First Jobs Report Under Trump Shows Solid Employment Gains, Weak Wage Growth

U.S. employers added more workers to their payrolls than expected in January as hiring picked up in retail and construction-related industries, though wage growth remained soft. The figures give President Donald Trump’s administration a higher jumping-off point for its plan to stoke further economic growth, while at the same time giving the Federal Reserve more breathing room when it comes to raising rates.

The economy added 227,000 net new jobs last month, easily beating Wall Street estimates for a gain of 175,000, according to data released from the Bureau of Labor Statistics on Friday. At the same time, the jobless rate ticked up to 4.8% from 4.7% in December as more people joined the workforce, sending the labor force participation rate to 62.9% from 62.7% the month prior.

“It was a solid report,†said Sameer Samana, global quantitative strategist for Wells Fargo Investment Institute. “We saw strength in the non-farm and private-sector side. Manufacturing payrolls have also been positive the last couple of months, so it’s not just non-manufacturing employment that’s improving.â€

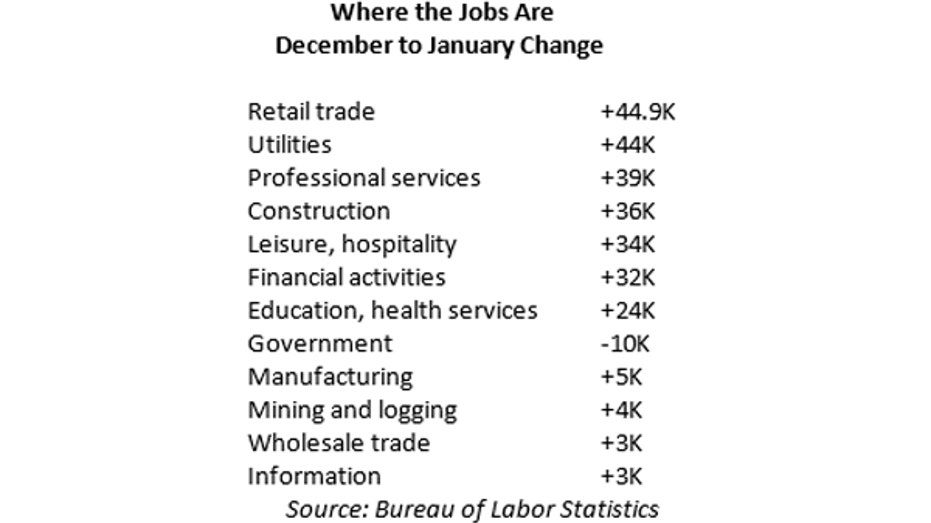

Where the jobs are

Employment picked up the most in financial services, construction and retail trade – which includes clothing, electronics and home-goods stores. Health-care employment, which has seen strong growth over the last several months, also continued to trend higher during the first month of the year.

Growth in those industries, which typically includes lower skilled, or lower-wage earners, shows the economic recovery is likely in its later stages as more people benefit, Samana said, explaining that economic growth periods typically tend to benefit highly skilled wage earners first.

Still, the underemployment rate, which measures Americans working part-time for economic reasons or highly-skilled workers in low-skilled or low-wage positions, ticked up to 9.4% for the month from 9.2% in December.

“More and more we’re seeing people come back into the labor market…the underemployment rate has been coming down, this time it ticked up. That could easily be due to the greater participation rate, much like the regular unemployment rate, but it’s something to watch,†Samana said.

Weak wage growth: a silver lining

Wage growth also remained a weak spot in January as average hourly earnings rose just one-tenth of a percentage point, falling short of expectations. Over the last 12 months, wages grew 2.5% as December wage growth was revised lower to 2.8% from 2.9%.

The lack of traction, though, combined with solid headline figures, gives the Federal Reserve more time to let growth improve before raising short-term interest rates, said Dennis DeBusschere, macro research analyst at Evercore ISI.

“That is a support for growth expectations and should benefit cyclical stocks and reduce upward pressure on the U.S. dollar,†he said. “From a growth and financial market standpoint, this was a very positive report indicating a virtuous cycle of low inflation and accelerating growth.â€

The U.S. central bank, at the conclusion of its two-day meeting Wednesday, held its benchmark interest rate steady at between 0.50% and 0.75% citing the need for continued strength in labor markets and inflation. Just after the monthly employment figures were released, Chicago Fed President Charles Evans, who expects a 2% - 2.5% annualized economic growth pace for the next couple of years, said the Fed should raise rates slowly despite the chance for Trump’s fiscal policies of lower taxes and more spending to spur more robust growth.

Wall Street sees just a 17% chance of a rate hike at the Fed’s March meeting, according to federal funds futures, with odds sitting at about 70% for at least one rate rise by the June meeting.

“This is just what the doves at the Fed wanted to see,†said Aberdeen Asset Management Senior Investment Manager James Athey. “At this stage in the economic cycle, you’d expect the headline employment number to be slowing a bit as we’re theoretically reaching full employment. The increase in participation and drop in wages suggest we’re not at full employment.â€