Fed vice chair talks inflation, hotels hit by crime wave and more: Tuesday's 5 things to know

JP Morgan CEO Jamie Dimon warns of recession in next 6-9 months, blames volatile markets coinciding with disorderly financial conditions

I think we’re in for a big downturn in the real economy: Art Laffer

Former Reagan Economic adviser Art Laffer discusses how the American wage growth has been wiped out by inflation under Biden on ‘Fox Business Tonight.’

Here are the key events taking place on Tuesday that could impact trading.

FED VICE CHAIR TALKS INFLATION: Federal Reserve Vice Chair Lael Brainard on Monday reiterated the U.S. central bank's plan to continue tightening monetary policy until there is clear evidence that inflation has slowed down, warning the U.S. economy will likely slow further as a result of elevated interest rates.

"Monetary policy will be restrictive for some time to ensure that inflation moves back to target over time," Brainard said. "It will take time for the cumulative effect of tighter monetary policy to work through the economy and to bring inflation down."

–

The Fed has already raised interest rates five times this year as it tries to wrestle inflation that is still running near a 40-year high back to its 2% target goal.

THE FED'S WAR ON INFLATION COULD COST 1M JOBS

Lael Brainard, governor of the U.S. Federal Reserve, during the National Association of Business Economics (NABE) annual meeting in Arlington, Virginia, on Monday, Sept. 27, 2021. (Al Drago/Bloomberg via Getty Images / Getty Images)

In its latest move, the Fed approved a third consecutive 75-basis-point rate hike, lifting the federal funds rate to a range of 3% to 3.25% – near restrictive levels. It also indicated that more super-sized increases are likely in the coming months.

Brainard – the Fed's No. 2 and a permanent voting member of the Federal Open Market Committee – said during prepared remarks delivered before the National Association for Business Economics in Chicago that the economy is likely to cool over the next year as rates remain elevated.

"The moderation in demand due to monetary-policy tightening is only partly realized so far," she said.

The economy has already cooled significantly in the U.S., with gross domestic product – the broadest measure of goods and services produced in a nation – contracting by 1.6% in the winter and 0.6% in the spring.

Brainard noted that Americans' savings have also dwindled faster than the Fed anticipated, suggesting there could be a pullback in spending soon.

There is a growing expectation on Wall Street that the Federal Reserve will trigger an economic downturn as it raises interest rates at the fastest pace in three decades to catch up with runaway inflation.

Fed Chair Jerome Powell has all but conceded the central bank will tip the economy into a recession with its rapid rate hikes, warning that higher rates will cause economic "pain."

CRIME WAVE EVOLVES: Hotels are getting caught in the nation's crime wave.

The father of a Marist College student was killed inside a Courtyard by Marriott hotel in what Poughkeepsie, New York officials have described as a "random" and "unprovoked" shooting. Two men were indicted Friday on charges related to the shooting death of the father, Paul Kutz, who was visiting the area for "Family Weekend" at the college of one of his three children.

FOX Business reached out to Marriott for comment on the incident and how it is handling the U.S. crime wave, but the hospitality company did not respond by the time of publication.

The FBI’s crime statistics for 2021, released last week, show crime is not abating. "Violent crime continued to be a major issue in the United States, remaining at or near the 2020 level which saw a 5.6% increase compared to 2019" according to the FBI's Uniform Crime Report.

CREDIT SUISSE TO BUY BACK $3B IN DEBT, SELL HOTEL SAVOY

Police vehicles outside of the Courtyard by Marriott seen on Wednesday, October 5, 2022, where a Paul Kutz was shot and killed on Sunday. (The Image Direct for Fox News Digital. / Fox News)

Meanwhile, law enforcement responded Thursday to an "active shooting" situation at a Hampton Inn – one of Hilton's brands – located in Dearborn, Michigan, according to a tweet from the state police. A Hilton spokesperson told FOX Business that the Dearborn Hampton Inn is an "independently owned and operated property" and that they "cannot speak on the hotel's behalf."

HILTON

The suspected gunman barricaded himself inside a room at the Hampton Inn after allegedly shooting someone, Fox 2 Detroit reported. Following multiple hours of being barricaded Thursday, the man was taken into custody by authorities.

