FTX bankruptcy will offer a look behind crypto’s dark curtain

Lawyers will be challenged to explain what happened in analogies that make sense

FTX a 'huge stain' on entire crypto space: Mitterlehner

MittGroup CEO Grant Mitterlehner appears on "Cavuto: Coast to Coast" to discuss whether the crypto industry can survive the FTX fiasco.

The bankruptcy of FTX Trading and other cryptocurrency companies will give the legal system — like Dorothy Gale in "The Wizard of Oz" — a peek behind the curtain into a private, opaque and largely unregulated world. Dorothy found the man behind the wizard. What the courts will find, according to court observers, is anyone’s guess.

In their quest to understand what took place behind the scenes at FTX, judges and lawyers will confront emerging technologies and unregulated issues, offering the opportunity to set fresh precedents or create new case law.

"There’s going to be very, very difficult forensic accounting questions and some really important questions about concepts, like, how do we understand what cryptocurrency is and is FTX more like a bank or more like a stockbroker?" said Jonathan Lipson, the Harold E. Kohn chair and professor of law at Temple University Beasley School of Law.

Representations of cryptocurrencies are seen in front of a FTX logo and decreasing stock graph in this illustration released on Nov. 10, 2022. (Reuters/Dado Ruvic/Illustration/File / Reuters Photos)

FTX'S SAM BANKMAN-FRIED COLLAPSE COMPARED TO ENRON, MADOFF

Is the legal system up to the task?

"Bankruptcy courts are not strangers to crises with systemic effects or to businesses using complicated technology. They have the tools and the experience to stabilize the situation and bring some order to chaos," Melissa Jacoby told FOX Business. Jacoby is the Graham Kenan professor of law at the University of North Carolina at Chapel Hill.

It won’t be easy.

"It will be a challenge for the lawyers to explain to the judges what these things are in analogies that make sense," Lipson told FOX Business.

Walking into spiderwebs

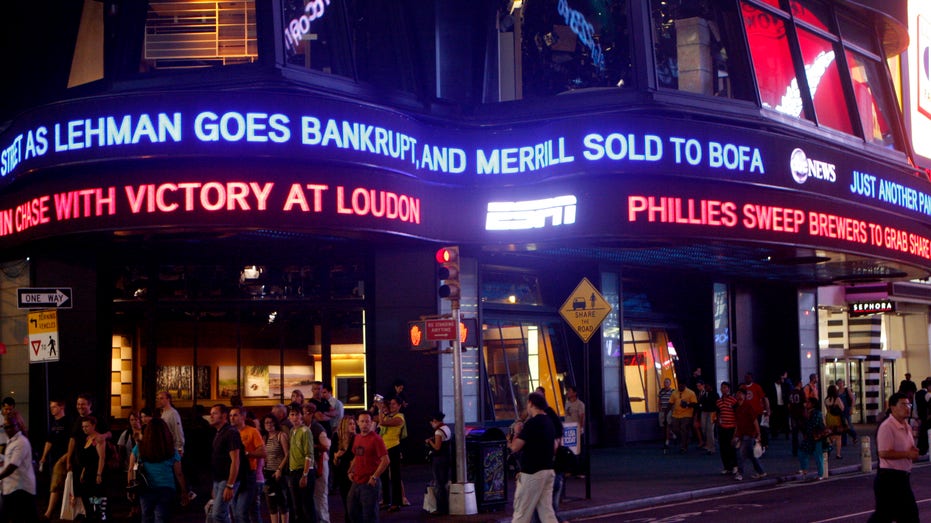

The Lehman Brothers name moves across a news ticker in New York's Times Square on Sept. 15, 2008. (Reuters/Joshua Lott / Reuters Photos)

WILL FTX'S BANKRUPTCY SPILL INTO THE GENERAL ECONOMY LIKE LEHMAN BROTHERS?

Lipson compared the situation to Lehman Brothers. The former Wall Street bank went bankrupt in 2008, taking down exotic financial products such as collateralized debt obligations, synthetic credit transactions and variable interest entities.

It took 14 years to complete the firm’s liquidation.

FTX judges and lawyers will have to understand concepts such as initial coin offerings, hard forks, staking rewards and cold wallets.

Lehman’s bankruptcy rippled worldwide, affecting everyone who had a financial instrument tied to the firm, from Wall Street investors, to state and local governments, and to homeowners with subprime mortgages.

For example, San Mateo County, California, filed claims totaling $155 million. Officials invested in Lehman notes to expand its community college, improve roads and build a rail system, Reuters reported at the time.

HERE ARE THE DEMS WHO BENEFITED FROM THE LEFT-WING PAC THAT FTX FUNNELED $27M THROUGH

FTX appears to have spun its own financial web. Crypto Fund Research listed on Monday more than a half-dozen crypto funds with significant exposure to FTX.

Funds with FTX Exposure

- Paradigm — $278 million

- Sequoia Capital — $213 million

- Galaxy Digital — $76.8 million

- Genesis — $175 million

- Galois Capital — $40 million

- CoinShares — $30.3 million

The list doesn’t include FTX customer claims, which may number more than a million.

Show me the money

Sam Bankman-Fried, founder and chief executive officer of FTX, speaks during the Institute of International Finance annual membership meeting in Washington, D.C., on Oct. 13, 2022. (Ting Shen/Bloomberg via Getty Images / Getty Images)

US MAY EXTRADITE SAM BANKMAN-FRIED AMID FTX COLLAPSE INVESTIGATION: REPORT

Temple’s Lipson says the length and breadth of FTX’s bankruptcy will depend on how much money is available to creditors and how hard people will try to recover their assets.

"How much time, money and energy lawyers and the bankruptcy system put into recovering those things is going to be a function of the cash on hand and the cash available to finance it."

The issue is further complicated by allegations of financial fraud.

Class-action lawsuit filed against FTX founder

Sam Bankman-Fried was hit with a class-action lawsuit filed by investors alleging that he and other high-profile celebrities violated Florida law and made consumers suffer more than $11 billion in damages.

Law firm Entwistle & Cappucci said its early investigation confirms that "billions of dollars of customer funds were wrongly diverted from FTX to Alameda [Research] and elsewhere leaving an enormous shortfall in customer accounts." The firm specializes in complex fraud and bankruptcy litigation.

UNC’s Jacoby says, "Bankruptcy can be a forum to investigate wrongdoing and potentially to claw back resources into the hands of the rightful parties, but there's a big caveat: based on the way Congress structured the system, investigations are dependent on someone being willing to fund such investigations."

Earlier this year, the founding family of Purdue Pharma agreed to a $6 billion settlement over its role in the opioid epidemic.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

How much can be recovered from FTX and possibly former CEO Sam Bankman-Fried and others will hinge on finding the money, if it exists.

"Lots of real money went in, and untangling where that money went is not going to be easy, but it’s not going to be impossible," Lipson said.