EV price war leaving delivery and fleet vehicles in the dark

Tesla, Rivian, Lucid, Ford and GM cut electric vehicle costs in fight for retail consumers

Wyoming moves to ban sales of new electric vehicles by 2035

Wyoming Sen. Jim Anderson discuss how he is pushing to have the sale of new electric vehicles banned in the state by 2035 on ‘Fox Business Tonight.’

While electric vehicle manufacturers slash prices to lure retail customers and increase their market share, EV costs in fleet and distribution remain elevated despite the sector accounting for 25% of CO2 produced in the U.S. every year.

By 2030, the World Economic Forum projects the number of delivery vehicles will increase by 36% in the top 100 global cities, despite the lack of availability in EV panel vans, heavy-duty trucks, and specialty vehicles like semi-trailers and buses.

Meanwhile, traditional automakers including Ford Motor and General Motors have joined EV makers Tesla, Lucid and Rivian in producing passenger EVs, sparking a price war that has benefited retail consumers but not commercial customers.

Tesla's new electric semi truck is unveiled during a presentation in Hawthorne, Calif., November 16, 2017. (Reuters/Alexandria Sage/File Photo / Reuters Photos)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 411.11 | +13.90 | +3.50% |

| LCID | LUCID GROUP INC. | 10.86 | +1.33 | +13.96% |

| RIVN | RIVIAN AUTOMOTIVE INC. | 14.80 | +1.07 | +7.79% |

DOMINO'S IS ELECTRIFYING DELIVERIES WITH HUNDREDS OF CHEVROLET BOLTS

High costs

In an interview with FOX Business, Hari Nayar, VP of fleet electrification and sustainability at Merchants Fleet, a fleet management and leasing company, said the high cost of available EVs in distribution is stopping logistics and transportation companies from electrifying their vehicles.

Other hurdles include the cost of infrastructure and general uncertainty about the quality and longevity of EV companies, particularly new original equipment manufacturers that lack established market recognition.

"Despite common belief, all data indicates that EVs are less expensive to own, operate and maintain over a vehicles’ lifespan," he added.

While EVs are expected to account for 14-18% of U.S. electricity consumption by 2040, other advances in technology and energy efficiency are expected to reduce demand while vehicle supply increases, Nayar said.

GM CEO BARRA SAYS THERE'S NO NEED TO CHASE TESLA, FORD EV PRICE CUTS

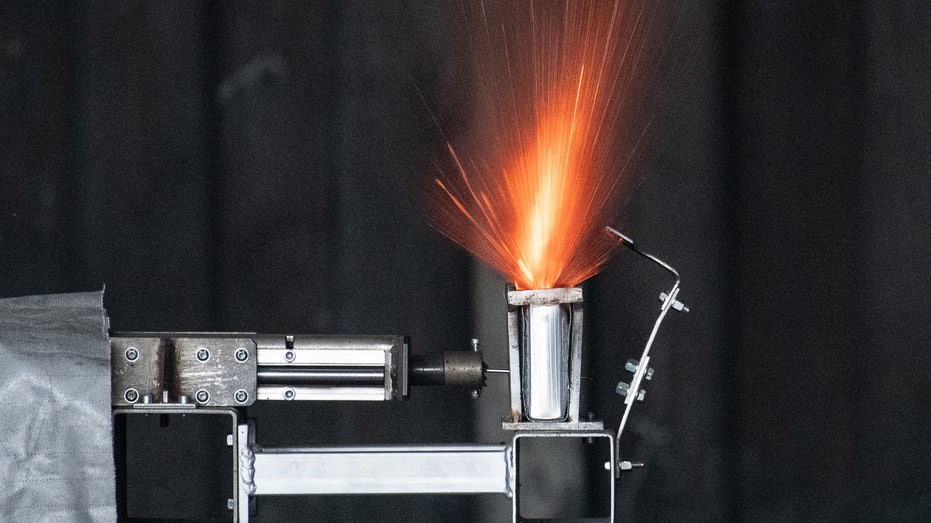

06 May 2022, Lower Saxony, Goslar: A lithium-ion battery havers during a nail test as part of a demonstration in a container on the premises of the fire protection company Stöbich. Exhibitors at the Innovation Forum of the Harz recycling region drew (Swen Pförtner/picture alliance via Getty Images / Getty Images)

Performance: EV vs. gasoline

Brad Jacobs, the VP of fleet consulting at Merchants Fleet told FOX Business: "While EVs have yet to reach cost parity with Internal Combustion Engine (ICE) vehicles from an origination cost standpoint, the prevailing thought is that EVs are more expensive."

"While EVs carry a higher purchase price, the cost to operate the vehicle is up to 40% less than an equivalent gas-powered vehicle," he explained. "To illustrate this, fleet operators say the most common instances of service prior to 40,000 miles are wiper blades, and perhaps a tire or two due to normal operating circumstances."

At the breakeven point, where the operating cost savings overcomes the higher acquisition cost, Jacobs said most vocational EVs will reach total cost of ownership parity between 1.5 and 2.5 years in service.

"With most lifecycles being 4 to 6 years, the cost savings can be substantial, even after the charging infrastructure is considered," he finished.