"The wellbeing, safety and security of our guests and Team Members are of paramount importance for Hilton and we continue to make every effort to ensure that all practices and standards are in line with strict safety and security regulations," the Hilton spokesperson told FOX Business.

MARRIOTT

Business leaders in other industries have raised concerns about crime in recent months.

On the company's late September earnings call, Rite Aid's chief retail officer, Andre Persaud, complained of rampant theft in New York City stores.

"I think the headline here is the environment that we operate in, particularly in New York City, is not conducive to reducing shrink just based upon everything you read and see on social media and the news in the city," he said.

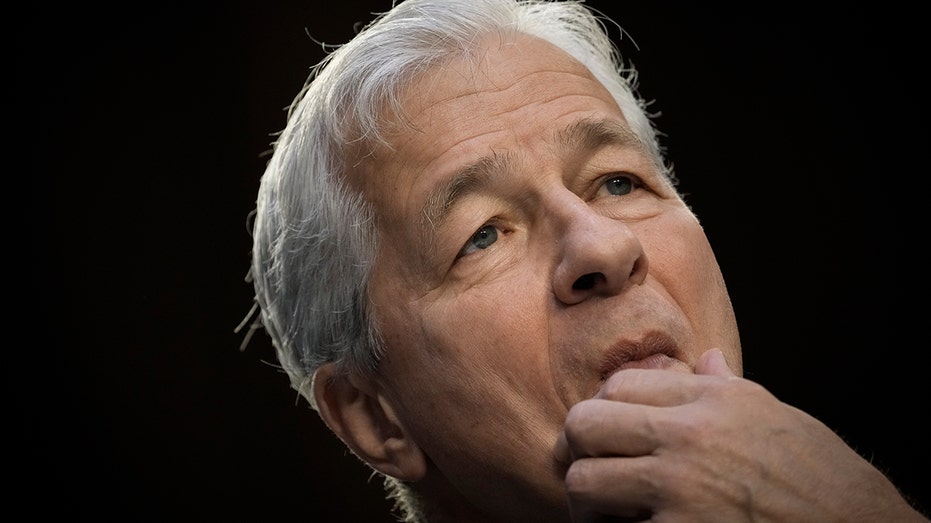

IMPENDING RECESSION: JPMorgan CEO Jamie Dimon on Monday warned that the U.S. is headed for a recession in the next six to nine months as volatile markets coincide with disorderly financial conditions.

Speaking to CNBC’s Julianna Tatelbaum at the JPM Techstars conference in London, Dimon said U.S. consumers would be in better shape this time around than the 2008 global financial crisis but the current factors contributing to a recession were still a cause for concern.

"But you can’t talk about the economy without talking about stuff in the future – and this is serious stuff," Dimon said, citing inflation, quantitative easing, and Russia’s war with Ukraine.

"These are very, very serious things which I think are likely to push the U.S. and the world – I mean, Europe is already in recession, and they’re likely to put the U.S. in some kind of recession six to nine months from now," he said.

FED'S BRAINARD WARNS HIGHER RATES WILL FURTHER SLOW US ECONOMY

JPMorgan Chase & Co CEO Jamie Dimon testifies during a Senate Banking, Housing, and Urban Affairs Committee hearing on Capitol Hill September 22, 2022, in Washington, DC. (Drew Angerer/Getty Images / Getty Images)

Dimon’s comments came after the September jobs report, released last Friday, showed that businesses kept hiring at a brisk pace, unemployment fell back to a half-century low and average pay rose.

Still, the jobs report raised concerns that the Federal Reserve was making little progress in its fight against inflation. With the Fed more likely to keep raising borrowing costs rapidly, the risk of recession will also rise.

Employers did pull back slightly on hiring last month, and average wage gains slowed. But economists say neither is falling fast enough for the Fed to slow its inflation-fighting efforts.

As a result, another hefty rate hike of three-quarters of a point — a fourth consecutive one — is likely at the Fed's next meeting in November.

The Fed's rate hikes are intended to cool the economy and tame inflation. The increases have, in turn, led to higher borrowing costs across the economy, notably for homes, credit cards and business loans.

