ESG investing has damaged credibility of asset managers like BlackRock

Investors need better answers from asset managers about ESG, climate agenda so they can decide who to trust

Wall Street's ESG investing likely a violation of fiduciary duty: Louisiana AG

Louisiana Attorney General Jeff Landry says he's concerned about 'woke' Wall Street banks buying assets at the expense of other investments to enhance their social policy on 'Cavuto: Coast to Coast.'

Asset managers like BlackRock have lost credibility on ESG or Environmental, Social, and Governance investing. BlackRock has joined climate change initiatives, committing to pressure companies to reach net-zero greenhouse gas emissions. But when 19 attorneys general (co-led by Nebraska) questioned whether these commitments were legal, BlackRock said it hadn’t followed through on them. Fellow climate initiative member, New York City Comptroller Brad Lander, has inquired about this "fundamental contradiction between BlackRock’s statements and actions." Asset managers have a serious trust problem when investors managing billions of dollars can’t get a straight answer.

Lander’s thorough letter may be the definitive description of ESG investing. He explains that New York City pension funds work for the benefit of "our planet," and make investment decisions "to limit global temperature rise below 1.5 [degrees]." Goals like achieving net zero are designed to "confront the climate crisis head on." Clearly, ESG requires a dual purpose to pursue both investment returns and environmental goals like net zero. Lander’s candid letter illustrates my concerns about ESG.

In instructing BlackRock to "[p]rovide a detailed approach to keeping fossil fuel reserves in the ground and phasing out high-emitting assets," Lander underscores the danger of putting net-zero, keep it in the ground activism ahead of managing assets. A return-focused asset manager shouldn’t push companies to keep profitable assets in the ground. Rather, companies should develop or sell such assets – whatever is more profitable.

Lander correctly describes the International Energy Agency’s net-zero pathway as prohibiting new investment in fossil fuels, and "rapidly curtailing" coal, oil and gas. Net zero requires decreasing worldwide electricity generation from coal and natural gas from 67% to 3% by 2050, no sales of internal combustion engine passenger cars after 2035, and a global carbon tax.

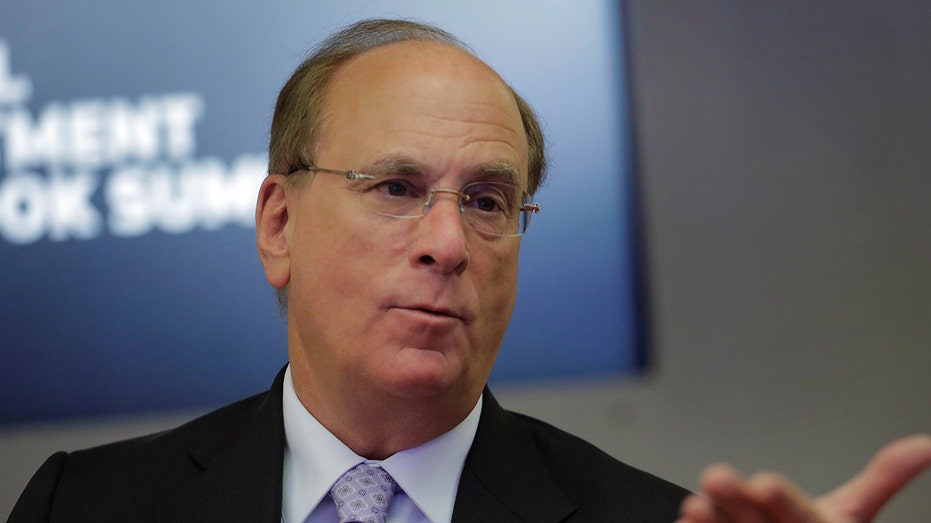

Laurence Fink, founder and chief executive officer of BlackRock, Inc., has come under fire from Republican attorneys general for his ESG support. FILE: Fink speaks during the Reuters Global Investment Outlook Summit in New York, U.S., November 13, 20 (REUTERS/Lucas Jackson / Reuters Photos)

Extending that logic, every financial institution belonging to the Net Zero Asset Managers Initiative should identify the actions they’ve taken to keep profitable assets in the ground, or otherwise put net zero above profitability.

Regardless of one’s view of climate change, pensions are the wrong instrument to use to transform the global economy. That is a risky gambit with a highly attenuated connection to investor returns that is bound to be rudely interrupted by world events. Pressuring public companies simply transfers assets to private companies, as BlackRock’s CEO acknowledges. Similarly, forcing U.S. companies to divest empowers foreign, often state-owned, companies.

Moreover, China can undo any emissions reductions occurring elsewhere in the world. During 2020, China built coal plants at a rate of more than one a week, and is currently blowing through its commitments to halt such activity. Just getting China on track for net zero will cost $8.2 trillion. Will China enact a green new deal that consumes nearly half its GDP? Will the world subsidize a belligerent regime that threatens its neighbors? We shouldn’t risk police officers and firefighters’ retirements on an investment scheme that depends on such unlikely events.

The world is far too uncertain to keep profitable assets in the ground to achieve net zero.

GOP mounts counteroffensive to Wall Street's ESG investing trend

FOX Business senior correspondent Charlie Gasparino details the Republican pushback to Wall Street's environmental, social, and corporate governance strategy on 'Cavuto: Coast to Coast.'

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Our state can’t afford to pass up an 800% return in coal, or a 100% increase in energy (since 2020) because of such commitments. By 2050, natural gas may be considered green, as Europe has indicated. Geopolitical conflict may increase worldwide demand for American energy. Global energy prices may continue to rise, prioritizing affordability above emissions. China may invade Taiwan, jeopardizing the supply of rare earth’s necessary for energy production under a net-zero scenario. Republicans may win the next presidential election and unleash an era of cheap and exportable American energy to preserve democracy around the globe. In the face of continual uncertainty, managing state pensions is exclusively about making money under any circumstances.

The history of social investing is replete with investments losses. The California Public Employees' Retirement System (CalPERS) has lagged its peers for a decade and ESG commitments have cost it billions. Overall, ESG has underperformed by 250 basis points for the past five years. Another long-term study noted that "ESG funds appear to underperform financially relative to other funds within the same asset manager and year, and to charge higher fees." Furthermore, adopting ESG policies does not cause improved company financial performance. This means asset managers have no financial basis for pressuring companies to adopt ESG.

CLICK HERE TO READ MORE ON FOX BUSINESS

Wall Street firms market themselves by referencing solid objects — a black rock. For firms making ESG commitments, the appropriate image would be a black box. Asset managers cannot have it both ways: either they maximize financial returns, or they push ESG and net zero. Lander and I both want asset managers to identify themselves. He wants to use the firms that choose ESG. I don’t. Over time, we will see whose returns are better.

John Murante is the Nebraska state treasurer and national chair of the State Financial Officers Foundation.