Diamond trading firm crafts gemstones into a commodity

Diamond Standard envisions scenario akin to what happened once investors could buy and sell gold without hauling around bars of it

A diamond is forever, but maybe not for much longer.

Spot trading in commoditized clusters of diamonds started in September and the firm behind the electronic exchange aims to launch a futures contract next year on the Minneapolis Grain Exchange. An exchange-traded fund is next up in Diamond Standard Inc.’s plans to get the gems included in the indexes that steer commodity fund investments.

"That’s the inflection point our early investors are waiting for," said Cormac Kinney, founder and chief executive of Diamond Standard, which has been buying about 10,000 diamonds a week and selling plastic-encased, equally valued clusters to investors.

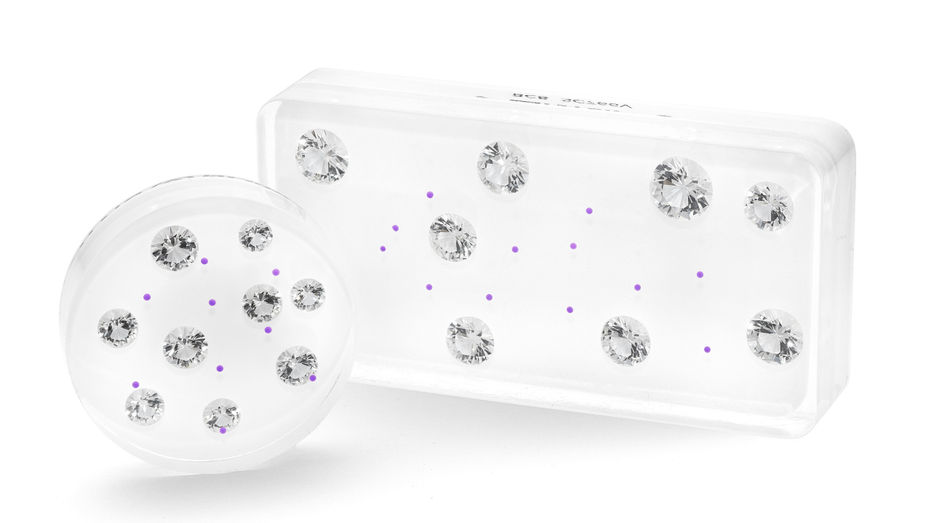

Diamond Standards coin is displayed next to currency for a size comparison. (Diamond Standard Newsroom)

AFFLUENT SPLASH OUT ON PREMIUM DRINKS, PRICEY BIRKIN BAGS BUT CLOUDS LOOM

Mr. Kinney is aiming for something similar to what happened when gold became financialized. Once investors could buy and sell gold without hauling around bars of it, commodity funds and others made allocations that elevated the price of the precious metal to new heights.

ETFs and new futures contracts flop all the time, to be sure. And functioning markets in investment diamonds have been elusive, despite investor interest that flares up during periods of high inflation, like now, when people are anxious to squirrel away wealth.

Buying diamonds is the easy part. The problem is selling them, which the famous De Beers advertising line about holding forever was meant to dissuade.

Diamond Bars, which will be sold in a coming offering, will be worth 10 diamond coins. The futures contracts will be for 20 coins, or two bars. (Diamond Standard Newsroom)

For one, many buyers pay retail but sell to dealers at wholesale prices, a lesson learned in the 1980s by Americans who were sold diamonds by telemarketers pitching sparkly hedges against the era’s inflation.

Though diamonds have dependably risen in value over the decades, it can take years to make up for the markup. Long holding periods on ring fingers and in safes, plus competition from jewelers for investment-grade stones, has limited liquidity, or the ability to transact at expected prices.

Diamonds are also idiosyncratic, with thousands of combinations of color, clarity, carat and cut, and usually valued by subjective appraisal. You can cut a gold bar in two and the halves will equal the whole, but two half-carat diamonds don’t add up to a 1-carat stone.

