GameStop stock whips skeptics with surge of up to 94%

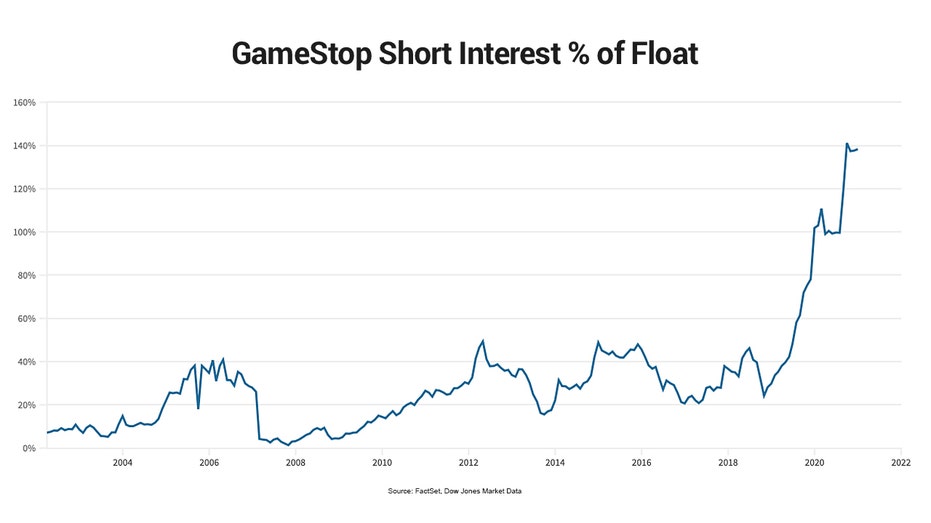

Short interest reached 138% of shares outstanding

GameStop Corp. shares soared to their highest level in more than five years Wednesday as short-sellers betting against the stock scrambled for the exit.

Shares of the Grapevine, Texas-based video-game retailer surged as much as 94% to an intraday high of $38.65 apiece before settling at $31.40. The last time shares traded at that level was in November 2015.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GME | GAMESTOP CORP. | 24.99 | +0.33 | +1.34% |

The spike appeared to be driven by a short-covering rally sparked by an agreement the company reached with activist investor RC Ventures regarding the addition of three board members.

Short interest last month reached 138% of shares outstanding, according to FactSet data. Short-sellers borrow shares in order to sell them with the hopes of buying them back at a lower price in the future.

The new directors, including Ryan Cohen, founder of RC Ventures and the online pet food supplier Chewy, all have extensive experience in e-commerce, online marketing, finance and strategic planning.

RC Ventures in September purchased 6.5 million GameStop shares to raise its stake to 9.98% with the goal of transforming the company into a major e-commerce player that sells a wide variety of merchandise with fast shipping.

STOCK MARKET BRACING FOR 'REGIME CHANGE' AMID WASHINGTON POWER SHIFT: GUNDLACH

The attempt to turn around GameStop’s business comes at a critical time for the company, which has suffered through store closures amid the COVID-19 pandemic at a time when more users were already purchasing their video games online.

GameStop on Monday reported comparable sales for the nine weeks through Jan. 2 rose 4.8% from a year ago, bolstered by a 309% increase in online revenue. Total sales were down 3.1% as the number of store locations decreased 11% during the pandemic.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

GameStop expects demand for the new Microsoft Xbox and Sony PlayStation gaming systems to drive sales into 2021 once supply-chain constraints ease.

Shares were up 5.89% this year through Tuesday, outperforming the S&P 500’s 1.2% gain.