EpiPen Price Gouging Came As Mylan Pulled Off Tax Inversion

Continue Reading Below

Does Mylan have a monopoly with EpiPens?

AllergyKids Foundation Founder Robyn O’ Brien on the increase in peanut allergies in children and the rising cost of EpiPens.

Mylan Labs (NYSE:MYL), the Pittsburgh-based pharmaceutical giant at the center of a major drug pricing storm over the EpiPen, managed to pull off a tax-ducking corporate inversion just a year and a half ago.

And now the FOX Business Network has learned that allergy advocates are preparing to use the inversion strategy to convince lawmakers to investigate the company’s EpiPen.

“I definitely think Congress needs to get involved. There needs to be an investigation,” Robyn O’Brien, founder of Allergy Kids Foundation told FOX Business Network.

Continue Reading Below

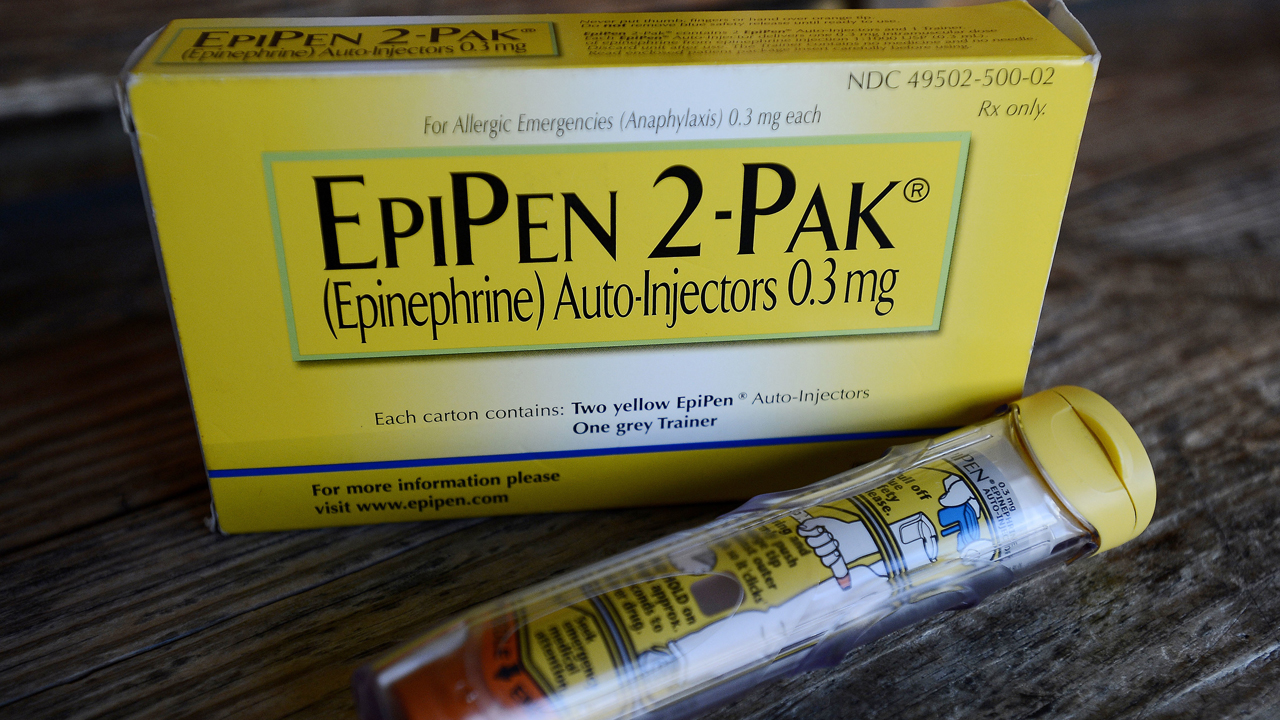

AdvertisementO’Brien represents millions of families in America who depend on EpiPens to save lives in the case of deadly exposure to allergens. The EpiPen is an auto-injector device that delivers epinephrine, the drug that counters the effects of a fatal allergic reaction. When Mylan bought the company that manufactures the EpiPen back in 2007, the cost for a single EpiPen was $57 dollars.

Today, just 9 years later, the cost has skyrocketed to as much as $700 for a pack of two. Many insurance companies cover some or most of the cost; however, millions of children of families who cannot afford insurance must be covered by Medicare which is paid for by the American taxpayer. Others saddled with high deductibles find themselves shelling out thousands of dollars for just a few packs of the device.

Rage Over Tax Trick

Mylan’s corporate inversion could now be used as a weapon against it.

Known officially as Mylan N.V., Mylan bought the small generic specialty drug arm of Abbott Labs (NYSE:ABT) in early 2014. That estimated $5 billion dollar purchase enabled the much larger Mylan (which has a current market cap of $24 billion dollars) to ‘move its headquarters’ to the Netherlands, a more tax-friendly country.

Mylan was able to complete one of the last corporate inversions before Congress, President Obama and Republican presidential nominee Donald Trump launched a full court press to demonize the practice which involves Company A (in this case Mylan) buying Company B (usually based in a foreign country with a lower tax rate) in order to lower Company A’s tax bill.