Exxon CEO warns Biden administration against limiting fuel exports

Exxon argues against push to get energy companies to slow overseas shipments and stash more fuel in storage tanks

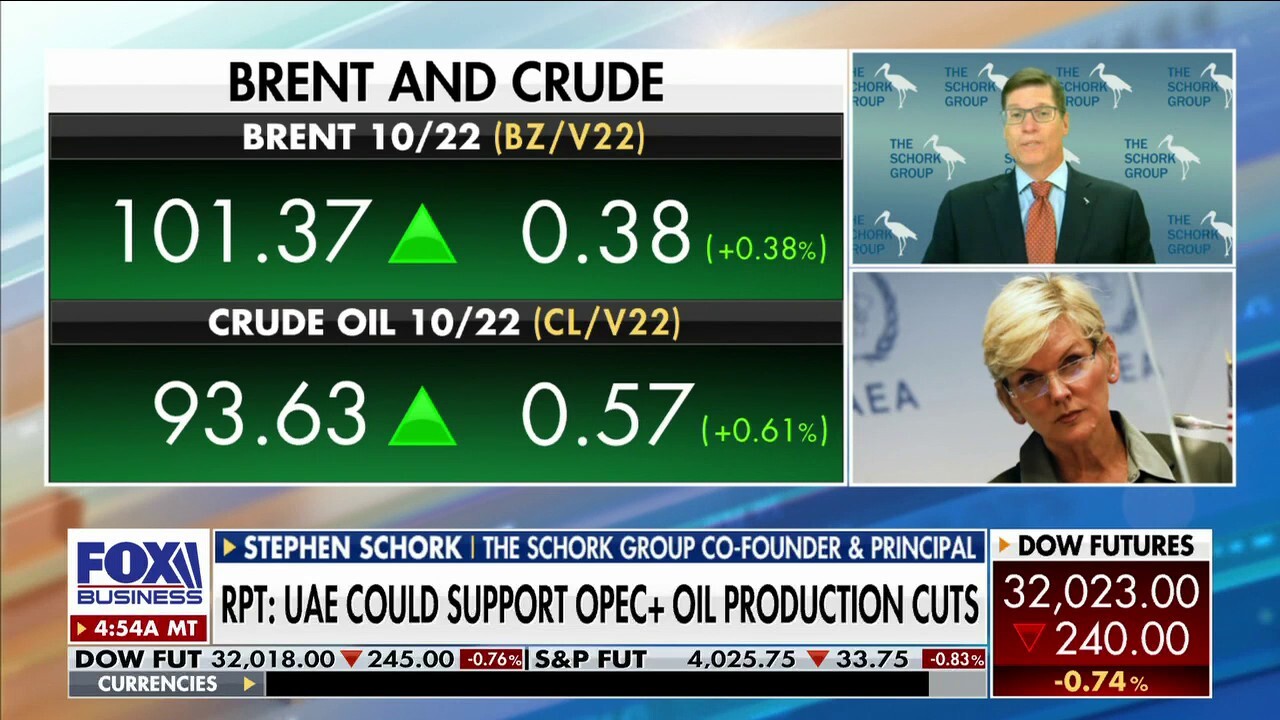

Biden telling oil producers to stop exports will ‘create logistical nightmares, deprive other markets’: Expert

The Schork Group co-founder and principal Stephen Schork says if the Biden administration wants to relieve gas shortages in local markets, it should rescind the Jones Act.

ExxonMobil Corp. is pushing back against reductions of U.S. fuel exports urged by the Biden administration in August, arguing that restricting shipments would further squeeze global supplies and lift pump prices at home.

Exxon told the Energy Department this week that the oil industry should not slow fuel shipments in favor of putting more in storage tanks, according to a letter reviewed by The Wall Street Journal. Easing exports would not fill tanks in the Northeast—a region where U.S. officials said oil companies need to send more supplies—and instead would create a glut in the Gulf Coast that would lead refineries to cut output, according to the letter, which was signed by Exxon Chief Executive Darren Woods.

"Continuing current Gulf Coast exports is essential to efficiently rebalance markets—particularly with diverted Russian supplies," Woods wrote. "Reducing global supply by limiting U.S. exports to build region-specific inventory will only aggravate the global supply shortfall."

A storage tank is seen at the ExxonMobil oil refinery along the Houston Ship Channel in Houston June 9, 2004. (Photo by Carlos Javier Sanchez/Bloomberg via Getty Images / Getty Images)

US IMPOSES NEW SANCTIONS ON IRAN OIL EXPORTS, TARGETS CHINESE FIRMS

An Energy Department spokesperson said parts of the country have oil and gas supply levels that are unacceptably at or near five-year lows during hurricane season.

"The administration has impressed upon the oil and gas industry that it must do more to ensure fair prices and adequate supply for all Americans, while meeting the needs of our allies," the spokesperson said.

Oil companies have clashed this year with Democrats over supply shortages, record-high oil prices and soaring industry profits. After campaigning on a promise to reduce fossil fuel usage, President Biden this year has asked oil companies to lift their fuel-making capacity, pump more oil out of the ground and expand exports of liquefied natural gas (LNG) to ease a crisis in Europe.

