Gold gets better as Russia, Ukraine and inflation dog stocks

Gold could hit $2,000 an ounce: Mark Haefele, CIO of UBS

Marketplace ‘very volatile,’ investors don’t want to buy ETFs: Expert

Adviser Investments CIO Jim Lowell argues investors don’t want to purchase ETFs and suggests buying ‘inside basket’ in a ‘selective manner.’

Gold's shine is becoming more attractive to investors looking to protect themselves against the unpredictable swings in the equity market sparked by Russia's invasion of Ukraine.

Gold closed at $1,925.10 Thursday, a new 52-week high, putting the SPDR's Gold Exchange-Traded fund's gain for the month at over 5%. It is the largest fund backed by physical gold with over $56 billion in assets.

RUSSIA INVADES UKRAINE: LIVE UPDATES

Gold prices, which mirror the fund, could continue to climb, according to UBS.

INFLATION SLAP: WHERE CONSUMERS ARE PAYING THE MOST

"Amid the risk of supply disruptions, we think broad commodities can be an effective geopolitical hedge for portfolios as well as offering an attractive source of returns in an environment of accelerating growth, persistent inflation and higher rates," Mark Haefele, chief investment officer of Global Wealth Management, UBS AG, wrote.

"We think a protracted escalation could push gold prices above ($2,000 an ounce)."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GLD | SPDR GOLD SHARES TRUST - USD ACC | 459.61 | +1.44 | +0.31% |

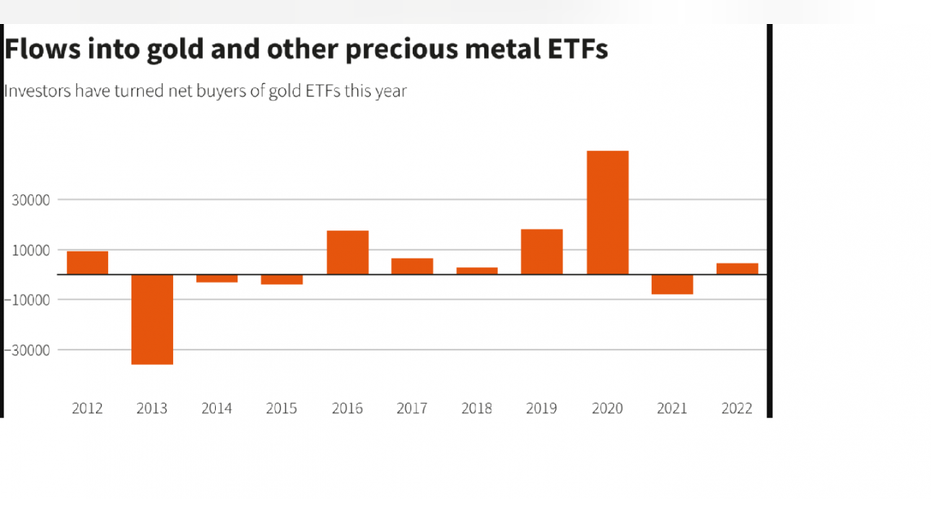

Investors have been pouring into gold, as tracked by Refinitiv Eikon. Nearly $5 billion has flowed in gold and precious metal ETFs this year compared to outflows of nearly $8 billion in 2021.

(Source: Refinitiv Eikon )

Not only can gold, silver and other precious metals help hedge against geopolitical uncertainty, but the assets class can also serve as a hedge against inflation.

Consumer prices in the U.S. surged by 7.5% in January, the most since 1982, while prices at the producer level jumped 9.7%, the highest level ever.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SLV | ISHARES SILVER TRUST - USD ACC | 71.01 | +0.92 | +1.31% |

Month-to-date silver's gain has jumped over 10%.