Economically-Sensitive Small Caps Poised for Continued Strength

Small-cap stocks saw their highest monthly return in five years as they jumped 8% in March, outperforming their large-cap counterparts by one percentage point, according to data from Barclays.

While small caps ,which have a market capitalization of roughly $300 million to $2 billion, are still in negative territory for the year, the upward momentum seen in the final month of the first quarter is likely to continue, according to panelists at Tuesday’s FTSE/Russell Small Cap Summit in Midtown Manhattan. That trend is contingent on two factors: As long as U.S. economic data remain relatively strong and the Federal Reserve holds off on raising interest rates in the near term.

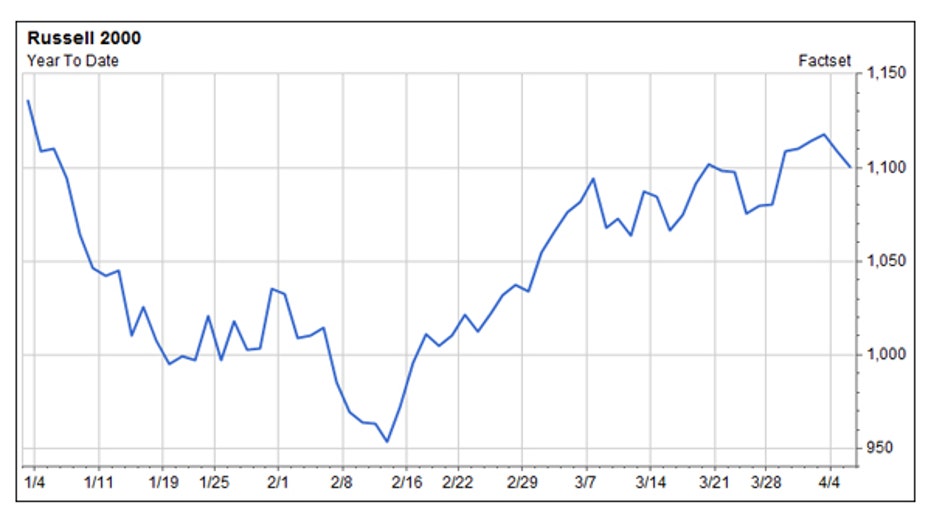

The Russell 2000 is down about 3% year to date, but a far cry from the losses of as much as 17% in mid-February.

Heidi Richardson, head of U.S. investment strategy for BlackRock’s U.S. iShares unit, said part of what led to the risk-on rally in March from the depths of mid-February was a more dovish stance by the Fed.

“I think as long as the Fed’s on hold and pausing in terms of these rate hikes, small caps will continue to do well,” she said. “I think they become more vulnerable in a rising rate environment just due to the level of debt on their balance sheets.”

She went on to say that while there’s likely to be continued volatility in financial markets as investors try to determine when the U.S. central bank will again raise interest rates after its first move in nearly a decade back in December, small caps will continue to do well.

Still, given the uncertainty surrounding central bank policy in the U.S., Richardson said it’s surprising the VIX, a measure of volatility, hasn’t seen a bigger rise than the range of 12-14, compared to the long-term average of 20.

“There are a lot of things going on around the globe that’s going to lead to higher volatility,” she explained.

But, she said, it’s not all bad news for small caps. The flip side to rate hikes of a quarter to a half of a percentage point is that unlike large corporations, smaller ones are not as susceptible to the effects of a stronger dollar.

“I think there’s actually some light at the end of the tunnel for small caps. We shouldn’t just say they’re going to be vulnerable in a rising rate environment,” Richardson said.

To that point, however, Rolf Agather, managing director of North American research for FTSE Russell, said the impact of a rate rise on small-cap stocks is only temporary: Historically, it starts with a downward move within three to six months, but then returns to growth after that.

“Obviously we’re at the beginning, not the end of potentially a rate-hike environment, but potentially this [recent action] is anticipation of that kind of regime and we’re starting to see the preliminary effect on the markets,” he said.