WORLD RECORD PINK DIAMOND SOLD FOR $57.7M IN HONG KONG: 'APPETITE FOR RARE'

Fungibility, more than opaque pricing or illiquidity, is the biggest hurdle for investment diamonds, said Olya Linde, a Zurich-based partner at consulting firm Bain & Co., who specializes in energy and natural resources.

"If anyone solves that, that’s the first big step toward unlocking the investment demand," she said. "This is where the real technology, artificial intelligence and machine learning, probably can come in."

Mr. Kinney, a computer scientist, believes he has cracked the code to commoditizing diamonds. He has run a quantitative hedge fund and created and sold trading programs and other software, including to News Corp, which owns The Wall Street Journal.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NWSA | NEWS CORP. | 22.50 | -1.71 | -7.06% |

| NWS | NEWS CORP. | 25.65 | -1.74 | -6.35% |

He got into diamonds when he met his wife, Mimi So, a dealer of gemstones and designer of fine jewelry. Buying an engagement diamond for someone like her was daunting. He had access to a trove of market data from her business and went about choosing a diamond the same way he approached quantitative trading.

"I put together a huge spreadsheet of different diamonds and analyzed how their price changed based on carat, the color, clarity," Mr. Kinney said. "It was basically to explore, what are the trade-offs that you have with a diamond? What makes the price go up or down?"

He bought a 5.01-carat D VVS1 diamond for his bride. A decade later, after building trading systems and working on statistical arbitrage and optimization of factor models, Mr. Kinney returned to diamonds.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"He always questioned, ‘Why would the price change so much? Why if you buy something at one price, and the next day you went to unload it, would it be so different,’" Ms. So said. "That was always hard to answer because it was more who you knew or who you would show it to."

Mr. Kinney decided that the way to commoditize diamonds was to group them in equally valued clusters. To do that, he would need to create a type of yield curve that organized values by thousands of combinations of characteristics, so that diamonds could be organized in equal bunches.

The values were constantly changing. The data set could never be completed. He decided he couldn’t write an algorithm to produce the curve. Diamond Standard would discover prices instead by buying thousands of diamonds.

The firm, which has Fifth Avenue offices near Manhattan’s diamond district, got started last year by raising $75 million in an offering of its coins, using the money to buy the stones that would go in them.

Priced at $5,000, each coin wound up with either eight or nine stones, or between about 3.125 carats and 3.4 carats. The stones are suspended in a disc of plastic resin along with a wafer that works like a credit-card chip and uses blockchain technology to ensure authenticity. Bars, which will be sold in a coming offering, will be worth 10 coins. The futures contracts will be for 20 coins, or two bars.

The stones are suspended in a disc of plastic resin along with a wafer that works like a credit-card chip and uses blockchain technology to ensure authenticity. (Diamond Standard Newsroom)

Diamond Standard now buys diamonds from dealers around the world as needed to meet demand for its coins, which are minted in New York after the stones are examined by the Gemological Institute of America. Some buyers have coins delivered to their homes. Most are stored in a vault in Delaware, where there is no sales tax.

Coins recently traded for $5,700 on Diamond Standard’s electronic exchange, and the average spread between bids and asking prices has been about 1%. That is a lot less than an auction fee or the haircut sellers can expect on 47th Street, Mr. Kinney said.

CLICK HERE TO GET THE FOX BUSINESS APP

Diamond prices rose during the pandemic when competition from fancy vacations and other experiential spending dried up. They exploded during the bonanza of betrothal that followed the lockdowns. "It went nuts," said Paul Zimnisky, who publishes a price index for rough diamonds. "Everyone was sold out."

After reaching records early this year, prices have declined. Though demand is threatened by economic uncertainty, China’s Covid-19 lockdowns and a more normal pace of engagements, Mr. Zimnisky said sanctions on Russian diamonds and the lack of major new mines should support prices.

If Diamond Standard’s coins take off, it will need a lot of stones. Mr. Kinney said he is counting on the market liquidity to encourage people who have been holding diamonds forever to finally sell.