Disney responds to activist Nelson Peltz after denial of board seats for Trian

Trian says it 'intends to take our case for change directly to shareholders'

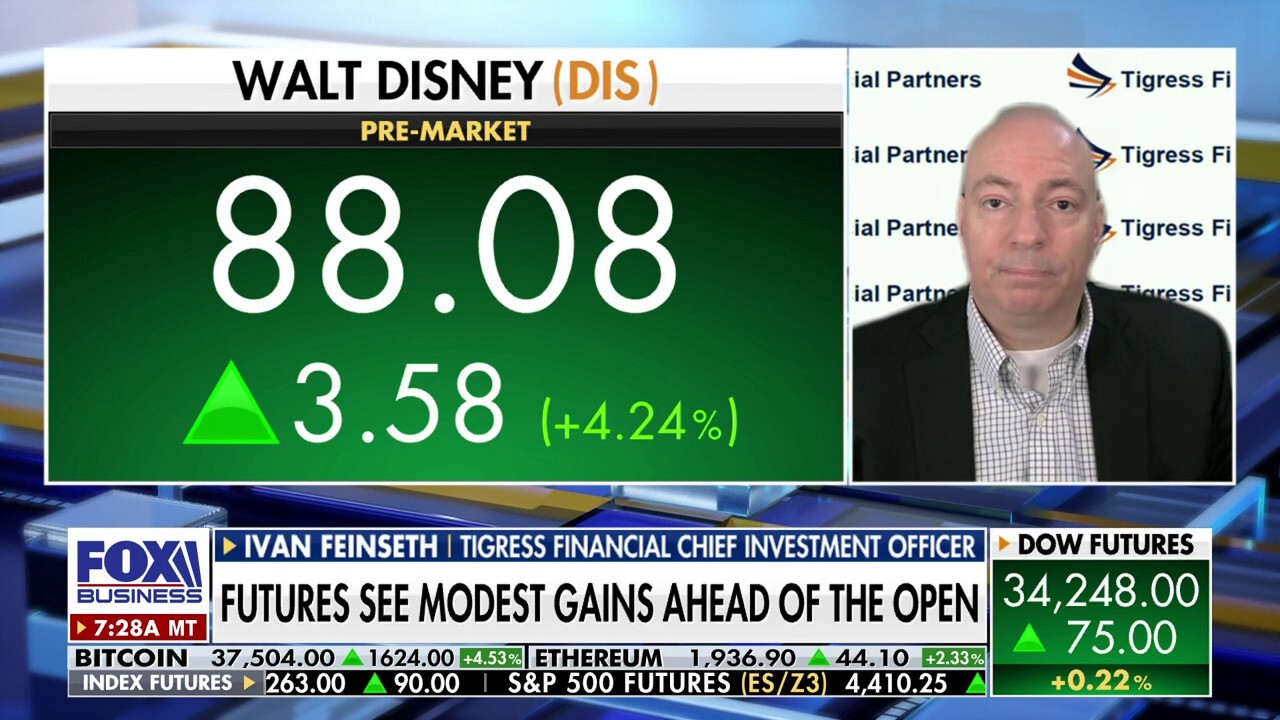

Content is king, Disney is ‘king of content’: Tigress CIO

Tigress Financial Chief Investment Officer Ivan Feinseth joins "Varney & Co." to discuss the U.S. markets and Disney’s optimistic stock price.

Disney and Trian Fund Management put out warring statements Thursday as a challenge by activist investor Nelson Peltz is slated to pick back up.

Trian said the firm "intends to take our case for change directly to [Disney] shareholders" after the entertainment giant denied its pursuit of board seats earlier in the day. The firm, after recently boosting its Disney holdings, has a stake worth roughly $3 billion under its control.

"Since we gave Disney the opportunity to prove it could ‘right the ship’ last February, up to our re-engagement weeks ago, shareholders lost ~$70 billion of value. Disney’s share price has underperformed proxy peers and the broader market over every relevant period during the last decade and over the tenure of each incumbent director," the investment management firm said in a statement. "Investor confidence is low, key strategic questions loom, and even Disney’s CEO is acknowledging that the Company’s challenges are greater than previously believed."

Disney and Trian Fund Management put out warring statements Thursday as a challenge by activist investor Nelson Peltz is slated to pick back up. (Joe Raedle / File / Getty Images)

Trian also said that Disney giving James Gorman and Jeremy Darroch board seats would not "restore investor confidence or address the root cause behind the significant value destruction and missteps that this Board has overseen," despite them being an "improvement from the status quo." The entertainment giant had unveiled the appointments Wednesday.

DISNEY'S BOB IGER ADMITS SECOND STINT AS CEO MORE CHALLENGING THAN HE EXPECTED

Disney, meanwhile, appeared to push back against Trian and Peltz, saying Thursday that it has a "proven track record" of providing long-term shareholder value.

It stood by its new board members, saying they showed the company’s commitment to that and other efforts to grow the company.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DIS | THE WALT DISNEY CO. | 108.69 | +3.71 | +3.53% |

The entertainment giant has been undergoing major changes since Bob Iger took over the CEO job again, something Disney noted in its response to Trian. Disney has shed thousands from its workforce and switched to having three business segments, among other measures.

Earlier this month, it also indicated it would trim $2 billion more in costs, raising its annual savings goal to $7.5 billion.

The entertainment giant has been undergoing major changes since Bob Iger, shown, took over the CEO job again, something Disney noted in its response to Trian. (Charley Gallay / File / Disney / Getty Images)

Disney on Thursday also argued that the "dynamic" of Peltz and former Marvel Entertainment Chair Ike Perlmutter’s share ownership was "relevant" to weigh in connection to board seats sought by Peltz for himself and any others.

Walt Disney Co

Perlmutter was "terminated from his employment by Disney earlier this year and has voiced his longstanding personal agenda against Disney’s CEO, Robert A. Iger, which may be different than that of all other shareholders," the company said.

DISNEY'S IGER TO STEP DOWN IN 2026, SAYS CHAPEK'S TENURE WAS ‘DISAPPOINTING’

Disney said it is "executing" on making improvements at its film studio and bringing more growth to its Experiences segment, all while progressing on getting its streaming services to generate a profit and transforming ESPN into a digital platform, which are all initiatives it has highlighted on other occasions as important for the company’s future.

Disney said it is "executing" on making improvements at its film studio and bringing more growth to its Experiences segment, all while progressing on getting its streaming services to generate a profit and transforming ESPN into a digital platform. (Joseph Prezioso / Anadolu Agency / File / Getty Images)

In the fourth quarter, its direct-to-consumer streaming services – Disney+, Hotstar, Hulu and ESPN+ – collectively produced $5.55 billion in revenue while their operating loss became $387 million, shrinking an eye-popping amount. Iger said at the time that Disney "remain[ed] confident we will achieve profitability in Q4 of fiscal 2024."

DISNEY CEO BOB IGER SAYS COMPANY IS LOOKING TO CUT COSTS BY $7.5 BILLION

The company reported that the revenues of its Experiences segment were $8.16 billion. That marked a 13% boost from the $7.25 billion it posted in the same three-month period the prior year.

Disney has seen a 4% lift in its shares since the start of the year and a 5% drop in the past 12 months.