FTX lawyers say Bankman-Fried's 'incessant and disruptive tweeting' is complicating bankruptcy case

FTX is asking a federal judge in Delaware to consolidate bankruptcy cases involving the company and 'end the chaos'

FTX collapse has 'reverberated throughout crypto': Pete Hegseth

'Fox & Friends Weekend' co-host Pete Hegseth explains how FTX's bankruptcy has impacted his cryptocurrency investments, and previews Fox Nation's fourth annual Patriot Awards.

Lawyers for the collapsed crypto exchange FTX slammed former CEO and founder Sam Bankman-Fried for creating a "chaotic environment" in court documents filed Thursday, as the company goes through bankruptcy proceedings.

FTX attorneys said Bankman-Fried's "unconventional leadership style,""his incessant and disruptive tweeting," and "the almost complete lack of dependable corporate records" have complicated efforts to restructure the company. They also accused the disgraced crypto mogul of attempting to move assets out of the United States and to the Bahamas, where they will be under the control of the Bahamanian government, in an apparent effort to circumvent U.S. regulators.

FTX, once the world's third-largest exchange with a valuation near $32 billion, sent shockwaves through the crypto world on Friday when it announced that it was filing for bankruptcy, along with Alameda Research and other affiliated companies. Days earlier, industry rival Binance backed out of a deal to buy its troubled competitor after taking a look at the books and learning that FTX had "mishandled customer funds."

Bankman-Fried announced his resignation as chief executive when the bankruptcy papers were filed in Delaware on Friday.

FTX'S BAHAMAS LIQUIDATORS REJECT ‘VALIDITY’ OF US BANKRUPTCY PROCEEDINGS

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, Aug 17, 2022. (Jeenah Moon/Bloomberg via Getty Images / Getty Images)

FTX attorneys said Bankman-Fried's "unconventional leadership style,""his incessant and disruptive tweeting," and "the almost complete lack of dependable corporate records" have complicated efforts to restructure the company. (OLIVIER DOULIERY/AFP via Getty Images / Getty Images)

Now under new management, FTX called these bankruptcy proceedings "unprecedented" and asked a federal judge in Wilmington, Delaware, to transfer a competing bankruptcy case filed by Bahamanian liquidators in New York to Delaware to consolidate all cases related to FTX's bankruptcy.

"Having two bankruptcy courts consider related issues simply makes no sense," the attorneys wrote. "It would result in potentially inconsistent opinions, duplication of efforts, and unnecessary expense."

SAM BANKMAN-FRIED EXPRESSED OPTIMISM ABOUT CRYPTO REGULATIONS MONTHS BEFORE FTX'S COLLAPSE

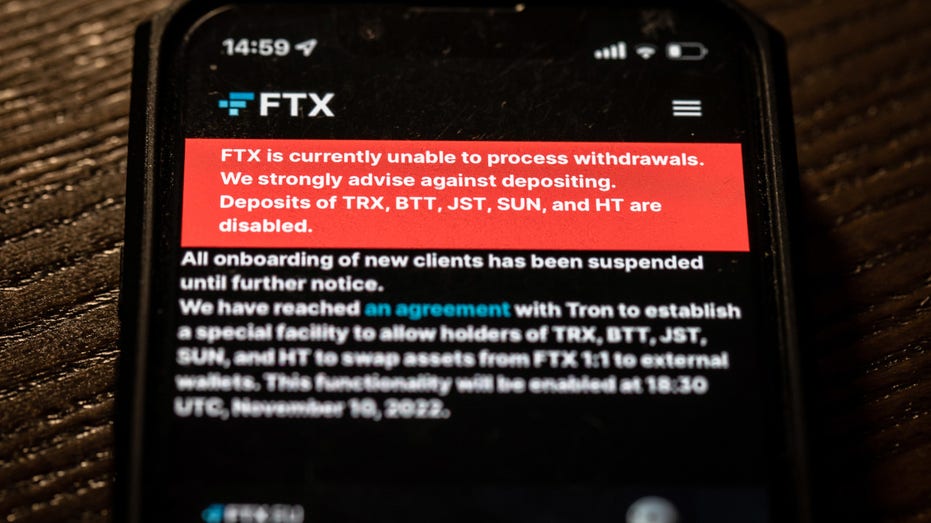

A withdrawals notice on the FTX website displayed on a smartphone arranged in Barcelona, Spain, on Tuesday, Nov. 15, 2022. (Angel Garcia/Bloomberg via Getty Images / Getty Images)

They argued that the filing in New York was a "blatant attempt" to avoid the supervision of the Delaware court and requested the cases be consolidated "to end the chaos and to ensure that assets can be secured and marshaled in an orderly process that all proceedings related to the Debtors and their affiliates … take place in a single venue."

NEW FTX BOSS CONDEMNS BANKMAN-FRIED FOR 'COMPLETE FAILURE OF CORPORATE CONTROLS

Both the company and Bankman-Fried are under investigation in the U.S. and other countries for possible securities violations amid allegations that FTX used $10 billion of customer funds to prop up Alameda Research, its affiliated trading firm.

CLICK HERE TO GET THE FOX BUSINESS APP

New CEO John Ray III accused his former boss of allowing "a complete failure of corporate controls" in a separate filing with the U.S. bankruptcy court for the district of Delaware.

FOX Business' Megan Henney contributed to this report.