Flash Crash Flashback; Global Markets Still at Risk

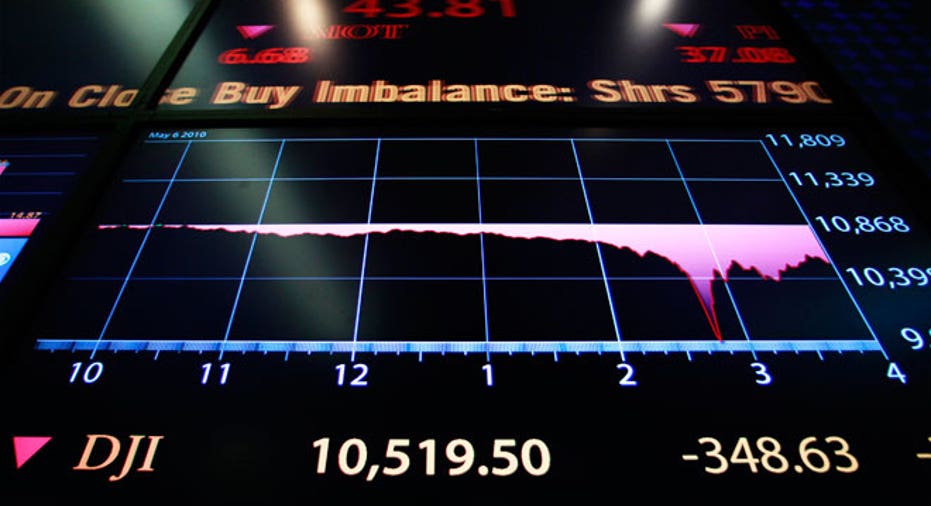

Around this time in May of 2010, my financial regulatory colleagues and I in the US Government were looking at what had taken place on May 6th—known as the Flash Crash. The Dow Jones Industrial Average had dropped nearly a thousand points in 20 minutes.

Thousands of investors lost money as stocks many thought were safe, tumbled. Some prominent company stocks traded at mere pennies. While the rebound recouped almost all of the market losses by the close of trading, lots of investors took heavy hits. Something had clearly gone horribly wrong. Regulators were charged with figuring it out. Now, six years later, it is reasonable to ask: Are we safer from some similar market meltdown? That fateful day, markets were diving to unforeseen deep depths. Traders wondered what they should do. It was entirely new. Should they buy? Should they sell? Or, just go straight to...well, a bad place? As The Clash used to sing: "If I stay there will be trouble, an' if I leave it will be double....Should I stay or should I go?" Well, most traders couldn’t figure it out and bailed. Some, primarily the high frequency folks with sophisticated algorithms and the ability to react quickly, stayed. In fact, but for those market makers, things could have been worse and the recovery would not have occurred so rapidly. They were, as they are today, needed market makers, even in times of a monumental market mess.

In fact, a Treasury Department report a few months ago documented the same phenomena from the October 15, 2014 Treasury market meltdown moment—when the yield on the 10-year US Treasury plunged precipitously before bouncing back. High frequency market makers actually stayed in and provided liquidity. An SEC-CFTC Staff Report on the Flash Crash was concluded, and I reiterated in my comments at a joint meeting that “The inter-relatedness of markets exacerbated the problems and was a major lesson of May 6.†Before that day, people often spoke about 24-7-365 markets operating around the world, but the Flash Crash was a manifestation. Markets being inextricably linked was no longer a tag line, but a fact with demonstrable data to prove it. As a result, both agencies instituted "circuit breakers"—which are essentially trading speed bumps. When a price falls or rises beyond acceptable levels, designated pauses allow traders to catch their breath and help calm jittery markets. If prices move too far, trading can be halted for the day. The Chicago Mercantile Exchange (CME) had, for years, already instituted these (CME calls them "stop logic"), and they worked brilliantly. However, it wasn’t until after the Flash Crash that the CFTC and SEC worked to harmonize circuit breakers for all US exchanges. The good news, we eventually did so in 2012. While they aren’t exact, the circuit breakers are certainly close enough for government work, and they have helped avoid Flash Crash-like circumstances. If traders are getting out of markets, thus creating light liquidity, the circuit breakers allow time for liquidity to be replenished. As we know, more plentiful liquidity leads to better and less volatile pricing. So: Are we safer? Yes, you betcha!‎ But…there's a but. There's almost always a "but" when you talk financial regulation. While US and EU regulators have, to a large extent, harmonized circuit breakers, many other regulators around the world have not. Some which have done so, have done so poorly. For example, a year ago July, the Chinese Securities Regulatory Commission (CSRC) instituted a ban on selling stocks for shareholders with over five percent of a stock. As the ban was expected to be withdrawn in early January of this year, many smaller traders decided to sell before the anticipated rush of the above-five-percenters. At the same time, Chinese regulators had recently instituted circuit breakers. While one might think that was a good thing, the speed bumps and market stops were poorly calibrated—meaning they didn't work. First, trading was paused as traders sought to exit from stocks. Then, just days later, as the market dropped seven percent, all trading was halted less than half an hour into the session, sending stock shock waves across myriad markets around the world. That chaos in the Shanghai Composite Index began the year which witnessed the worst first two months of exchange trading in recent memory. The epic fail in China also led the CSRC to scrap their circuit breakers altogether. What this says about global market rules being more closely harmonized is clear: just do it, and do it correctly. The clash, however, continues as regulators squabble over this rule and that rule. Some regulators even say harmonization isn’t needed. They are wrong. Global companies are negatively impacted by disjointed rules every single day. While rules certainly don’t need to be exact, they should be comparable and comprehensive in a general sense. Circuit breakers, in particular, should be key amongst those that need harmonization by global regulators. In the coming days, it just so happens that global regulators are meeting in Lima, Peru at the International Organization of Securities Commissions (IOSCO). This is a perfect venue for working towards harmonizing rules so that regulators, exchanges and traders operate more seamlessly, and thereby increase confidence in markets. Such confidence begets even greater liquidity, which creates better pricing. That's better pricing not just for companies and traders, but for average investors and consumers. Sure, national regulators will continue to clash over certain rules. It's a given. However, all it should take is a little Flash Crash memory trip to be reminded of what took place and of the continuing need to address these matters. In Lima, global regulators should get to work. And, they should stay—and get it right—before they go.Bart Chilton, a former Commissioner of the US Commodity Futures Trading Commission, is a Senior Policy Adviser at the global business law firm DLA Piper, LLP (U.S.) and the author of Ponzimonium: How Scam Artists Are Ripping Off America. He can be reached at bart.chilton@bartchilton.com.