Fmr. Wells Fargo CEO: Almost All Asset Classes Are Overvalued

The Dow Jones Industrial Average soared above its all-time closing high during Tuesday’s session. But the question on investors’ minds is whether the U.S. economy is really heading in the right direction.

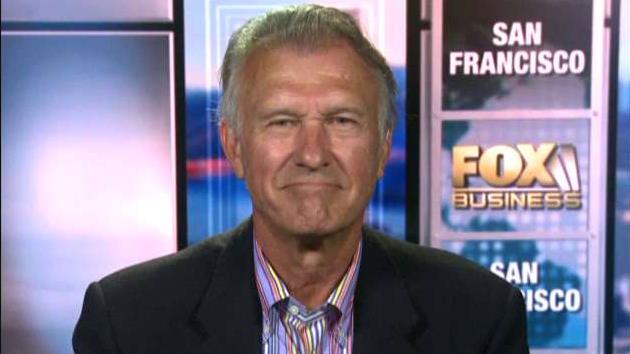

Former Wells Fargo Chairman and CEO Richard Kovacevich joined the FOX Business Network’s Charles Payne to help connect the dots between recent market behavior, slow economic growth, and low demand for banks loans.

“Because of the central banks quantitative easing around the world, almost all asset classes are overvalued; take government bonds or even negative interest rates today,” Kovacevich said. “These are extraordinary overvaluations of many assets.”

But the U.S. stock market, he said, may be the area of least overvaluation.

“Our economy, although slow, is still one of the best in the world,” he said. “The dollar is strong and the dividend you can receive by stocks in the market is significantly above what you can get in the bond market.”

While Kovacevich described market rallies that are often a result of irrational exuberance, he said this time is different. He warned investors to exercise caution in those overvalued asset classes, and suggested they look to other corners of the market for returns.

“I think our stock market is saying the end is close because the fundamentals would not be causing us to have record after record markets—especially with Brexit and everything else, but people are taking their money and putting it in the stock market because they know the end is near in the rest of the asset classes.”