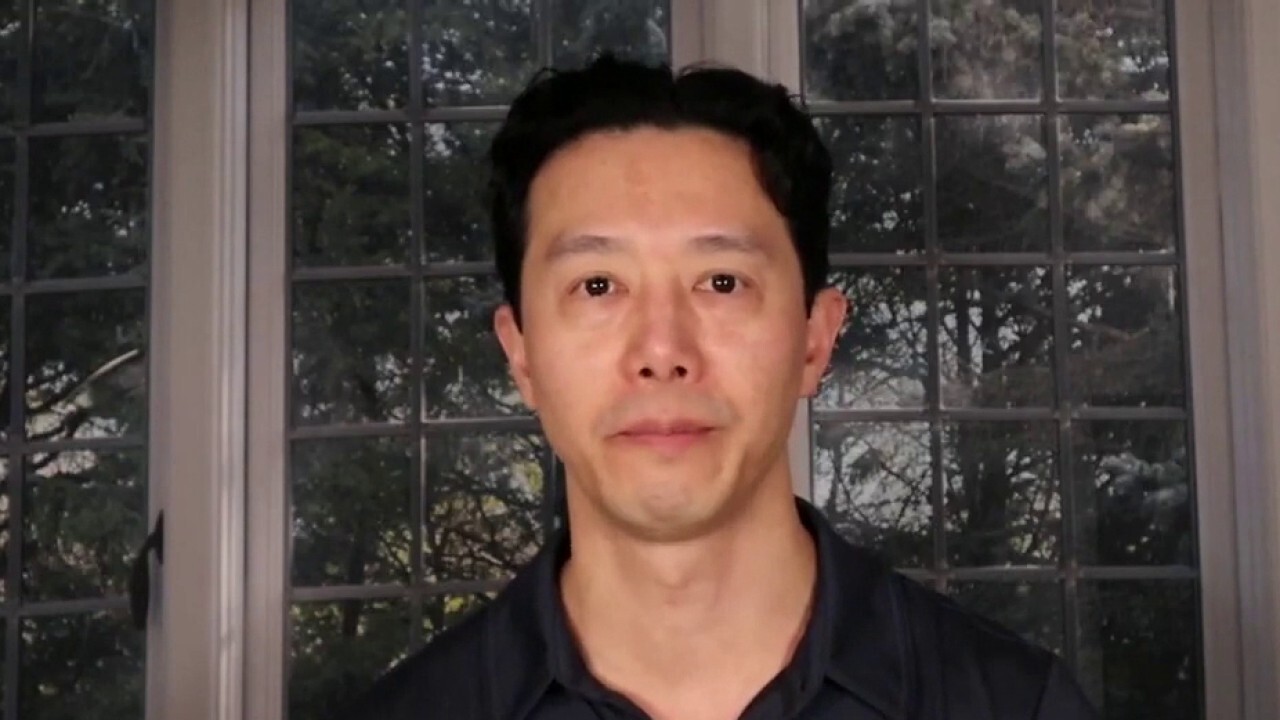

Crypto industry needs 'sensible' regulation, expert says

Ava Labs president argues 'certainty' in the near future is most important

Crypto expert on importance of 'certainty' in the space

Ava Labs President John Wu argues certainty 'will give a lot of clarity' to the industry 'and hopefully spur another huge leg of growth.'

Ava Labs President John Wu weighed in on potential regulation for cryptocurrencies on Thursday, arguing that it is most important that there is "certainty" in the near future because, from an operator’s perspective, there is so much interest in terms of human and financial capital entering the space, which leads to "huge innovation."

He told "Mornings with Maria" that he believes the industry wants "sensible" regulation.

Wu provided the insight as Treasury Secretary Janet Yellen indicated more government regulation is needed to monitor the expansion of crypto and other digital assets and to fend off fraudulent and illicit transactions.

One result would be that users would get documentation of their crypto dealings for use in their tax filings.

Crypto expert says regulatory overhang a 'concern'

Ben McMillan, founding partner and CIO at IDX Insights, discusses crypto volatility and potential regulation for the industry.

In remarks prepared for delivery Thursday at American University, Yellen said, "Taxpayers should receive the same type of tax reporting on digital asset transactions that they receive for transactions in stocks and bonds, so that they have the information they need to report their income to the IRS."

Thursday’s speech will be Yellen’s first about cryptocurrency since President Biden signed an executive order on government oversight of the digital assets last month.

Biden’s executive order urges the Federal Reserve to explore whether the central bank should jump in and create its own digital currency.

CLICK HERE FOR FOX BUSINESS' REAL-TIME CRYPTOCURRENCY PRICING DATA

Yellen said the effort would "promote a fairer, more inclusive, and more efficient financial system" while countering illegal activity and preventing risks to national security and financial stability.

Crypto industry wants 'sensible' regulation: Ava Labs president

Ava Labs President John Wu argues that it is most important that there is 'certainty' in the near future because from an operator’s perspective, there is so much interest in terms of human and financial capital entering the space.

"The reason why this country has been great through innovation, is because there’s entrepreneurs and there’s capital markets that work and function well," Wu told host Maria Bartiromo.

"We do not want the capital markets for the trading of these assets offshore because there’s uncertainty of rules here."

He added that "we want the developers, the engineers and the innovators in this space to be doing it onshore, not overseas, so certainty will give a lot of clarity for all of that and hopefully spur another huge leg of growth."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| COIN | COINBASE GLOBAL INC. | 165.12 | +19.00 | +13.00% |

| BITQ | BITWISE CRYPTO INDUSTRY INNOVATORS ETF - USD DIS | 19.19 | +2.45 | +14.64% |

Bitcoin was hovering around $43,000 on Thursday, after declining for three straight days. The cryptocurrency has lost more than 5% during that slide.

Last week Bitcoin, along with cither cryptocurrencies, declined as newly released inflation numbers increased, and after the European Union voted on crypto legislation.

Last Thursday, European Union lawmakers backed new safeguards for tracing transfers of bitcoin and other cryptocurrencies.

Two committees in the European Parliament jointly voted by 93 to 14 on cross-party compromises, which crypto exchange Coinbase Global warned would usher in a surveillance regime that stifles innovation.

Bitcoin trades around $45K after three-day slide (Photo Illustration by Chesnot/Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Under the draft law first issued by the EU's executive European Commission, crypto firms such as exchanges would have to obtain, hold, and submit information on those involved in transfers, Reuters reported.

Currently, there are no EU requirements for tracing crypto transfers.

CLICK HERE TO READ MORE ON FOX BUSINESS

FOX Business’ Ken Martin and The Associated Press contributed to this report.