Dow closes above 37,000 for first time ever as Powell hints at rate cuts

Fed left interest rates unchanged but signaled 3 cuts coming next year

Federal Reserve will cut at the March meeting: Jeremy Siegel

Wharton School professor Jeremy Siegel says all eyes are on the S&P and Dow following Fed Chair Powell's decision to leave interest rates unchanged on 'The Claman Countdown.'

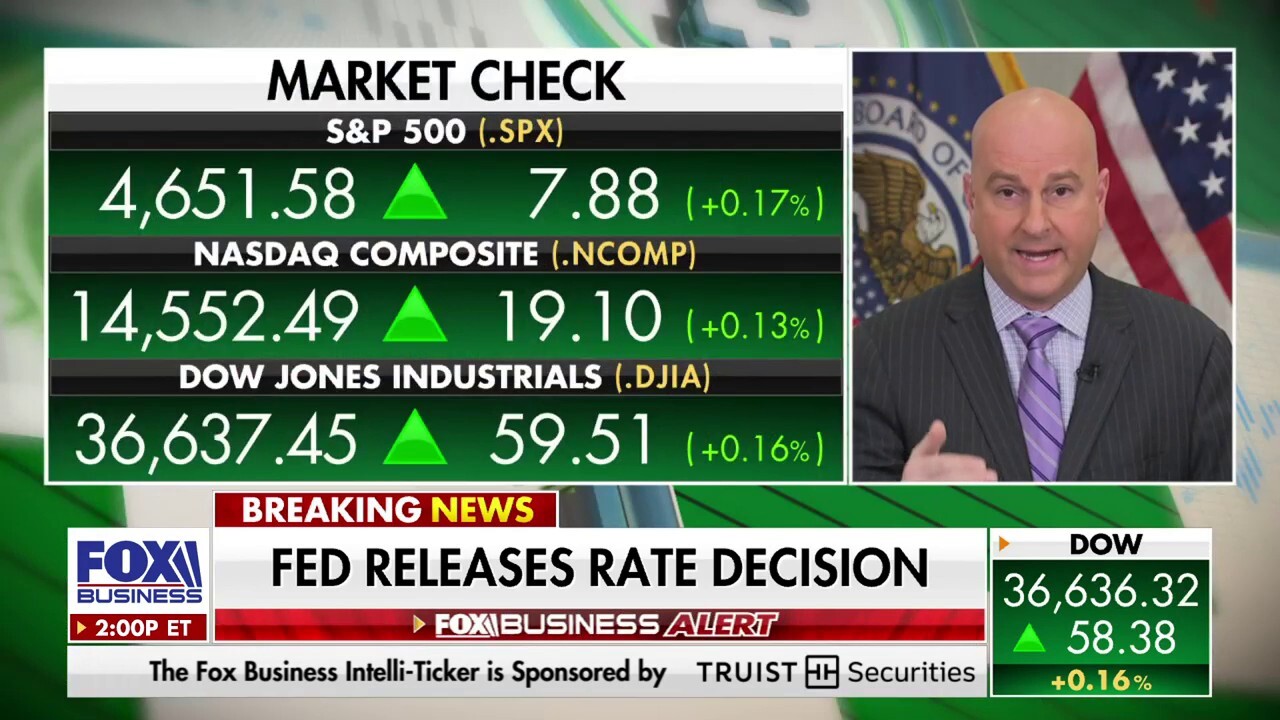

The Dow Jones Industrial Average ended the week scoring its third record close after crossing 37,000 for the first time in history Wednesday after Federal Reserve Chairman Jerome Powell signaled policymakers are likely done raising interest rates and cuts could soon be in the cards.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 46677.85 | -739.42 | -1.56% |

"We believe that we are likely at or near the peak rate for this cycle," Powell said during a press conference following the decision. "Participants didn't write down additional hikes that we believe are likely. So, that's what we wrote down. But participants also didn't want to take the possibility of further hikes off the table. So, that's really what we were thinking."

Federal Reserve Board Chairman Jerome Powell speaks during a news conference at the headquarters of the Federal Reserve Dec. 13, 2023, in Washington. (Win McNamee/Getty Images / Getty Images)

Policymakers, in their annual projections, priced in the potential of three rate cuts, with the federal funds rate falling to a range of 4.4% to 4.9%, down from the current 5.25% to 5.50%.

Federal Reserve leaves interest rates unchanged

FOX Business correspondent Edward Lawrence with the latest fed decision on 'Making Money.'

The Dow, which rose nearly 3% for the week, registered its longest weekly streak of gains since February 2019, as tracked by Dow Jones Market Data Group.

Dow Jones Industrial Average

"This is great news for the equity market and the U.S. economy," Wharton University professor Jeremy Siegel said during an appearance on "The Claman Countdown" following Powell's press conference Wednesday. Siegel predicts the first potential rate cut will come in March, in line with the CME's FedWatch Tool.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| UNH | UNITEDHEALTH GROUP INC. | 277.05 | -8.20 | -2.87% |

| MMM | 3M CO. | 149.10 | -6.06 | -3.91% |

| AAPL | APPLE INC. | 255.76 | -5.05 | -1.94% |

UnitedHealth Group has added the most points to the benchmark since the 36,000 level, while 3M has subtracted the most, according to Dow Jones Market Data Group.

Apple hit an all-time high this week and has added $1 trillion in market cap this year alone, driving it just above $3 trillion. For the year, shares have risen 52%.

Apple closed at an all-time high Wednesday. (REUTERS/Mike Segar/File Photo / Reuters Photos)

The S&P 500 rose 2.5% this week, its longest win streak since September 2017.

S&P 500

And the Nasdaq Composite gained 2.8%, its best week since June.

WHAT AMERICANS ARE MOST WORRIED ABOUT

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 46677.85 | -739.42 | -1.56% |

| SP500 | S&P 500 | 6672.62 | -103.18 | -1.52% |

| I:COMP | NASDAQ COMPOSITE INDEX | 22311.979453 | -404.16 | -1.78% |

ETSY WILL LAY OFF 11% OF STAFF, UNCERTAIN ECONOMY THE CULPRIT

As for the economy, inflation, while easing, remains a wildcard for policymakers.

"Inflation has eased from its highs, and this has come without a significant increase in unemployment. That's very good news, but inflation is still too high. Ongoing progress in bringing it down is not assured, and the path forward is uncertain," Powell added.

Organic ground beef in a bowl. (Daniel Karmann/picture alliance via Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Earlier this week, the consumer price index for November eased, but certain price pockets remain high, such as rent, which is up 6.5% on an annual basis. Beef and veal prices are 8.7% higher than a year ago.

*This article has been updated to reflect Friday's closing prices.