Fed decision, Instacart IPO and UAW strike top week ahead

Instacart is set to go public this week at a fraction of its 2021 valuation

Wall Street is missing out on Oracle's cloud business: Mike Murphy

Rosecliff founder and managing partner Mike Murphy discusses Oracle's stock slide and Arm's IPO on 'Varney & Co.'

The Federal Reserve's decision on interest rates will dominate the coming week as investors also follow the ongoing UAW strike against Ford, GM and Stellantis, which is threatening to disrupt the economy.

Stocks ended the Friday session lower, capping off a mixed five days.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

The Dow Jones Industrial Average was the only benchmark to post a slight gain for the week.

Dow Jones Industrial Average

In IPO news, Instacart is expected to begin trading in the coming week.

INSTACART: WHAT TO KNOW ABOUT ONLINE GROCERY SERVICE

Last week, the online grocery shopping company, which fulfills customer orders, disclosed its target valuation of up to $10 billion after Arm Holdings' strong market debut.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ARM | ARM HOLDINGS PLC | 123.70 | +12.82 | +11.56% |

The stock will trade on the Nasdaq Marketsite under the symbol CART.

The Instacart logo on a laptop computer arranged in Hastings-on-Hudson, New York, on Jan. 4, 2021. (Tiffany Hagler-Geard/Bloomberg via Getty Images / Getty Images)

SUPERMARKET ADDS 'SHRINKFLATION' WARNINGS TO OVER A DOZEN PRODUCTS

Monday, September 18

S&P 500 rebalance

On Monday, Blackstone and Airbnb will replace Lincoln National and Newell Brands in the S&P 500, while Deere & Co will replace Walgreens Boots Alliance in the S&P 100.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WBA | NO DATA AVAILABLE | - | - | - |

| BX | BLACKSTONE INC. | 129.69 | +2.87 | +2.26% |

| ABNB | AIRBNB INC. | 122.18 | +0.91 | +0.75% |

| LNC | LINCOLN NATIONAL CORP. | 40.30 | +1.05 | +2.69% |

| NWL | NEWELL BRANDS INC. | 4.63 | +0.11 | +2.43% |

Meanwhile, Israeli Prime Minister Benjamin Netanyahu will reportedly meet with Elon Musk, according to the Washington Post.

ELON MUSK, ISRAELI PM NETANYAHU TO MEET IN U.S.

Tesla CEO Elon Musk (Chesnot / Getty Images)

The meeting comes amid Musk's criticism of the Anti-Defamation League (ADL).

Tuesday, September 19

Biden in NYC

AutoZone will report earnings after the bell and could provide details on the impact of the ongoing UAW strike against Detroit's Big Three automakers.

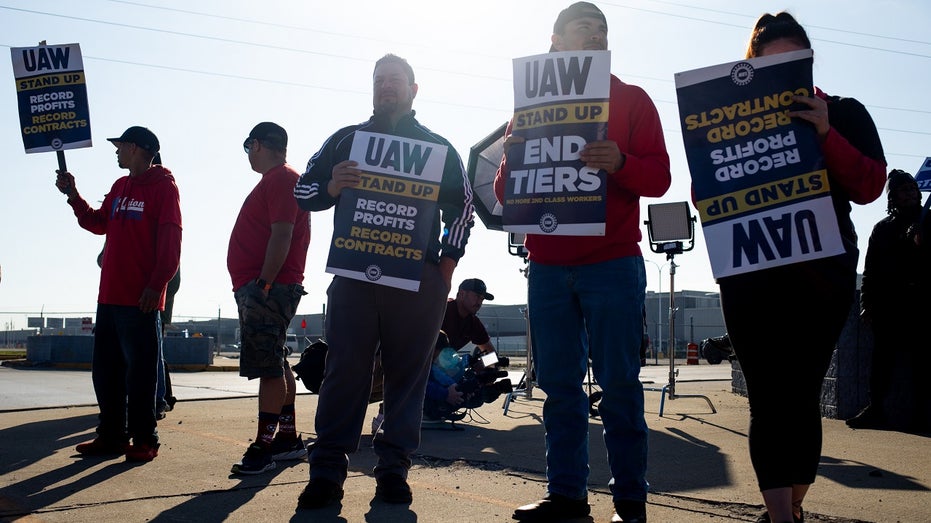

The strike, which began Friday, could cost the economy nearly $6 billion over just nine days.

LOOMING UAW STRIKE COULD COST US ECONOMY MORE THAN $5B IN JUST 10 DAYS

United Auto Workers members on a picket line outside the Ford Motor Co. Michigan Assembly plant in Wayne, Michigan, on Friday, Sept. 15, 2023. The UAW began an unprecedented strike at all three of the legacy Detroit carmakers, kicking off a potential (Emily Elconin/Bloomberg via Getty Images / Getty Images)

In economic news, building permits and housing starts will be released.

