Deutsche Bank shares sink: What to know

Bank closings and rescues are rattling the global financial markets

Could banking crisis impact commercial real estate?

Morgan Stanley private wealth adviser Kathy Entwistle and Lexerd Capital Management founder and CEO Al Lord give market outlook and discuss the banking crisis on 'Mornings with Maria.'

Shares for Deutsche Bank are falling Friday amid concerns that Germany's largest bank will pay higher costs for insuring itself against default.

The same rising cost of financial derivatives, called credit default swaps that insure bondholders against banks defaulting on debt, also led to a government-backed takeover of Swiss lender Credit Suisse by its rival UBS.

"Worries about contagion are again rearing up even though more deposits appear to have been flowing into the German lender since the banking scare erupted, and it is thought to have capital reserves well in excess of regulatory requirements," said Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.

A TICK-TOCK OF THE US BANKING CRISIS

Edward Moya, a senior market analyst for OANDA in New York, said "Big banks with poor management are getting punished."

"Deutsche Bank has had lots of problems for quite some time," he added. "Traders appear confident that bank worries are not going away anytime soon."

In this picture taken trough a window, German Chancellor Olaf Scholz waits for the arrival of Austria's Chancellor Karl Nehammer at the chancellery in Berlin, Germany, Mar. 31, 2022. (AP Photo/Michael Sohn / AP Images)

In response to the bank’s sharp fall in share price, German Chancellor Olaf Scholz said at a news conference in Brussels on Friday, "Deutsche Bank has thoroughly reorganized and modernized its business model and is a very profitable bank."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DB | DEUTSCHE BANK AG | 35.80 | -0.47 | -1.28% |

Shares traded in the U.S. are down more than 25% the last 12 months and over 20% year-to-date.

Banking crisis rundown

The month began with investors pulling $40 billion out of Silicon Valley Bank, and on March 10, the Federal Deposit Insurance Corporation (FDIC) said it seized control of SVB while confirming the lender was shut down by California regulators.

On March 12, the FDIC shut down Signature Bank after regulators said keeping the bank open could threaten the stability of the entire financial system.

Both banks had a very high ratio of uninsured deposits to fund their businesses.

YELLEN SAYS US WILL TAKE MORE ACTION TO PROTECT SMALLER BANKS IF NEEDED

By March 15, global inflation and the subsequent banking crisis was impacting institutions around the world. Swiss authorities announced a backstop to Credit Suisse after shares for the bank plummeted 30%. Five days later, the Bank of Switzerland took over Credit Suisse despite receiving a $54 billion financial lifeline from the Swiss National Bank to bolster its liquidity.

UBS REACHES AGREEMENT TO BUY CREDIT SUISSE AFTER UPPING OFFER

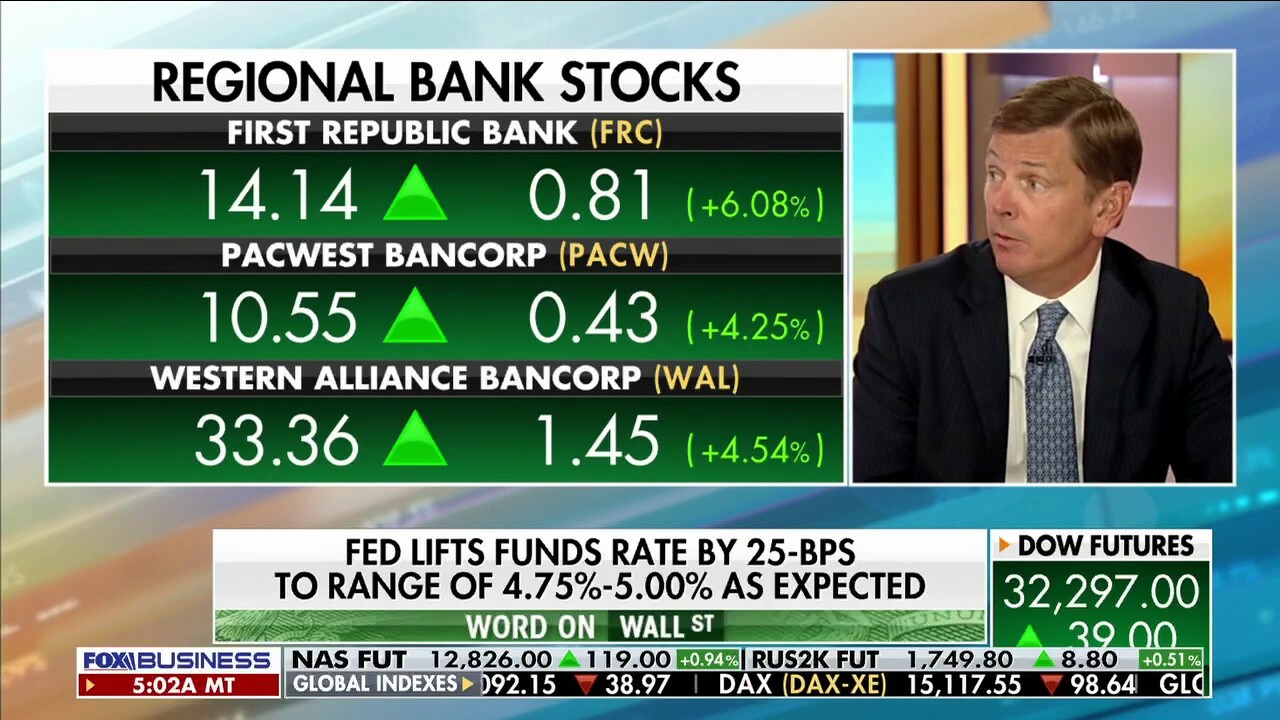

On March 16, U.S. Treasury Secretary Janet Yellen and JPMorgan Chase CEO Jamie Dimon began working together on a plan to help the banking sector. On the same day, First Republic Bank received $30 billion in deposits from 11 of the largest U.S. banks as customers raced to withdraw deposits.

CLICK HERE TO GET THE FOX NEWS APP

Credit Suisse collapse would be a Lehman moment, traders 'panicked': Naeem Aslam

Former Federal Reserve Governor Robert Heller, Solus Alternative Asset Management strategist Dan Greenhaus and Zaye Capital Markets CIO Naeem Aslam discuss the Fed's rate hike trajectory as Credit Suisse instability threatens global markets.