Exxon Mobil

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XOM | EXXON MOBIL CORP. | 150.93 | +0.30 | +0.20% |

Russia’s invasion of Ukraine pushed oil prices to their highest levels in years and has made European countries and other nations increasingly reliant on U.S. fossil-fuel exports. In June, when U.S. gasoline prices hit a record $5 a gallon, U.S. exports of crude oil and finished products together hit 6.75 million barrels a day, the fourth-highest monthly figure on record and the biggest month since the onset of the pandemic in early 2020, U.S. data show.

In August, Energy Secretary Jennifer Granholm sent a letter to oil companies urging them to reduce exports of fuel and instead refill stocks in the East Coast, a region at risk of fuel disruptions, in part, because of its distance from large Gulf Coast refineries. She said if the companies did not do so, the administration would consider "additional federal requirements or emergency measures," which many analysts interpreted as a threat to limit exports.

"The most effective way to resolve this issue without having to deploy emergency actions is for industry to prioritize building inventories during this critical window," she wrote in her letter. "The data clearly show there has not been sufficient progress in building inventories ahead of peak hurricane season."

Energy Secretary Jennifer Granholm speaks during the daily briefing at the White House in Washington, D.C., June 22, 2022. (AP Photo/Susan Walsh / AP Newsroom)

Ms. Granholm has also discussed export restrictions with industry executives in private conversations, according to people familiar with the matter. At a press conference in September, she said the administration was not currently weighing any restrictions.

Earlier this year, domestic inventories of crude and products languished at their lowest levels since 2015. American refiners have lost almost 5% of their daily fuel-making capacity since the pandemic began through facility shutdowns and conversions to biofuels, while shale drillers kept oil output roughly flat from December to June, according to federal data.

GAS PRICES MOVING IN DIFFERENT DIRECTIONS DEPENDING ON WHERE YOU ARE: GASBUDDY ANALYST

The boost in overseas shipments helped to drain fuel inventories further, and factored into the rapid price increases in gasoline and diesel earlier this year, oil analysts said at the time. Likewise, rising LNG exports have pushed domestic natural-gas prices higher this year, as well.

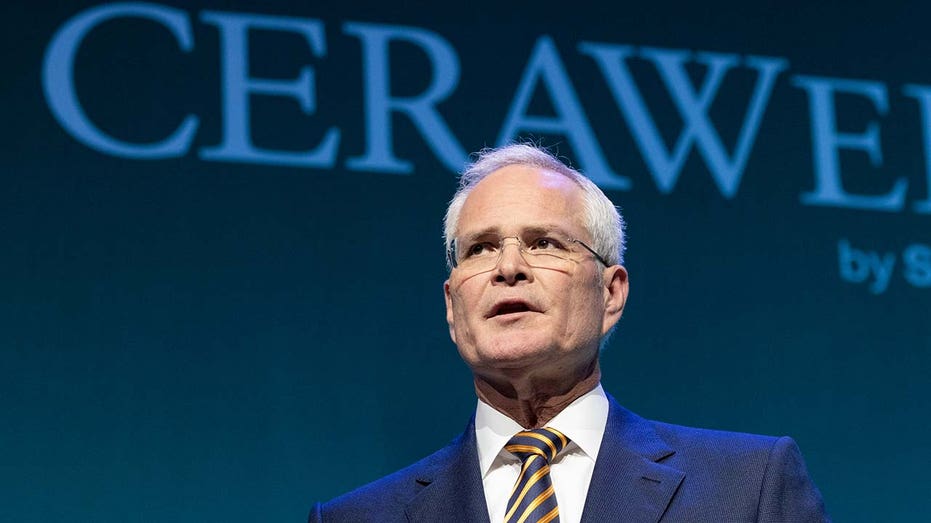

Darren Woods, chair and CEO of ExxonMobil Corp., speaks during the 2022 CERAWeek by S&P Global conference in Houston March 7, 2022. (F. Carter Smith/Bloomberg via Getty Images / Getty Images)

Some political pressure from high energy prices has abated, for now. Gasoline prices have dropped more than $1.20 a gallon since reaching the peak of about $5 a gallon in June, as oil prices have come down on fears of an economic downturn. Inventories of gasoline across the U.S. have increased almost 6% since early June.

In his letter, Woods said the East Coast had 59.3 million barrels of total gasoline and ethanol in storage, about 1% lower than usual for that time of year. Demand for gasoline through June, he said, was 9% below the average in the three years before the COVID-19 pandemic.

BIDEN IS DESTROYING AMERICAN ENERGY AND ORDINARY CITIZENS SUFFER

Woods also said pipelines that carry fuel from the Gulf Coast to the East Coast are full. Without waivers of the Jones Act—the law passed a century ago that effectively limits the number of vessels allowed to move goods between U.S. ports—Woods said there are not enough ships to move more U.S.-made fuel to the Northeast.

Darren Woods, chairman and chief executive officer of ExxonMobil Corp., speaks during the 2022 CERAWeek by S&P Global conference in Houston March 7, 2022. (F. Carter Smith/Bloomberg via Getty Images / Getty Images)

On Wednesday, the Biden administration issued a temporary Jones Act waiver, allowing a tanker carrying diesel to unload its 300,000-barrel cargo into Puerto Rico.

Exxon primarily sells gasoline to the East Coast market, according to Woods’ letter. If a supply disruption occurred in the Northeast, the company could move fuel from elsewhere in the Midwest and from refineries in other countries, he said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"Free market incentives remain the most efficient way for the industry to address these problems," Woods said.