Fox posts higher revenue on ad sales strength

Advertising revenue rose almost 6% in latest quarter

Fox Corp., parent of Fox News and the Fox broadcast network, reported higher revenue in the latest quarter, as advertising sales continued to improve driven by its news programming, live sports and streaming platforms.

Executive Chairman and Chief Executive Lachlan Murdoch said the company didn’t plan to veer away from its focus on live news, sports and advertiser-supported streaming services.

"We have not been convinced to deviate from areas where we cannot be a leader," Mr. Murdoch said.

Commercials for sports betting were a significant factor in the increased ad revenue. Mr. Murdoch said there was 50% more local sports betting in the quarter than the company had in all of the fiscal year ended June 30.

Mr. Murdoch also praised the performance of Fox News, reminding analysts that a year ago, he was fielding questions about whether the network had peaked and would see its dominance slip due to the emergence of newer competitors including NewsMax and One America Network, which target its core conservative audience.

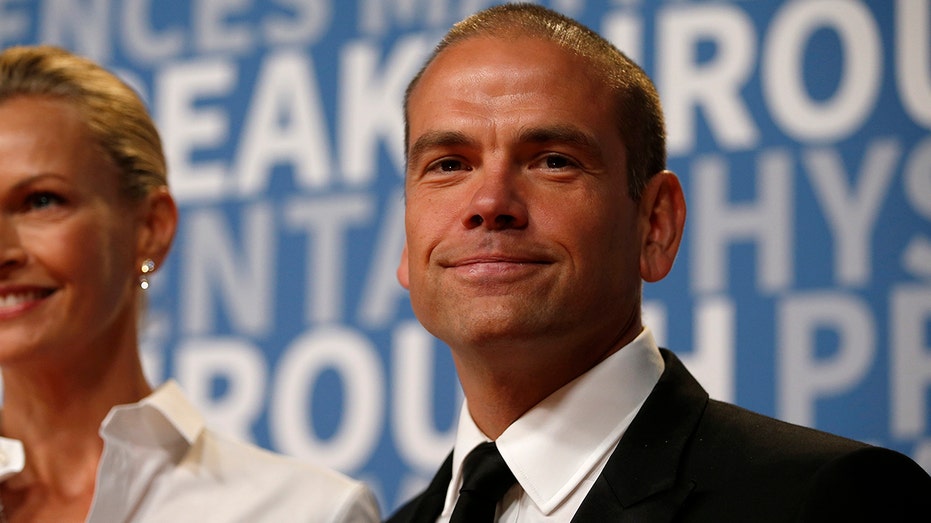

Lachlan Murdoch, co-chairman News Corp and executive chairman of 21st Century Fox, poses for a picture on the red carpet for the sixth annual 2018 Breakthrough Prizes at Moffett Federal Airfield, Hangar One in Mountain View, California, on Sunday, De (Nhat V. Meyer/Bay Area News Group/Digital First Media Group/Bay Area News via Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NWSA | NEWS CORP. | 22.50 | -1.71 | -7.06% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"Fox News leads by a wide margin," Mr. Murdoch said, adding that the network has gained market share among younger, Democratic and independent viewers. "We simply could not be better placed as we look forward to the midterm elections."

Tubi, a free, advertiser-supported streaming service that Fox acquired in 2020, had its strongest quarter to date, the company said. The service had 3.6 billion hours streamed in 2021, a 40% increase from 2020. Fox has been investing in more original content for Tubi, as well as beefing up its library.

Revenue at Fox increased nearly 9% to $4.44 billion for the quarter ended Dec. 31, topping analysts’ consensus expectations of $4.25 billion.

Fox’s advertising revenue rose about 6% over last year due to pricing strength at its Fox network, as well as from live sports and Tubi.

The company’s cable programming unit, which includes the Fox Business Network and Fox Sports 1 channel as well as Fox News, generated $1.64 billion in revenue, a 10% increase from the same quarter last year. Contractual price increases, including distribution agreement renewals, helped boost affiliate revenues. Advertising revenue also increased at the division thanks to pricing power at Fox News and its national sports networks.

Fox Nation, the direct-to-consumer streaming platform operated by Fox News, logged higher subscription revenue compared with last year. The recently launched Fox Weather also landed new distribution deals with YouTubeTV, Amazon News and Roku.

Revenue from Fox’s TV stations rose to $2.76 billion from $2.56 billion in the year-earlier period due to an increase in advertising revenues, which benefited from live sports, growth at Tubi and the continuing recovery from Covid-19 restrictions in local markets.

The company recorded higher expenses in the segment as it recognized higher sports and entertainment-programming rights amortization at the Fox network and increased its digital spending at Tubi.

Fox News parent Fox Corp. and Wall Street Journal parent company News Corp share common ownership.

Main entrance to News Corporation / Fox News headquarters in New York. ( Erik McGregor/LightRocket via Getty Images / Getty Images)

CLICK HERE TO READ MORE ON FOX BUSINESS

The company posted a loss attributable to stockholders of $85 million, or 15 cents a share, for the fiscal second quarter, compared with a profit of $224 million, or 37 cents a share, in the year-earlier period.

Fox Corp. attributed the loss to a change in the fair value of its investment in the sports betting and gaming provider Flutter Entertainment PLC. Fox Corp. is also currently involved in arbitration with Flutter over its efforts to acquire Flutter’s 18.6% stake in sports-betting firm FanDuel Group. As part of its investment in Flutter, Fox received an option to buy the FanDuel stake, but the sides differed on the pricing methodology.

Fox had an adjusted profit of 13 cents a share, which came ahead of analysts’ estimates, according to a FactSet poll.

Click here to read more on the Wall Street Journal.