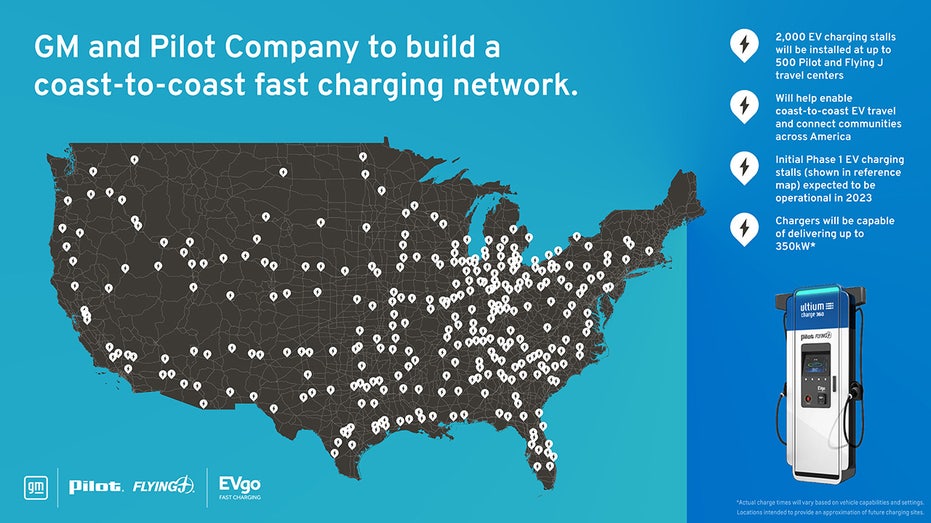

GM and Pilot Company to Build Out Coast-to-Coast EV Fast Charging Network (GM / Fox News)

US POSTAL SERVICE ANNOUNCES $9.6B INVESTMENT IN NEW ELECTRIC VEHICLE FLEET WHILE OPERATING AT A LOSS

Batteries

Nayar said batteries make up a significant portion of an electric vehicle's cost, accounting for up to 30-50% in the case of 18-wheelers and buses.

"It’s too early to predict how it will play out, but OEMs are stepping up to provide long warranties for battery replacement to help drive overall EV ownership costs down," he explained.

According to the U.S. Department of Energy, most of today's EVs use lithium-ion batteries, though the exact chemistry often varies from that of consumer electronics.

Currently, the department is undergoing research and development to reduce the relatively high cost of EV batteries, while extending the batteries’ useful life and addressing safety concerns like overheating.

Don Gao, CEO of Positec Group, told FOX Business, "To this point, innovations in battery technology have been driven by the EV industry in order to maximize drive time and minimize range anxiety that historically has hindered EV adoption."

"As battery technology becomes more pervasive, we’re seeing advances in other aspects of batteries, such as much faster charge times and longer service life," he continued. "These innovations are driving adoption in new industries, such as outdoor power equipment and agricultural machinery."

TREASURY DEPARTMENT DELAYS ELECTRIC VEHICLE TAX CREDIT CHANGES

Tax credits

Workers load packages into Amazon Rivian electric trucks at an Amazon facility in Poway, Calif.,Nov. 16, 2022. (Reuters/Sandy Huffaker / Reuters Photos)

In 2020, just 2% of vehicles on the road in the U.S. were EVs, but in 2022, alongside incentives offered by the Inflation Reduction Act, the number reached roughly 6% and is projected to grow by more than 20% by 2030, department of energy data shows.

Section 45W of the act provides a new incentive for commercial vehicles with tax credits of up to $40,000 for medium and heavy-duty EVs, whereas the prior incentives were primarily focused on passenger cars.

The act also extends the credit for charging stations through 2032. Commercial users can get a tax credit of up to $100,000 per property.

Merchants Fleet's Jacobs told FOX Business, "We’ve had gas stations, fuel cards, maintenance networks, and well-established ancillary services for decades to keep a vehicle on the road."

"In a very short time, the educational demands for charging, infrastructure projects, futureproofing, driver behavior and education, grants and incentives are just a few of the concepts that have been thrown into the mix that must be understood," he added.

EVS BEHIND BP'S $1.3B TRAVELCENTERS OF AMERICA DEAL

Infrastructure

Tesla vehicle is charged at a Tesla supercharging station in Kettleman City, Calif., Jan. 25, 2023. (Reuters/Mike Blake / Reuters Photos)

Most infrastructure changes will be related to the transmission, rather than the generation, of electricity. Transformers and power lines will be upgraded to remove bottlenecks while delivering power to EV charging locations.

Nayar said, "The grid in its present state can support the transition to electrification."

However, "There will need to be significant changes in order to keep up with the rate of electrification, not only for vehicles but other industries as well," he added.

With the adoption of EVs and charging infrastructure increasing on the roadways, Jacobs said even petroleum companies understand the potential impact to their business and sales.

"We will likely see competition and potential disruption in the electricity space," he continued. "We are already seeing DC fast chargers as standard on newly constructed gas stations all over the country, not just California and New York."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Tesla will lead EV market for 'quite some time': R 'Ray' Wang

Constellation Research founder R 'Ray' Wang joins 'Varney & Co.' to discuss Tesla shares following their record revenue and earnings report.