Former NYSE president in talks to reboot FTX exchange

Tom Farley’s new firm joins 2 other suitors in auction for bankrupt crypto exchange founded by Sam Bankman-Fried

FTX is the ‘latest example of the elites ripping off America’: Charles Payne

‘Making Money’ host Charles Payne reacts to former FTX CEO Sam Bankman-Fried being found guilty on seven counts of criminal fraud.

A company run by former New York Stock Exchange President Tom Farley is among three suitors vying to buy the remnants of FTX, as the auction for the collapsed cryptocurrency exchange founded by Sam Bankman-Fried reaches its final stages.

Bullish, the crypto exchange run by Farley, fintech startup Figure Technologies and crypto venture-capital firm Proof Group are competing to buy FTX, according to people familiar with the matter. The winner could restart the exchange after its planned exit from bankruptcy next year.

SAM BANKMAN-FRIED'S TRIAL AND VERDICT IN PICTURES

A banker advising FTX on the process said at a hearing last month that the company received interest from over 70 parties and narrowed it to three, without naming them. A winner could be picked in December.

FTX founder Sam Bankman-Fried arrives at court in New York, on Jan. 3, 2023. (Photographer: Stephanie Keith/Bloomberg via Getty Images / Getty Images)

CoinDesk earlier reported on Proof’s bid; the other two haven’t been previously reported. There are no guarantees a deal will come together, and another suitor could yet emerge.

FTX FOUNDER SAM BANKMAN-FRIED’S BIGGEST FEAR IN JAIL REVEALED BY AUTHOR

As recently as last fall, FTX ranked as one of the world’s biggest crypto exchanges, handling billions of dollars in trading volumes for individual investors outside the U.S. and professional traders. Venture capitalists valued FTX at $32 billion in January 2022, making Bankman-Fried a billionaire several times over.

It collapsed abruptly in November 2022 following a run on FTX customer funds. Prosecutors charged Bankman-Fried with fraud, accusing him of using a back door to plunder billions of dollars of customer funds and spend it on luxury real estate, personal investments and political donations. A New York federal jury last week convicted him on all seven counts he faced. He is expected to be sentenced in March and faces up to 110 years in prison.

SAM BANKMAN-FRIED FOUND GUILTY ON FRAUD CHARGES

Should a new owner take control of FTX, customers could receive shares in the restarted exchange or new tradable tokens to partially make up for what they are owed, some of the people said. Roughly $9 billion of customer deposits on FTX remain unaccounted for.

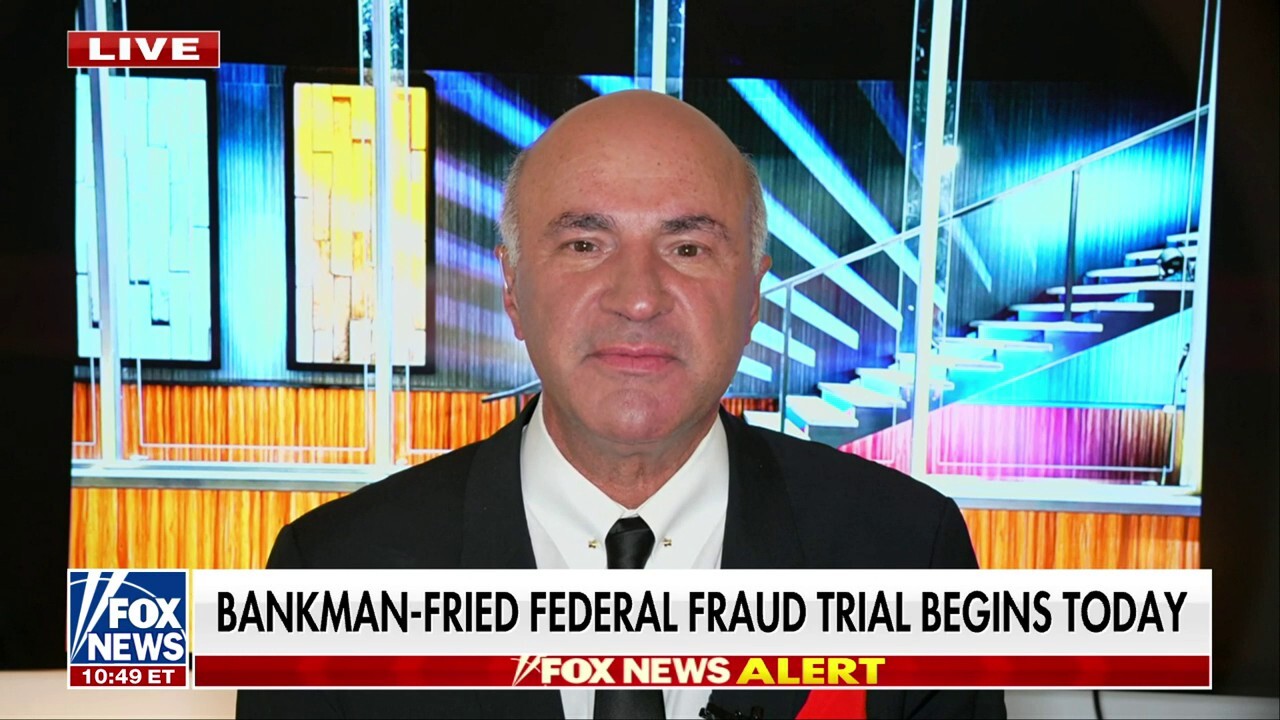

Kevin O’Leary on SBF fraud trial: ‘FTX was a big mistake’

O’Leary Ventures chairman and former FTX spokesman Kevin O’Leary joins ‘America’s Newsroom’ to discuss the start of former FTX CEO Sam Bankman-Fried’s fraud trial.

FTX’s real-estate portfolio in the Bahamas and other assets aren’t part of the sales process for the exchange.

Some crypto watchers warn that a relaunch of FTX could struggle to get traction with professional traders, who might have long memories about the exchange’s legacy of fraud and embezzlement. Some bidders have discussed dropping the FTX brand from the rebooted exchange.

WHAT'S AHEAD FOR SAM BANKMAN-FRIED?

Kelly O’Grady on SBF guilty verdict: FTX founder’s ‘hubris was on display’

FOX Business’ Kelly O’Grady reports on the trial of Sam Bankman-Fried after the former FTX CEO was found guilty on seven counts of criminal fraud.

Bullish is backed by a roster of prominent investors including Peter Thiel’s Founders Fund and hedge-fund manager Louis Bacon. Farley, its CEO, was president of the NYSE from 2014 to 2018. In December 2022, it called off a $9 billion deal to go public via a merger with a blank-check company.

Figure, a startup co-founded by former SoFi CEO Mike Cagney, was part of a group that unsuccessfully tried to buy the bankrupt crypto lender Celsius earlier this year. Figure uses blockchain technology for lending and capital markets.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Proof Group was part of the consortium that won the auction for Celsius. The group agreed to purchase $50 million of equity in the newly reorganized company.