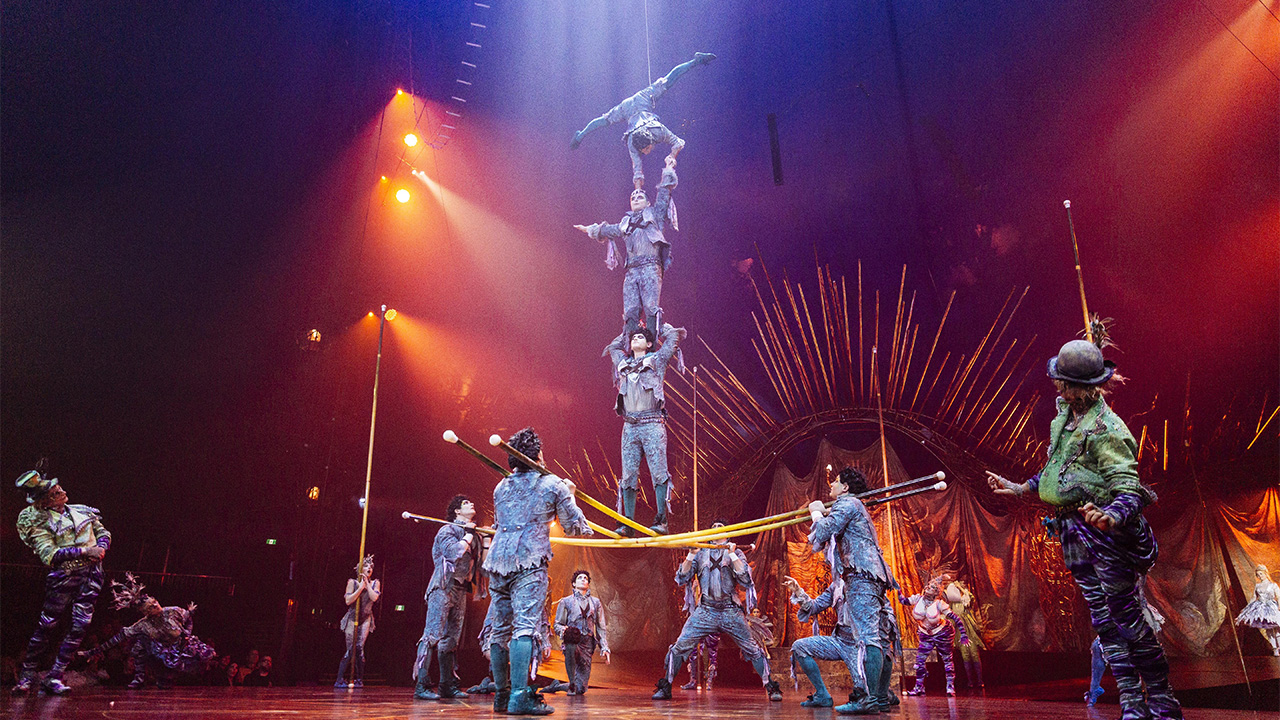

Cirque du Soleil files for bankruptcy protection

Cirque du Soleil Entertainment Group filed for bankruptcy protection in Canada on Monday.

Cirque du Soleil Entertainment Group filed for bankruptcy protection in Canada on Monday in an effort to restructure its operations as it faces pressure from closed shows due to the coronavirus pandemic.

(Associated Press)

Investment firms TPG, Fosun Group and Caisse de Depot et placement du Quebec have submitted a proposal to buy the circus company's assets. The companies' stalking horse bid would provide Cirque du Soleil with $300 million of liquidity.

As part of the proposal, economic development agency Investissement Quebec would provide $200 million in debt financing to support the proposed acquisition.

BROADWAY THEATERS TO REMAIN CLOSED THROUGH EARLY JAN. 2021 DUE TO CORONAVIRUS

TPG, Fosun, and Caisse have been investors in Cirque du Soleil since 2015, they said.

The circus company said it will also file a companion bankruptcy in the U.S. to seek protection from creditors in the U.S.

In connection with the restructuring, the company will also lay off about 3,480 employees who were furloughed in March due to the coronavirus-induced government-mandated shutdowns. The investors will also set up two funds worth $20 million to offer additional relief to affected employees and independent contractors.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The funds will go toward helping the company relaunch, providing relief for affected employees and partners and assuming some of the company's outstanding liabilities.

The company's existing secured creditors will get $50 million of unsecured, takeback debt as well as a 45% equity stake in the restructured company. Some of its first lien lenders will also get a repayment of an interim loan of around $50 million.

The purchase agreement will set the minimum acceptable bid for an auction of the company and will be supervised by the court and a court-appointed monitor.