INSTACART RAISES IPO PRICE RANGE AFTER ARM'S STRONG WALL STREET DEBUT

The United Nations Headquarters in New York City (iStock / iStock)

Meanwhile, President Biden will travel to New York City to participate in the 78th session of the United Nations General Assembly.

FORD CEO SAYS ELECTRIC VEHICLES PROVOKING 'CHARGING ANXIETY'

Wednesday, September 20

FOMC interest rate decision

The Federal Reserve will announce its decision on interest rates Wednesday after two reports on inflation last week ran hotter-than-expected. Consumer prices jumped 3.7% from the same time last year, faster than expected. While inflation at the wholesale level rose 1.6% annually.

According to the CME's FedWatch Tool, 98% of the market is expecting policymakers to hold rates steady.

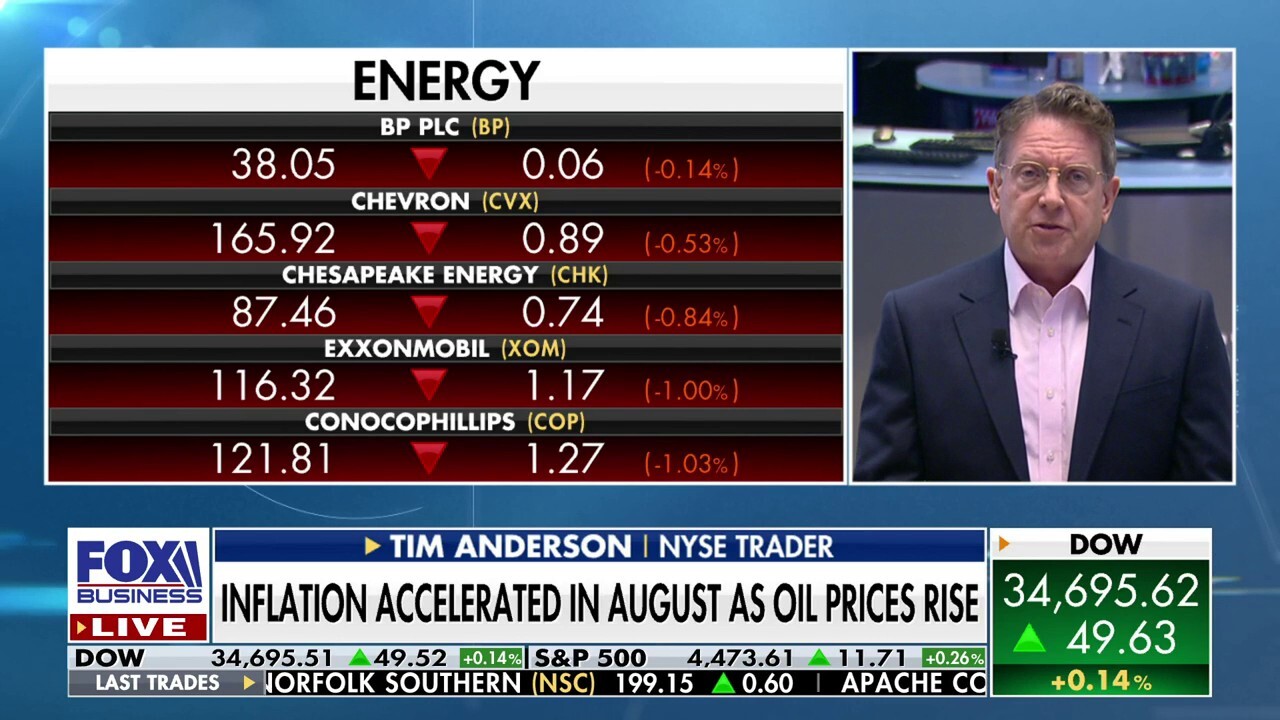

Fed is very close to ending rate hikes: Tim Anderson

NYSE trader Tim Anderson discusses whether inflation is slowing on 'Cavuto: Coast to Coast.'

MONTHLY HOME PRICES HIT ALL-TIME HIGH, DRIVING PENDING SALES DOWN

Thursday, Sep. 21

Oracle will kick off CloudWorld in Las Vegas. CEO Larry Ellison hinted that the company will deliver significant updates at the event during last week's earnings call.

Oracle's Larry Ellison gestures while giving a demonstration during his keynote address at Oracle OpenWorld in San Francisco, Sept. 30, 2014. (Robert Galbraith / Reuters Photos)

Investors punished Oracle shares after the company's forecast fell shy of some estimates.

ORACLE SHARES HAVE WORST DAY SINCE 2002

Oracle

Economic reporting will include data on initial jobless claims and existing home sales.

Friday, September 22

U.S. manufacturing survey

Blue Apron will end its run on the New York Stock Exchange Friday and join the Nasdaq on Sept. 25.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| APRN | NO DATA AVAILABLE | - | - | - |

On the economic front, data from the U.S. Manufacturing Purchasing Managers Index is slated for release.