Credit Suisse sheds nearly 25%, key backer says no more money

Saudi lender acquired a stake of almost 10% in Credit Suisse last year

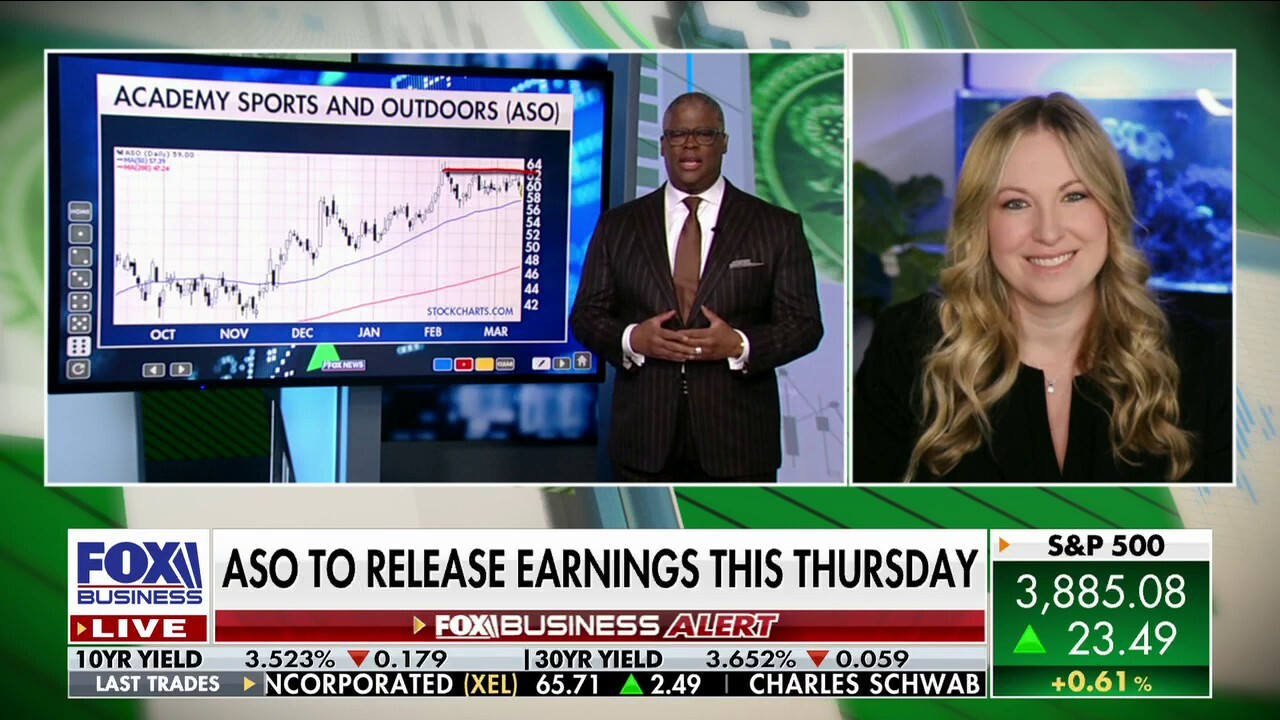

Market expert breaks down best stocks to trade up amid volatility

Simpler Trading director of options Danielle Shay says she's looking ahead to short stock squeezes.

ZURICH - Credit Suisse lost almost a quarter of its value on Wednesday, dropping to a new record low after its largest investor said it could not provide the Swiss bank with more financial assistance.

"We cannot, because we would go above 10%. It’s a regulatory issue," Saudi National Bank chairman Ammar Al Khudairy said on Wednesday.

The Saudi lender acquired a stake of almost 10% last year after taking part in Credit Suisse's capital raising and committed to investing up to 1.5 billion Swiss francs ($1.5 billion).

Broader equity markets fell sharply, reversing earlier gains, as Credit Suisse's drop by as much as 24% re-ignited some of the jitters among investors about the resilience of the global banking system after the collapse of Silicon Valley Bank.

CHUCK SCHUMER, DEMS RUSH TO GIVE BACK DONATIONS FROM SILICON VALLEY BANK CEO

Speaking at a Morgan Stanley conference on Wednesday, Ralph Hamers, chief executive of Swiss rival UBS said the lender has benefited from recent market turmoil and seen money inflows.

Broader equity markets fell sharply, reversing earlier gains, as Credit Suisse's drop by as much as 24% re-ignited some of the jitters among investors about the resilience of the global banking system after the collapse of Silicon Valley Bank. (Reuters/Arnd Wiegmann / Reuters Photos)

"In the last couple of days as you might expect we've seen inflows," Hamers said. "It is clearly a flight to safety from that perspective, but I think three days don't make a trend."

CREDIT SUISSE SHARES HIT RECORD LOW

Credit Suisse on Tuesday published its annual report for 2022 saying the bank had identified "material weaknesses" in controls over financial reporting and not yet stemmed customer outflows.

Switzerland's second-biggest bank is seeking to recover from a string of scandals that have undermined the confidence of investors and clients. (Stephanie Keith/Bloomberg via Getty Images / Getty Images)

Switzerland's second-biggest bank is seeking to recover from a string of scandals that have undermined the confidence of investors and clients. Customer outflows in the fourth quarter rose to more than 110 billion Swiss francs ($120 billion).

GOLDMAN BOUGHT THE PORTFOLIO SVB REPORTEDLY BOOKED LOSSES ON

The shares fell below the 2-Swiss franc mark for the first time in Zurich as they headed for a seventh straight daily decline.

Five-year credit default swaps on Credit Suisse debt widened to 574 basis points from 549 bps at last close, according to data from S&P Global Market Intelligence, marking a new record high. (Stephen Kelly/Bloomberg via Getty Images / Getty Images)

The cost of insuring the company's bonds against default shot up. Five-year credit default swaps on Credit Suisse debt widened to 574 basis points from 549 bps at last close, according to data from S&P Global Market Intelligence, marking a new record high.

CLICK HERE TO GET THE FOX BUSINESS APP

Earlier this week, Credit Suisse CEO Ulrich Koerner told a conference that the bank's liquidity coverage ratio averaged 150% in the first quarter of this year - well above regulatory requirements.