Dimon said the Fed, in hindsight "waited too long and did too little.

MARKETS LOWER: U.S. stocks fell Monday, continuing a stretch of volatility as concerns about Federal Reserve tightening, escalation in the Ukraine war and China-trade policy shake markets.

The S&P 500 turned lower after opening with slight gains, shedding 27.27 points, or 0.7%, to close at 3612.39. The Dow Jones Industrial Average edged down 93.91 points, or 0.3%, to 29202.88 while the Nasdaq Composite fell 110.30 points, or 1%, to 10542.10. That's the lowest closing value for the tech-heavy Nasdaq since July 2020, according to Dow Jones Market Data.

Shares of chip-manufacturers suffered losses stemming from the Biden administration's new restrictions imposed on semiconductor exports, aimed at hampering China's military. The PHLX Semiconductor Sector dropped 3.5% on Monday to its lowest closing level since November 2020. Those losses also helped drag down stocks for businesses that are major chip users.

"The new restrictions placed on selling semiconductors to China are big reason why we are seeing the downtrend in those stocks," said Randy Frederick, managing director of trading and derivatives at Schwab Center for Financial Research.

CALIFORNIA'S DROUGHT WITHERS TOMATOES, PUSHING GROCERY PRICES HIGHER

Traders work on the floor at the New York Stock Exchange in New York, Tuesday, Oct. 4, 2022. (AP Photo/Seth Wenig / AP Images)

Technology stocks represent about one-fourth of the S&P 500, noted Frederick.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| QCOM | QUALCOMM INC. | 137.34 | +1.04 | +0.76% |

| AVGO | BROADCOM INC. | 332.92 | +22.41 | +7.22% |

Chip maker Qualcomm sank $6.31, or 5.2%, to $114.60 on Monday while Broadcom fell $22.78, or 5%, to $437.70. Technology was the worst performer among the S&P 500's 11 sectors, down 1.6%.

Shifting expectations about more interest-rate increases from the Fed have been the primary driver of recent stock-swings. Friday's jobs report showed the labor market is still tight as the unemployment rate fell back to a half-century low, exacerbating concerns that the Fed could tighten financial conditions more aggressively.

Hopes for a "Fed pivot" – in which the central bank would pause interest-rate increases and jolt stocks higher – have largely been dashed. Traders now expect the benchmark federal-funds rate to touch 4.7% by the second quarter of 2023, according to FactSet derivatives data, more aggressive than the Fed's own forecasts.

"Inflation is still high and the labor market is red-hot – there's nothing to suggest the Fed will be dovish or pivot for at least several months," said Michael Antonelli, market strategist at Baird.

Investors are looking ahead to the next U.S. inflation data release Thursday as another important indicator for where monetary policy might be headed.

"There's still that hangover in markets. The U.S. labor market is still incredibly strong, and the Fed has a single mandate right now: inflation," said Fahad Kamal, chief investment officer at Kleinwort Hambros. "The most important number in the world right now" is the coming inflation figure, he said.

3Q EARNINGS SEASON UNDERWAY: Earnings season is picking up speed, with household names in the consumer and finance sectors set to report this week.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| PEP | PEPSICO INC. | 170.49 | +2.96 | +1.77% |

| DAL | DELTA AIR LINES INC. | 75.35 | +5.57 | +7.98% |

| WBA | NO DATA AVAILABLE | - | - | - |

| BLK | BLACKROCK INC. | 1,056.38 | +1.58 | +0.15% |

| JPM | JPMORGAN CHASE & CO. | 322.40 | +12.24 | +3.95% |

| WFC | WELLS FARGO & CO. | 93.97 | +2.41 | +2.63% |

| MS | MORGAN STANLEY | 179.96 | +4.12 | +2.34% |

| C | CITIGROUP INC. | 122.69 | +6.95 | +6.00% |

PepsiCo is on the docket for Wednesday and Delta Air Lines, Walgreens Boots Alliance and BlackRock will give updates Thursday. JPMorgan, Wells Fargo, Morgan Stanley and Citigroup will report on Friday.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"Everyone is expecting a poor earnings season but quite a lot of that is already priced in," Esty Dwek, chief investment officer at FlowBank said.