Ben Bernanke assesses the Fed, Powell and inflation

Consumer inflation sits at 8.3% - a 40-year high

Fed's Bullard on potential for US recession

St. Louis Fed President James Bullard forecasts a 'pretty good second half of the year' despite economic headwinds.

With inflation at a 40-year high, the Federal Reserve is under the gun to tame it without triggering a recession as Chairman Jerome Powell faces widespread criticism for waiting too long to raise interest rates in the aftermath of the COVID-19 pandemic.

CONSUMER INFLATION SOARS TO 8.3% IN MAY

The tightening plan, which this month, included a half-point rate hike for the first time in two decades has roiled financial markets and stoked investor uncertainty over whether he can steer the U.S. economy to a so-called soft landing.

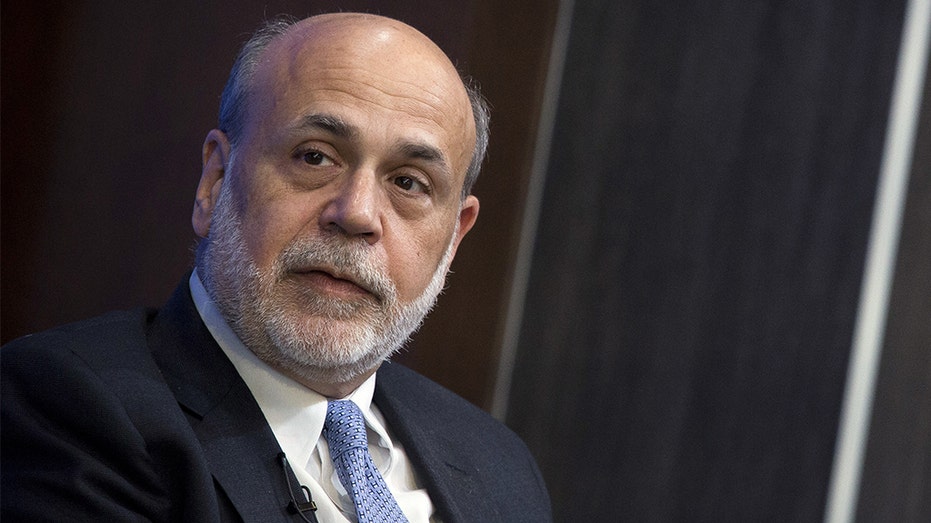

Ben Bernanke, former chairman of the Federal Reserve, speaks during an event at the Brookings Institution in Washington, April 14, 2016. (Drew Angerer/Bloomberg via / Getty Images)

Former Federal Reserve Chairman Ben Bernanke is no stranger to financial upheaval having navigated the financial crisis of 2008 when the U.S. and global financial system teetered on the brink of collapse.

The Fed 'completely missed' inflation signals: Peek

Fox News contributor Liz Peek says the U.S. economy is looking 'pretty ugly' as inflation takes hold.

S&P 500 FALLS INTO BEAR MARKET ...BRIEFLY

On Monday he’ll participate in a rare Q&A held by the Brookings Institution at 11 a.m. ET which will live stream on FOXBusiness.com.

In an excerpt from his new book titled "21st Century Monetary Policy: The Federal Reserve from the Great Inflation to COVID-19," he dives into the role of the Fed and the challenges the central bank faces in times of crisis as we’ve seen over the past three years.

IS A RECESSION COMING? WALL ST. WEIGHS IN

Introduction:

On January 29, 2020, Jay Powell strode briskly to the podium to begin the first press conference of his third year as chair of the Federal Reserve. He flipped open a white binder, looked up briefly to welcome the assembled reporters, and then looked down to read his prepared statement. His demeanor was low-key, almost somber. But his message was upbeat: The U.S. economy had entered the eleventh year of a record-long expansion, unemployment remained at a half-century low, and people in lower-paying jobs were seeing wage gains after years of stagnation. The trade tensions that had roiled financial markets for the past two years had diminished and global growth seemed to be stabilizing.

In passing, he noted "uncertainties" affecting the economic outlook, "including those posed by the new coronavirus.". A follow-up question on the virus, from Donna Borak of CNN, did not come until 21 minutes into the 54-minute press conference. At that point, only a few cases had been reported outside China. The virus, Powell cautiously acknowledged, was "a very serious issue" that could cause "some disruption to activity in China and possibly globally."

Federal Reserve Chairman Jerome Powell (AP Photo/Jacquelyn Martin, File)

Five weeks later, on March 3, Powell walked to the same podium and in the same calm tone read a much darker statement to reporters. He offered his sympathy to people the virus had harmed around the world, noted that it had disrupted the economies of many countries, and predicted that measures to contain the virus "will surely weigh on economic activity both here and abroad for some time." The Fed, he said, was cutting interest rates "to help the economy keep strong in the face of new risks." He hinted at more to come. The state of the world had changed dramatically—and the Fed’s policy had changed with it.

Between the January 29 and March 3 press conferences, the virus had evolved from a localized problem to an incipient global crisis. Reported cases of the disease that would become known as COVID-19 had risen from fewer than 10,000, almost all in China, to more than 90,000 worldwide. Italy had quarantined towns in its Lombardy region and Iran had reported a surge of infections. In the United States, the first virus death was reported on February 29—a man in his 50s, near Seattle. U.S. cases, and deaths, grew exponentially from there, threatening to overwhelm health-care systems in New York City and other hot spots.

(Copyright © 2022 by Ben S. Bernanke. Used with permission of the publisher, W. W. Norton & Company, Inc. All rights reserved. )

Meanwhile, virus fears triggered the worst week in U.S. financial markets since the 2007–2009 financial crisis, signaling trouble ahead for the economy. The Dow Jones Industrial Average, which had hit a record high earlier in the month, plunged more than 12 percent during the week ending February 28. In March the turmoil spread to bond markets. Sellers of even ultrasafe U.S. Treasury securities had difficulty finding buyers, who showed little interest in holding anything other than cash. The markets for private credit, where corporations, home buyers, and state and local governments borrow, threatened to freeze entirely as lenders and investors grappled with coronavirus-induced uncertainty.

DJIA

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The market’s panic attack did, in fact, presage economic trauma. With businesses and schools closing, either voluntarily or under lockdowns imposed by local governments, economic activity contracted at an unprecedented rate. In February 2020, following a long recovery from the Great Recession, only 3.5 percent of the labor force was unemployed. Two months later, in April, the official unemployment rate stood at 14.8 percent, a shocking increase that likely understated the damage to the labor market. More than 20 million jobs were lost in April, by far the largest drop recorded since the data series began in 1939. The Business Cycle Dating Committee of the National Bureau of Economic Research, the arbiter of the timing of recessions and expansions, would later date the start of the pandemic recession to February.

Excerpted from 21st Century Monetary Policy: The Federal Reserve from the Great Inflation to COVID-19. Copyright © 2022 by Ben S. Bernanke. Used with permission of the publisher, W. W. Norton & Company, Inc. All rights reserved.