Decade-long bull market good for Main Street, not just Wall Street

The bull market in U.S. stocks turns 10 years old Saturday and, despite the last few weeks of disappointing market news, the current state of the American economy is vastly superior to what it was a decade ago.

And as befits the longest bull market since, the decade did not just benefit Wall Street, it also benefited Main Street.

The unemployment rate on March 9, 2009, was 8.3 percent; last month it was an enviable 3.8 percent, according to a Labor Department report issued Friday.

In 2009 there were 12.5 million unemployed Americans; in 2019 there were 6.2 million unemployed Americans – despite the fact that the nation had 21 million more residents than a decade earlier.

Retail investors today have a vastly simpler and cheaper way to invest than they did 10 years ago. Today investors can adjust their portfolios with the flick of a finger and for less than $5 per trade. And such dramatically less expensive transaction costs have contributed to consistently better returns.

In other words, it's no longer necessary to either spend time on Wall Street or know a broker who does. Retail investors can stay on Main Street.

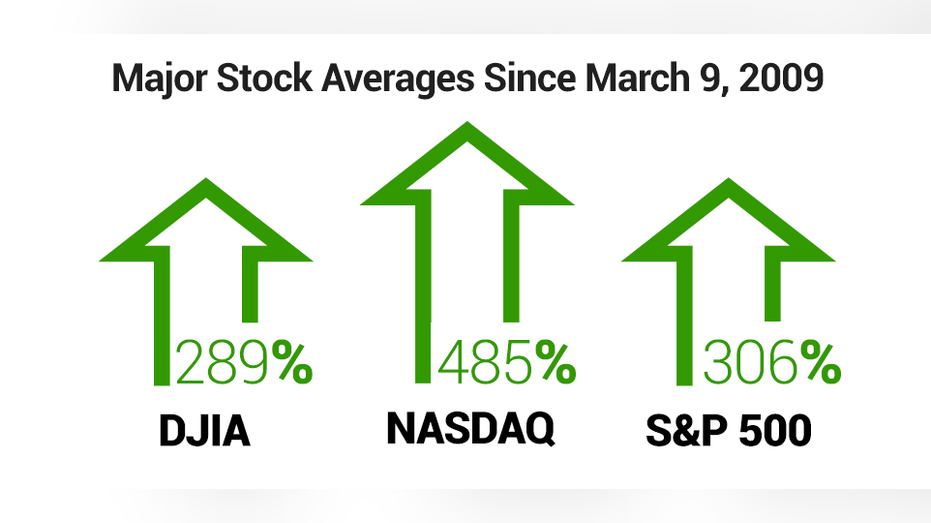

Meanwhile, Wall Street has been hot. Major equity indexes are far above their levels of 10 years ago:

The Dow Jones Industrial Average climbed 289 percent, the S&P 500 rose 306.33 percent, and the Nasdaq Composite soared 484.99 percent.

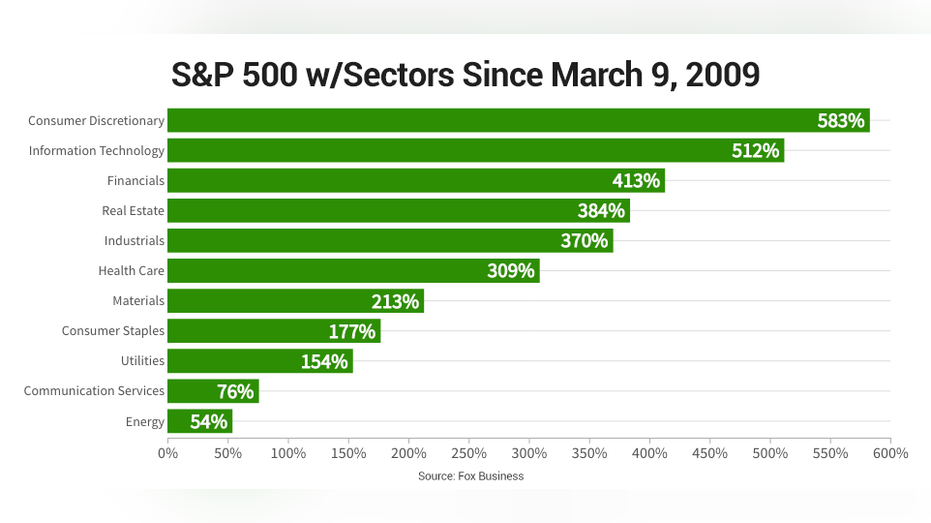

Here are the biggest 10-year gainers by sector:

Consumer discretionary stocks climbed 582.82 percent, Information technology rose 512.35 percent, and Financials soared 413.03 percent.

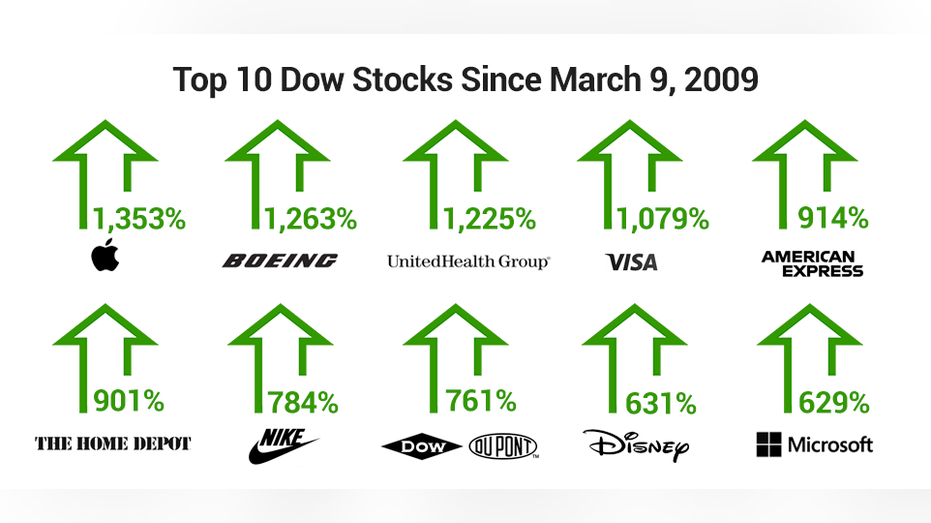

The gains in share prices since March 9, 2009, are equally striking:

Visa climbed 1,079.36 percent, UnitedHealth Group rose 1,225.46 percent, Boeing soared 1,263.10 percent, and Apple has added 1,352.89 percent.

CLICK HERE TO GET THE FOX BUSINESS APP

Here are the 10 Dow shares that have grown the most in the last decade: