GameStop meme stock mania is SEC’s bad dream on repeat

GameStop shares have advanced over 100% this quarter

SEC 'should look into' GameStop, Roaring Kitty amid 'legitimate' questions: Gasparino

FOX Business senior correspondent Charlie Gasparino raises questions over the timing of Roaring Kitty's livestream and GameStop's secondary sale on 'The Claman Countdown.'

GameStop investors got another news dump on Monday, this time from the company at its annual shareholders meeting. CEO Ryan Cohen told investors the video game retailer plans to "continue reducing costs and focusing on profitability," without elaborating.

Shares fell 12% and slipped further on Tuesday, but are still up over 100% this quarter amid extreme volatility. Much of the gains have been driven by retail investor "Roaring Kitty" who disclosed an update to his GameStop holdings in early May, after a three-year hiatus.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GME | GAMESTOP CORP. | 24.99 | +0.33 | +1.34% |

"In some ways it's kind of a repeat of the meme stock trading we had in 2021. It's the same person, Keith Gill a.k.a. Roaring Kitty again," Michael Piwowar, former commissioner of the Securities and Exchange Commission and now executive vice president of finance at the Milken Institute, told FOX Business.

GAMESTOP RAISES OVER $2B IN STOCK SALE DURING ROARING KITTY CRAZE

GameStop

Piwowar said it does not appear Gill is doing anything illegal under the current rules, but he does believe the SEC is very likely reviewing whether there are any violations and perhaps discussing whether the current rules are adequate to protect investors and guard against market manipulation.

"The SEC got a wake up call three and a half years ago and hit the snooze button," Piwowar said. "If this is something that the commission decides is not in the public interest, and the commission decides that it's not in the interest of fair, orderly and efficient markets, and protecting investors, they could change the rules," he explained.

The SEC, in response to a prior inquiry from FOX Business, said it "does not comment on the existence or nonexistence of a possible investigation."

Gill has since followed with vague social media posts open to interpretation, including one late Monday showing former tennis legend John McEnroe during his professional playing years. McEnroe was famous for his volatile on-court temper.

Gill's livestream in early June, which drew in about 600,000, did not provide much new detail, but he did endorse Cohen’s leadership.

Keith Gill, a Reddit user credited with inspiring GameStop's rally, speaks during a YouTube livestream arranged on a laptop at the New York Stock Exchange in New York on Friday, June 7, 2024. (Michael Nagle/Bloomberg via Getty Images / Getty Images)

WHO IS ‘ROARING KITTY' - WHAT TO KNOW

"It becomes a bet on the management" of GameStop – particularly on CEO Ryan Cohen "and his crew" – during the "transformation stage" that he believes the video game retailer has entered. "That’s probably going to be an ongoing debate as to how people feel about him, whether he can successfully transform that business," the meme stock retail trader said, cracking jokes here and there. He also reminded his viewers to "make your own decisions."

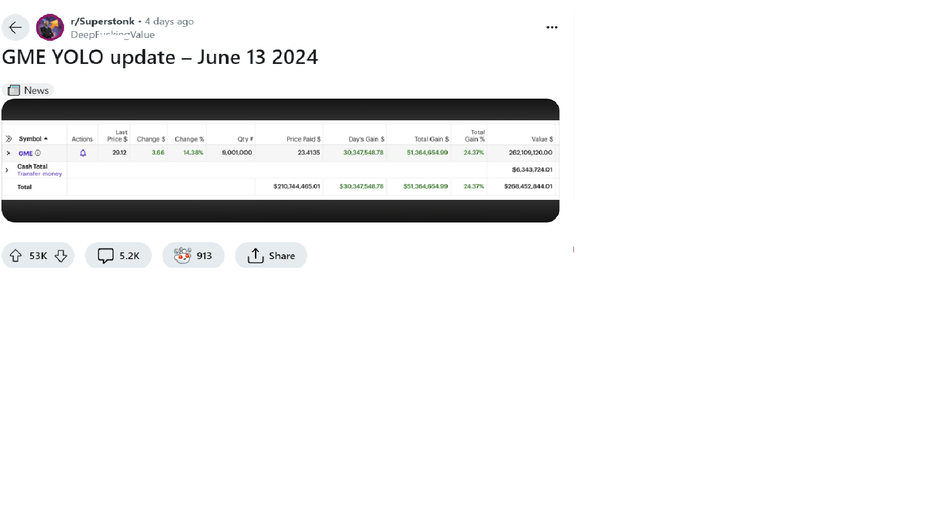

He updated his position on June 13 on Reddit under his "DeepF---ingValue" handle. Based on a posted screenshot, he now owns 9 million shares purchased at $23.41 per share. The value has risen to $262 million. His cash position dropped from around $29 million to $6 million, with his total stake worth $268 million.

Keith Gill, via his Reddit handle, Superstonk/DeepF---ingValue, posted his latest account performance as of June 13, 2024. ( )

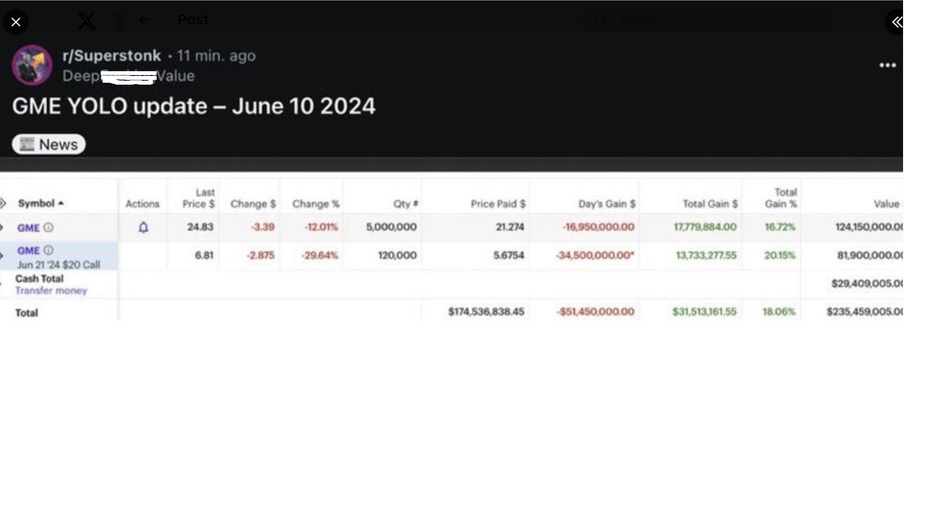

His call options, valued at $81.7 million during his June 10 update, are no longer on the account ledger. He could have exercised those or sold them outright.

Gill, via his Reddit handle, Superstonk/DeepF---ingValue, posted his latest account performance as of Monday June 10, 2024. (Superstonk / Reddit )

FOX Business is unable to verify the accuracy of the account screenshot.

This month, GameStop reported a net loss of $32.2 million compared with a loss of $50.5 million in the year-ago period. Sales fell 28% to $881 million, down from $1.2 billion.

The company also plans to sell up to another 75 million shares on top of the 45 million already sold.