Copper crunch drives record prices

Copper has gained over 36% this year

Copper supply 'under pressure' is driving price up: Barrick Gold CEO

Barrick Gold Corporation president and CEO Mark Bristow weighs in on his company's copper revenue, the connection between copper and electric vehicles, and his outlook for the cryptocurrency market.

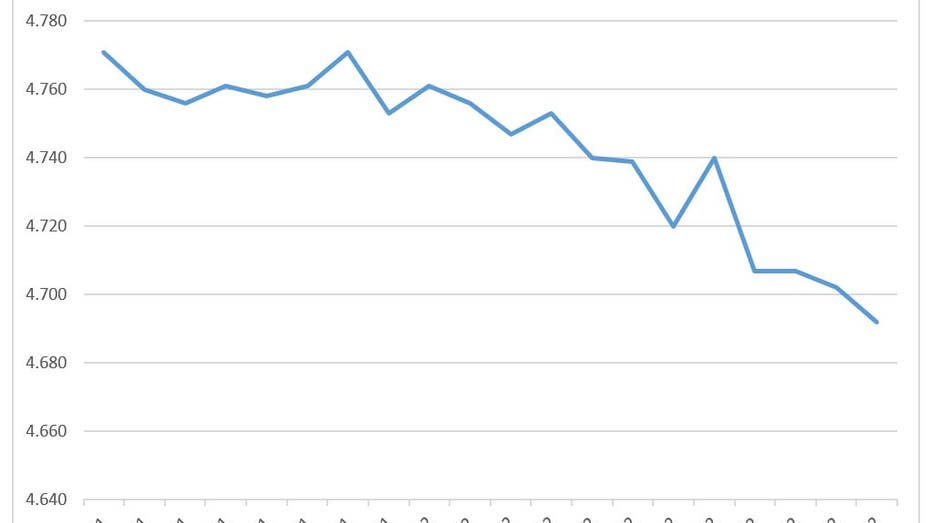

Copper flirted with a fresh record high Tuesday as traders continued to bid up its price amid an environment of tight supplies.

The price of the base metal was trading higher by 3 cents at $4.7920 per pound Wednesday exceeding, its all-time high of $4.7785 reached Tuesday.

BITCOIN NO MATCH FOR GOLD: BARRICK GOLD CEO

Copper’s price curve is the most backwardated it’s been in 10 years. Backwardation occurs when the spot price is higher than the future price.

(Data: FactSet)

Supplies are "under pressure, and that’s what’s driving the copper price" higher, said Barrick Gold CEO Mark Bristow in a recent interview. About 20% of Barrick Gold’s business is in copper, and the company breaks even at $2.75 per pound.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FCX | FREEPORT-MCMORAN INC. | 60.67 | +1.45 | +2.45% |

| SCCO | SOUTHERN COPPER CORP. | 199.84 | +10.39 | +5.48% |

| COPX | GLOBAL X COPPER MINERS ETF - USD DIS | 84.68 | +3.37 | +4.14% |

Bristow noted that above-ground copper stocks have been "depleted" primarily due to heavy buying from China but also due to strong demand for electric vehicles.

Supplies, when measured in tonnes, are at levels seen 15 years ago and cover just 3.3 weeks of demand, according to analysts at Bank of America led by Michael Widmer.

They expect inventories to remain tight as more countries reopen from their COVID-19 lockdowns, driving the price up to as much as $5.89 per pound.

CLICK HERE TO READ MORE ON FOX BUSINESS

After copper market deficits this year and next, the Bank of America analysts predict a rebalancing in the market in 2023 and 2024 before a deficit returns in 2025. They warn the copper price could surge as high as $9.07 per pound if supplies do not bounce back.